The night before awakening: I have been in the casino for 730 days.

At three in the morning, I was once again awakened by my phone vibrating.

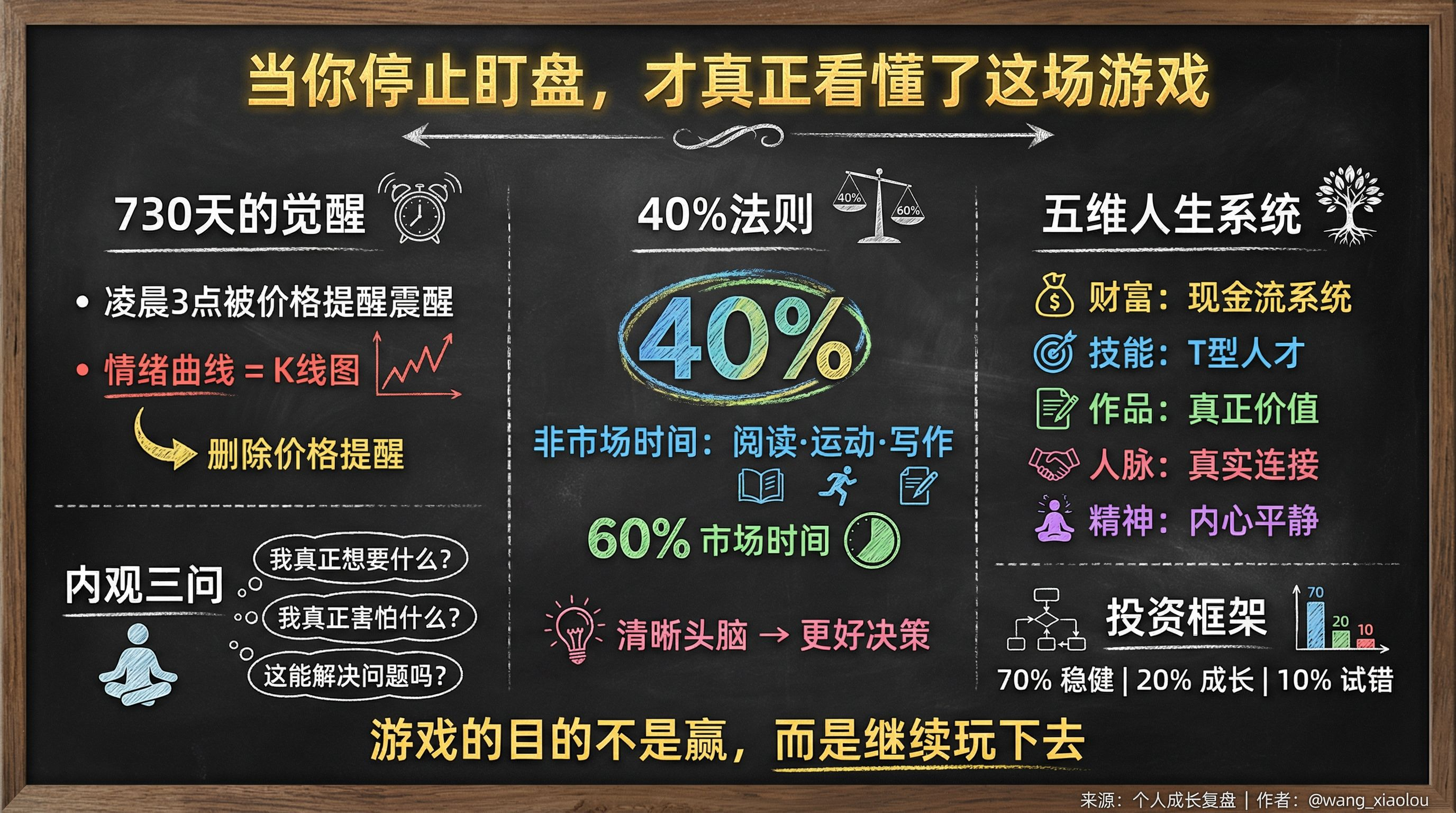

It's not an alarm clock, it's a price reminder. BTC has fallen below my stop-loss line, and ETH rose 8% while I was asleep. I sat on the bed, staring at those red and green fluctuating numbers, and suddenly realized: this has been going on for a continuous 730 days.

Two years. A full two years, my emotional curve has completely synchronized with the K-line chart.

When the market is rising, I feel like the chosen one, giving guidance in the group and 'passing on experience' to newcomers. When it drops, I lie on the sofa scrolling through Twitter, watching others flaunt their profits, and questioning life. One day I even made a spreadsheet in Excel to record my daily gains and losses along with my mood index—only to find a correlation as high as 0.94.

I call this 'digital life'.

But that day at three in the morning, when I opened the exchange app for the Nth time, I suddenly asked myself a question:

If all exchanges closed tomorrow, what would I have left?

The answer made me break out in a cold sweat: Aside from a bunch of floating numbers, there is nothing.

No works, no system, nothing that truly belongs to me. I thought I was 'investing in the future', but in reality, I was just betting in a casino, exchanging anxiety for dopamine, and time for illusion.

At that moment, I knew I had to change.

It's not about withdrawing from the market, but about withdrawing from the self defined by the market.

First practice: Learn to communicate with your desires.

Change starts with a very small action: I deleted the price alerts on my phone.

You cannot imagine how difficult this is. For the first three days, I would subconsciously open the exchange every ten minutes, even without alerts, my fingers would automatically slide to that familiar icon. Just like a person trying to quit smoking would unconsciously touch their pockets, I had been trained to be Pavlov's dog.

But I persevered. Because I started doing something more important: observing myself.

Every time I want to watch the market, I pause and ask myself three questions:

What do I really want now?

What am I really afraid of?

Can this action solve the problem?

The answer is often cruel.

What I want is not to 'know the price', but to 'confirm that I haven't missed an opportunity'. What I fear is not 'losses', but 'being surpassed by others'. And the action of watching the market, apart from creating anxiety, solves no problems.

This is what Xiao Mao refers to as 'introspection'—not suppressing desires, but seeing desires clearly.

Once the market dropped 15%, and my position instantly evaporated six figures. The old me would immediately panic, asking in the group 'Should I cut losses?', and then sell at the lowest point. But that time, I sat in a café, watching the people come and go outside, and suddenly felt very calm.

Not because I don't care about money, but because I found a rational anchor.

This anchor is not a specific price point, not a certain technical indicator, but an understanding of oneself: I know my risk tolerance, I know this money does not need to be used in three years, and I know that sharp declines are part of the cycle, not the end of the world.

When you truly understand your desires and fears, market fluctuations become background noise rather than the main melody.

That day I wrote a sentence in my notebook: Between greed during a surge and panic during a drop, I found myself.

40% Rule: Leave some space for the non-market self.

But having introspection alone is not enough. I found that although I am no longer shackled by price, I am still trapped by the 'crypto identity'.

In my Twitter following list, 90% are KOLs and project parties. My podcast subscriptions are all about cryptocurrency. In conversations with friends, I can't go three sentences without mentioning DeFi, NFT, Layer 2. I thought this was 'focus', but in reality, it was 'imprisonment'.

The turning point was an accidental conversation.

A friend who does traditional investing asked me: 'What book are you reading lately?' I was stunned for a while and realized I hadn't read a book unrelated to crypto in half a year. He smiled and said: 'Do you know how much time Buffett spends looking at stock prices? Zero. He spends his time reading, thinking, and playing bridge.'

At that moment I understood: A true master is not someone who invests 100% of their energy in the market, but someone who reserves enough space for their non-market self.

I started practicing the '40% rule':

At least 40% of my waking time is spent on things unrelated to the market.

From 6 to 8 in the morning: running, meditating, reading.

From 3 to 5 in the afternoon: writing, learning new skills, chatting with friends outside the crypto circle.

After 9 PM: completely avoid any trading-related content.

At first, it was painful. I always felt like I was 'wasting time', missing out on something important. But after sticking with it for a month, I discovered an astonishing change:

The quality of my trading decisions has improved.

Not because I have more information, but because I have a clearer mind. When you are no longer overwhelmed by the information flow and driven by FOMO, you can truly see what is noise and what is signal.

More importantly, I have rediscovered myself.

I started writing, not to gain followers, but to organize my thoughts. I began exercising, not to post on social media, but to combat the anxiety of long sitting. I started learning Japanese, not for any purpose, but simply because I found it interesting.

These 'useless' things have become my best remedy against market fluctuations.

Because they remind me: I am not just a 'crypto trader', I am a complete person.

Establish your own operating system.

But the real awakening happened when I realized a deeper problem:

I had always been using someone else's system to make my own decisions.

Seeing a KOL recommend a project, I would follow suit. Seeing a new coin on a certain exchange, I would rush in. Seeing discussions on Twitter about a certain narrative, I would FOMO. I thought I was 'learning', but in reality, I was just 'copying and pasting'.

It's like running my life on someone else's operating system—inevitably leading to stuttering, crashing, and blue screens.

I began to ask myself: If I want to establish my own operating system, what modules do I need?

After three months of practice and iteration, I built my own 'investment research framework':

Information Filtering Layer

Only focus on 20 truly valuable information sources.

Batch process information at fixed times each week, rather than responding in real-time.

Use Notion to establish a knowledge base and structure fragmented information.

Decision Model Layer

Clarify your investment logic: What do I believe in and why.

Establish position management rules: Never go all in, always leave room.

Set decision-checking checklists: Five questions that must be answered before each trade.

Execution Discipline Layer

Set buy and sell trigger conditions in advance, and do not change them last minute.

Record the logic and emotional state of each trade.

Monthly reviews are not about looking at profits and losses, but about the quality of decisions.

Mind Management Layer

Accepting losses is part of the game.

Don't compare returns with others, only compare execution with your own plan.

Stay curious, but do not be shackled by new narratives.

This system was not built overnight but was slowly polished through countless trials and errors.

The most critical thing is that it transformed me from a 'passive responder' to an 'active designer'. I am no longer led by the market but seek opportunities at my own pace.

This is what Xiao Mao refers to as 'sovereignty'—not detaching from the market, but not being defined by the market.

Ten-Year Perspective: From Trader to System Designer.

But I quickly realized that having an investment system alone is not enough.

If my life only has the dimension of 'making money', then I remain fragile. When the market is good, I find life meaningful; when the market is bad, I fall into nihilism.

What I need is not an 'investment system' but a 'life operating system'.

I began to redesign my life blueprint with a ten-year perspective. Not the kind of elusive 'dream list', but an executable, iterative system that includes five dimensions:

1. Wealth Dimension

Goal: Not 'how much money can I make', but 'establish a cash flow system'.

Strategy: 70% stable allocation (BTC, ETH, US Treasuries), 20% growth investment (high-quality projects), 10% trial and error (new narratives).

Verification standard: Can passive income cover basic living costs?

2. Skills Dimension

Goal: Become a 'T-shaped talent'—deeply engage in the Crypto field while expanding horizontal skills in AI, writing, products, etc.

Strategy: Deeply learn a new field each year, output at least one work.

Verification standard: Can I create value with new skills?

3. Works Dimension

Goal: Leave behind truly valuable things, rather than disappearing in the information flow.

Strategy: At least one in-depth article per week, one complete project per quarter.

Verification standard: Looking back after a year, do I still think it is valuable?

4. Connections Dimension

Goal: Build real connections, not just collect business cards.

Strategy: Deeply communicate with 3-5 interesting people each month, recording conversations and insights.

Verification standard: Can we help each other in critical moments?

5. Spiritual Dimension

Goal: Maintain curiosity, creativity, and inner peace.

Strategy: Reading, exercising, meditating, traveling, maintaining diverse experiences.

Verification standard: Do I still have interest in the world?

These five dimensions are not isolated but support each other. Wealth gives me freedom, skills give me leverage, works give me meaning, connections give me opportunities, and spirit gives me resilience.

And AI and Crypto play key roles in this system:

AI is my cognitive leverage.

I use AI to assist in research, writing, and learning, increasing my output efficiency by 10 times. But I am not replaced by AI; instead, I use AI to amplify my unique perspective.

Crypto is my capital leverage.

I do not treat Crypto as a tool for 'getting rich overnight', but understand the underlying logic behind it: ownership, liquidity, and value transfer. These logics apply not only to investments but also to life design.

When you have this 'life operating system', market fluctuations become background noise. Because you know that regardless of bull or bear, you are continuously evolving.

Root Node: When you become the center of your own system

Last year, there was a time when the market fell for three consecutive weeks, and my position retraced by 40%.

In the group, there were cries of despair, some said to exit the circle, some said to bottom-fish, some said to lie flat. Meanwhile, I sat in a café, continuing to write my article.

Not because I don't care about money, but because I know: this is just a stress test of the system.

My cash flow system is still running, my skills are still growing, my works are still accumulating, my connections are still deepening, and my spirit is still stable. Market fluctuations are merely one dimension's fluctuation among the five dimensions.

This is what Xiao Mao refers to as 'root node'—when you become the center of your own system, external fluctuations cannot shake you.

True freedom is not about doing whatever you want, but about not being forced to do anything.

I no longer feel forced to watch the market every day because I have my own decision-making system. I no longer feel forced to chase trends because I have my own research framework. I no longer feel forced to compare returns with others because I have my own life rhythm.

I established my own asset portfolio, with 70% in stable allocation allowing me to not worry about short-term fluctuations, 20% in growth investments to participate in industry growth, and 10% for trial and error to maintain curiosity.

I established my own cash flow system, not relying on 'a single throw', but on continuous value creation—writing, consulting, investment returns, and product sharing.

I treat making money as fuel to drive the quality of my life, rather than a source of stress. I treat losses as feedback, not punishment. Every loss tells me which part of the system needs optimization.

I began to use market cycles as the rhythm of my life:

Bull Market: Harvest period, realize profits, accumulate resources.

Bear Market: Construction period, learning and growing, polishing works.

Volatile Period: Testing phase, optimizing the system, maintaining rhythm.

This rhythm has made me no longer anxious. Because I know that regardless of which stage the market is in, I have things to do and I am making progress.

Infinite Game

Writing this, it has been 18 months since I deleted the price alerts.

In these 18 months, I have experienced the tail end of a bull market, a prolonged bear market, and countless fluctuations. My asset net worth has risen and fallen, but my life system has always been upgrading.

I wrote more than 50 articles, learned to use AI to assist in research, established my own knowledge base, met a group of truly interesting people, maintained a habit of exercising three times a week, and read 30 books.

More importantly, I no longer define myself as a 'crypto trader'.

I am someone exploring the possibilities of life in the Crypto era. I use Crypto as leverage, AI as a tool, writing as output, and curiosity as fuel, continuously evolving myself.

This is what I understand as the 'Era of the Super Individual':

Not everyone has to become a billionaire, but everyone can become the designer of their own life. It’s not about detaching from the market, but finding your own rhythm within it. It’s not about pursuing 'winning', but pursuing 'continuous evolution'.

Xiao Mao said it right: A true master is not someone who exits the market, but someone who can continue to evolve their life amidst market fluctuations.

This is an infinite game.

The endpoint is not 'financial freedom', not 'retirement', not 'lying flat'. The endpoint is continuous upgrading, ongoing existence, continuous creation, and continuous growth.

When I stopped staring at the market, I finally understood this game:

The goal of the game is not to win, but to keep playing.

And now, I have finally learned how to play.

If you are also in this game, if you have ever been shackled by price, if you also want to find your own rhythm—

Why not start today, give yourself 40% of the space, converse with your desires, and establish your own system?

This path is not easy, but it is worth it.

Because when you become your own root node, the whole world will make way for you.