Today, Tether also released its financial report, which includes that the total profit for 2025 exceeded $10 billion. This figure looks very large and very enticing, but compared to over $13 billion in 2024, Tether's annual profit decreased by 23%.

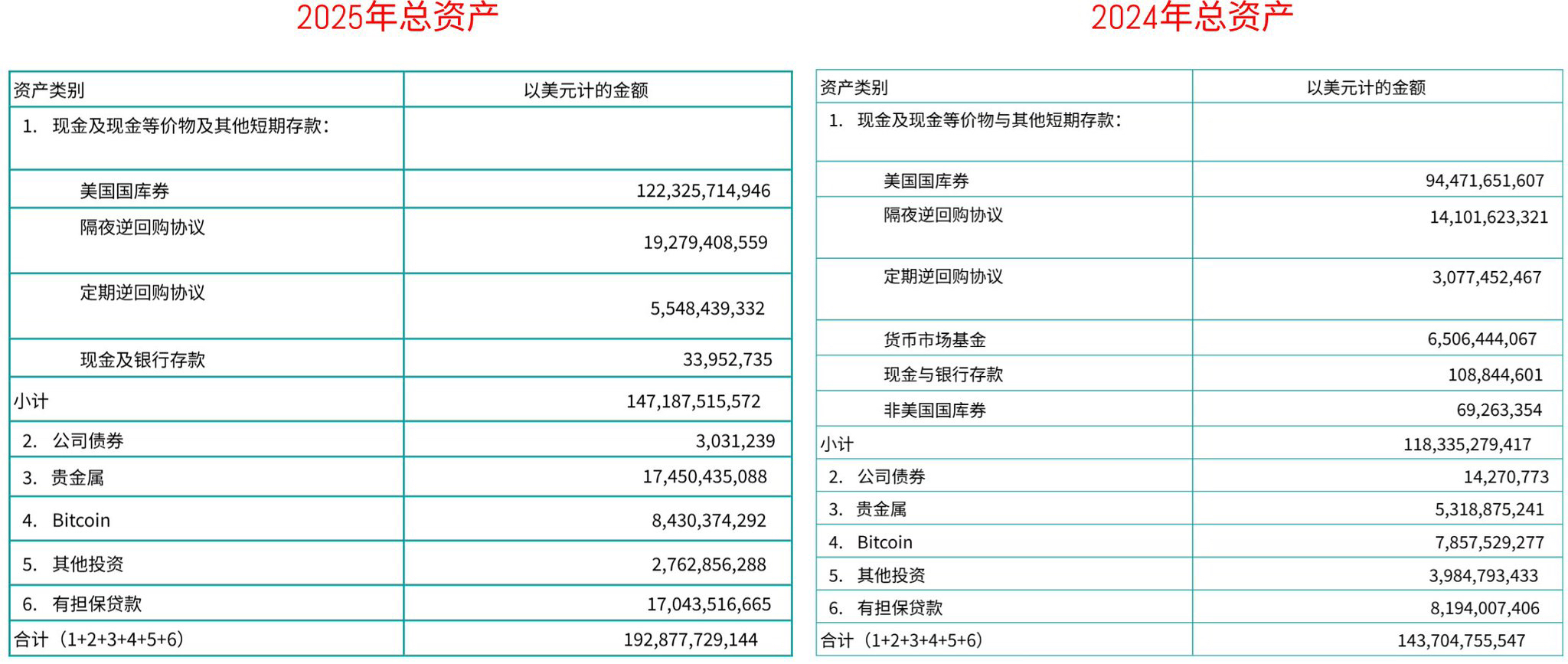

The main source of profit for Tether comes from the interest income generated by holding a large amount of U.S. Treasury bonds. The holding amount reached $122.3 billion in 2025 (accounting for about 63% of total assets), an increase of about 29% compared to $94.5 billion in 2024. Cash equivalents, such as overnight and term reverse repurchase agreements, also increased from about $17.4 billion in 2024 to about $24.9 billion in 2025. However, multiple interest rate cuts by the Federal Reserve in 2025 led to a decline in yields, directly compressing profit margins.

Some friends mentioned that the decline in Tether's profits may also be due to the drop in the price of $BTC, but in reality, Tether's holdings of Bitcoin are valued at 8.4 billion dollars in 2025, an increase from 7.8 billion dollars in 2024, indicating that Tether has increased its BTC holdings in 2025.

Additionally, Tether's holdings of precious metals (including gold) will increase to 174.5 billion dollars in 2025, an increase of about 229% compared to 5.3 billion dollars in 2024. The significant rise in precious metals in 2025 also provides Tether with substantial revenue, but on the other hand, the returns provided by US Treasuries will actually be lower.

This is also the dilemma that $CRCL is facing now, but Tether still has precious metals to increase returns, and although CIRCLE with only US Treasuries and cash is more compliant, it still hasn't found a better way to increase returns.

Moreover, more importantly, in 2025 compared to 2024, Tether's share of stable assets (US Treasuries, cash, etc.) decreased from 82.35% to 76.31%, while the share of non-stable assets (precious metals, Bitcoin, etc.) increased from 17.65% to 23.69%.

In fact, as a stablecoin, Tether's systemic risk is increasing. Currently, Tether's excess reserve funds are at 6.33 billion dollars, and if gold and/or Bitcoin experience a downturn, Tether's risk exposure is increasing. Of course, the likelihood of this is relatively low, but it is not 100% nonexistent, and there is no need to worry for now.