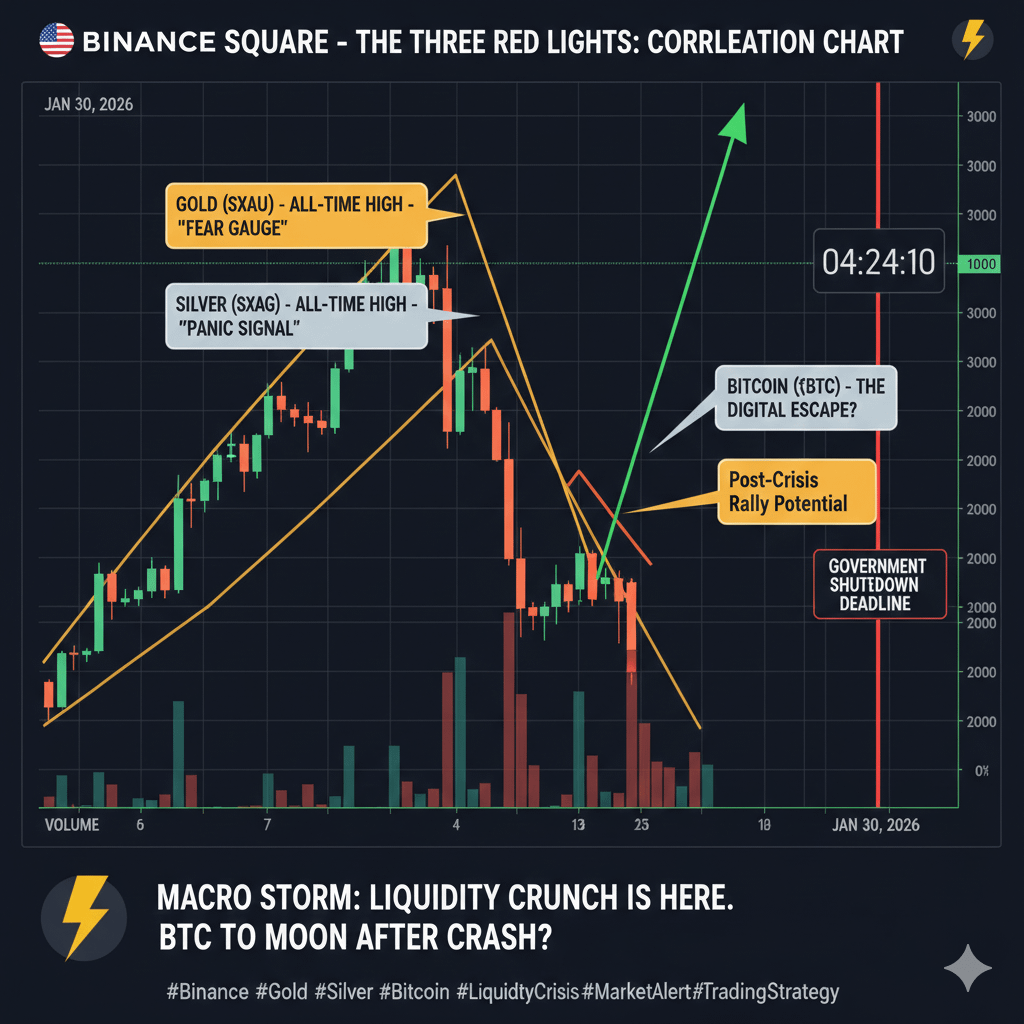

The financial system is shouting through three signals that we haven't seen since the major crises of 2000, 2008, and 2019.

⚠️ THE THREE RED LIGHTS ($XAU, $XAG, JPY)

As we mentioned in the risk analysis, we are facing a configuration of "Perfect Storm":

🔴 Japanese Bond Yield (10Y) at Highs: The Yen's Carry Trade is breaking down. The cheap money that fueled the Crypto and Stock rally is coming back home. Result: Forced liquidations.

🔴 Gold at Historic Highs ($XAU): When large funds do not trust politicians or central banks, they rush to gold. It's not optimism, it's a hedge against a collapse.

🔴 Silver at Highs ($XAG): The signal of industrial and monetary panic. When silver explodes like this, volatility is usually imminent.

📉 How will this affect your portfolio on Binance?

Immediate Impact (Shutdown): If the government shuts down, the SEC and CFTC will operate with minimal staff. Inflation and employment data will be delayed. The market hates the lack of information, which could lead Bitcoin to test the $82,000 - $84,000 range.

The Liquidity Risk: Many investors used cheap Yens to buy BTC. If the Yen rises, they are forced to sell their Crypto to pay their debts in Japan. Fast. Without warning.

The Crypto Advantage: Bitcoin was designed for this. If the traditional system shows deep cracks, the narrative of BTC as "digital gold" and an asset outside government control will strengthen once the initial panic for liquidity passes.

🔥 CONCLUSION: STAY ALERT

Historically, markets capitulate before recovering. We are seeing:

1️⃣ Bonds moving.

2️⃣ Metals flying.

3️⃣ Are liquidations on the way?

📌 Binance Square Advice: Review your leverage levels. In times of systemic stress, volatility does not forgive.

Are you accumulating $BTC as a safe haven or are you moving to Stablecoins waiting for the drop? 👇

#Binance #GovernmentShutdown #Bitcoin #carrytrade #GOLD #Silver #TradingStrategy2026