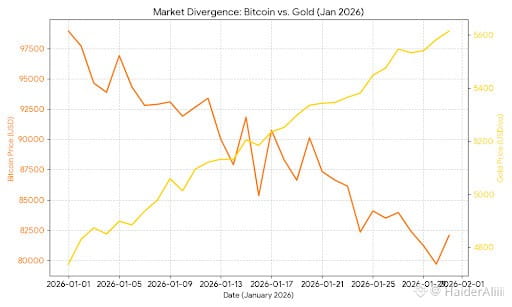

The chart illustrates the significant price divergence observed throughout January 2026, where Bitcoin and Gold have moved in opposing directions, challenging the traditional "digital gold" correlation narrative.

Most traders assume that because Bitcoin is called "digital gold," it must always move in tandem with physical gold. The common belief is that during times of war or geopolitical stress, both assets should skyrocket together.

In practice, the opening weeks of 2026 have proven this assumption wrong. While physical gold has shattered records to trade above $5,600/oz, Bitcoin has struggled to hold the $80,000 level, facing significant liquidations. This decoupling is not a failure of Bitcoin; it is a clarification of its role. Experienced traders are seeing that Bitcoin is currently behaving more like a "high-beta" liquidity play rather than a pure safe haven.

The Reality of the "Safe Haven" Label

In the current market, "safe haven" means different things to different pools of capital. Central banks and sovereign wealth funds are the primary drivers behind the current gold and silver surge. They are not buying gold because they expect a 10x return; they are buying it to exit the US Dollar and hedge against the volatility of the new Trump administration’s tariff policies.

Bitcoin, conversely, is still tied to the "risk-on" plumbing of the global financial system. When the US Dollar stabilizes or when interest rate expectations shift—as they are now with the approaching end of Jerome Powell’s term in May 2026—crypto often feels the "liquidity pinch" first.

Reference Note: As of late January 2026, Gold has seen an annual increase of nearly 97%, while Bitcoin has faced a monthly correction of over 10% after its late 2025 peak.

Common Mistakes: Chasing the Correlated Ghost

The most frequent mistake retail traders make is "revenge trading" the gap. When they see gold rising, they go long on Bitcoin, expecting it to "catch up." When it doesn't, they get caught in cascading liquidations.

In late January 2026, we saw over $1.6 billion in long positions wiped out in a single 24-hour window. This happened because traders ignored the macro signal: the market was entering a "risk-off" phase where investors prefer tangible assets over digital ones. Chasing a correlation that has temporarily broken is a quick way to lose capital.

How Experienced Traders View the Gap

A professional trader doesn't look at the $81,000 Bitcoin price and the $5,600 Gold price and see a contradiction. They see an opportunity in rotation.

History shows that capital is like water—it flows from overextended assets into undervalued ones. Gold is currently in a "super-cycle" and is arguably overbought. Bitcoin is undergoing a healthy "exhaustion" phase. Professional traders are watching for the moment gold's momentum stalls. When the "safe haven" trade becomes too crowded, the profits from gold often rotate back into the high-growth potential of the crypto market.

Instead of panicking about the "death of digital gold," experienced users are using this time to accumulate. They understand that the "Trump Effect"—deregulation, the GENIUS Act, and the potential for a crypto-friendly Fed Chair—provides a structural floor for Bitcoin that gold simply doesn't have.

The Subtle Difference: Tangibility vs. Technology

While gold offers stability and independence from financial infrastructure, Bitcoin offers something gold cannot: asymmetric upside and utility.

In 2026, we aren't just trading a price; we are trading a transition. Gold is the hedge for the world that was. Bitcoin is the infrastructure for the world that is being built. Comparing them is like comparing a fortress to a rocket ship. Both keep you safe in different ways, but only one is designed to leave the atmosphere.

The Trader’s Takeaway

The current market environment is a reminder that Bitcoin’s primary value proposition isn't that it mimics gold, but that it offers a decentralized alternative to the entire fiat system. The divergence we are seeing today is a necessary part of market maturity.

The missing piece that most users overlook is that volatility is the price of the premium. Gold is stable because its upside is capped. Bitcoin is volatile because its potential is still being discovered. If you want the safety of the past, you buy gold. If you want to trade the future, you accept the volatility of the present.

#Bitcoin #Gold #MacroEconomy #BinanceSquare