Over the past decade, the cryptocurrency industry has been continuously reshaping its brand image.

Sometimes it's 'decentralized finance', sometimes it's 'Web3', sometimes it's 'world computer', and sometimes it's 'digital gold'.

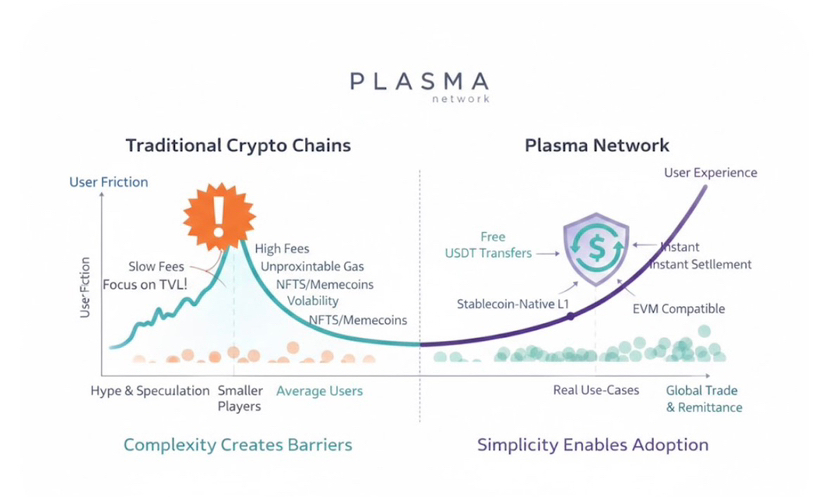

Every new chain is selling the same dream - higher transactions per second (TPS), lower fees, and a token that will change everything in the future.

But to be honest, these promises mean little to the average user.

People don't wake up in the morning thinking about which Gas token to use.

All they want is:

Funds arrive quickly

Prices remain stable

And easy and convenient transfers

This is where stablecoins <extra_id_1> transcend the entire cryptocurrency industry.

Stablecoins: a practical application case quietly adopted widely

Stablecoins like USDT and USDC are no longer experimental.

They have already:

Become a medium of global trade

Become a means of remittance

Become the pillar of exchanges, over-the-counter trading, and on-chain settlements

Trillions of dollars in transactions flow through them every day.

However, the problem is that the blockchain they rely on to operate was not born for them.

Ethereum:

Gas fees are hard to predict

High transfer fees during peak times

Tron:

Low fees, but there are limitations in centralization and user experience

Solana:

Fast speed, but network stability remains questionable

This means stablecoins have become the dollar of the internet,

But their infrastructure is still not perfect.

The story of Plasma begins with its fundamentals.

@Plasma does not attempt to be “another blockchain.”

It also does not position itself as an NFT, gaming, or DeFi hub.

The goal of Plasma is very clear:

“If stablecoins are the currency of the internet, then we need a blockchain optimized for stablecoin transfer needs.”

This is why Plasma is designed as a native stablecoin Layer 1.

Stablecoins are here:

Not secondary tokens

Not experimental

But rather the core of the network

Free transfers for USDT: architecture rather than marketing

When people hear that USDT transfers on Plasma are free,

They would think it’s just a promotional gimmick.

But that’s not the case.

The design philosophy of Plasma is based on the following criteria:

Users should not have to think about gas fees every time

The payment experience should be as simple as sending a WhatsApp message

Therefore, the network model of Plasma is designed to

Make transfers of stablecoins like USDT a core feature of the network.

This is not an additional feature, but a fundamental function.

EVM compatibility: old tools, new thinking

Although Plasma is a new chain, it does not require developers to learn everything new.

It:

Fully compatible with EVM

Supports tools like Solidity, MetaMask, and Hardhat

This means the entry threshold for developers is low,

But the mindset is vastly different.

The question here is not:

“How much TVL is locked?”

But rather:

“How much capital can be transferred without friction?”

$XPL XPL: Backbone of the Plasma ecosystem

This is where XPL comes into play.

XPL is not a token designed for speculation.

It is the economic coordination layer of the Plasma network.

The functionality of XPL:

Ensure network security

Incentivizing validators and infrastructure

Smooth stablecoin transfers

This means users send USDT,

But the backend is powered by XPL.

This separation is implemented to:

Protect users from price volatility

And maintain the sustainability of the network

Argument: Cryptocurrency hype ≠ mass adoption

History shows:

The most eye-catching technology does not always end up as the ultimate winner,

But only the technology with minimal friction can survive.

Email is better than fax,

UPI outperforms bank cards,

Stablecoins outperform traditional remittances.

Plasma is the next step in this evolution.

It does not claim:

“We will change everything.”

But rather:

“We will improve the parts that already work.”

In the future: when blockchains are no longer visible

The ultimate vision of Plasma is:

Users may not even realize they are using blockchain.

In simple terms:

Remittance

Instant settlement

Price remains stable.

When this happens,

Networks like XPL and Plasma will continue to operate in the background,

but real value will be created there.

Conclusion

@Plasma is not part of the hype cycle.

It stems from a very practical problem:

“Since the world is already using stablecoins,

Shouldn't we build the right infrastructure for them?”

$XPL and Plasma is the answer to this problem.

Less noise,

More practical action,

And a tangible step towards true internet currency.

We have explained why Plasma is a must-have and why a blockchain philosophy prioritizing stablecoins is needed.

The question now is:

If Plasma really exists,

How will it change the cryptocurrency industry and the real world?

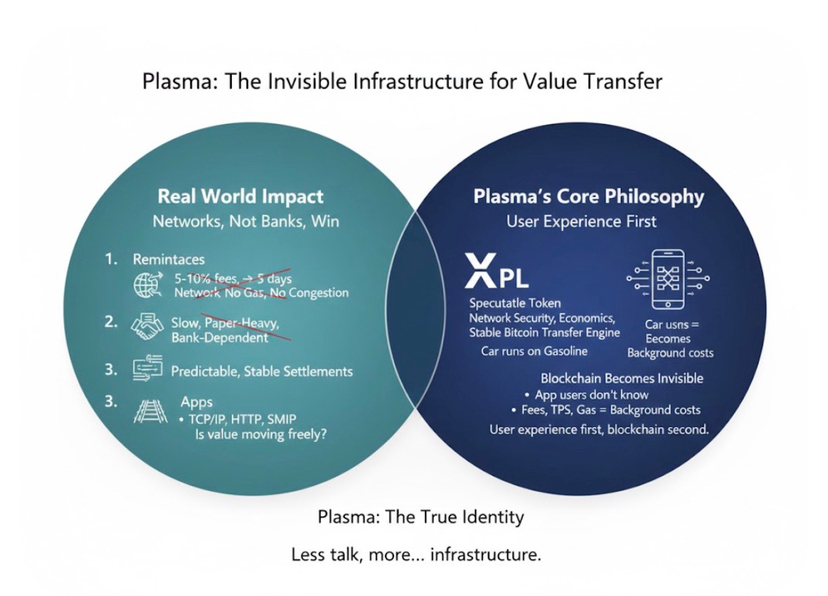

1. Remittances: the network, not banks, is the winner

Even today, millions of people from the following regions face:

Middle East → Asia

Europe → Africa

United States → Latin America

Face the following issues:

5-10% transaction fee

2-5 days settlement time

Exchange rate losses

Stablecoins improve these issues, but the infrastructure has not.

In networks like Plasma:

USDT<extra_id_1> becomes part of the network

No need to worry about gas fees

No need to worry about “network congestion”

This difference is significant.

It's like the difference between email and post offices. 2. Commercial payments: the quiet revolution of B2B

Nowadays, national-level B2B payment systems:

Slow speed

A plethora of paper documents

Rely on banks

But many companies are now:

Make vendor payments through stable connections

Invoice settlements

Over-the-counter trading

Payment methods are also becoming stable.

The problem still exists:

These systems do not exist.

Plasma:

Predictable transfers

Stable settlements

Backend

Users do not need to understand blockchain,

Just make the payment

3. Applications

Cryptocurrency made a big mistake:

Every blockchain begins to claim to be the “home of applications.”

But the expansion of the internet does not depend on applications, but on infrastructure.

TCP/IP

HTTP

SMTP

No one knows them,

But everyone is using them.

Plasma: The same goes for it

Not flashy

Not hyping NFTs

No 100x marketing

There’s only one question:

“Will value flow freely?”

4. What is XPL?

The biggest revelation of XPL:

View it as a “speculative token”

“When will the price surge” plugin

But

Network security

Validator economy

Stable Bitcoin transfer engine

For example:

Users will not remember gas prices,

But cars run on gasoline.

XPL belongs to this category.

5. When blockchain becomes invisible

The true victory of cryptocurrency will be:

Application users may not even know

They are using blockchain

Fees, TPS, gas

All become backend costs

Plasma:

“User experience is paramount,

Blockchain is secondary.”

When Acerogh appears,

The noise on cryptocurrency Twitter will decrease,

But true mass adoption will begin from then.

Conclusion

Plasma is not an “Ethereum killer.”

Next is Solana

“If the world is already using stablecoins,

Should they get the right infrastructure?”

In the first part, we explored the reasons.

In the second part, we explored

Say less, do more…

This is the true essence of @Plasma Plasma.

:

Transactions, liquidity, and stablecoin economics: the true test of Plasma

So far, we have discussed:

The reason for Plasma's creation

How does it provide infrastructure prioritizing stablecoins

Now, let’s get to the core of cryptocurrency:

Transactions and liquidity

This is where each network is truly tested.

1. The biggest truth about trading:

What traders fear is friction, not technology

For active traders, the biggest issue is not TPS or block size.

The real question is:

Gas fees when transferring funds

Delays in on-chain transfers at exchanges

Uncertainty in the costs of stablecoin trading

When the market fluctuates,

Speed is crucial,

The concept of blockchain is equally important.

This is exactly where Plasma trading strategies come into play.

2. Stablecoins ≠ merely “anchored assets”

Nowadays, traders use stablecoins simply to:

Lock in profits

Avoid volatility

Wait for the right timing to enter

But if every transaction is accompanied by:

Sometimes high transaction fees

Sometimes the network speed slows down

Sometimes bridging risks

Traders will be repeatedly obstructed.

In Plasma, stablecoins:

Not “auxiliary assets”

But rather the main flow of the network

That is to say, the liquidity of USDT is not an extra burden,

But rather the natural operation of the network.

3. The invisible enemy of on-chain transactions: settlement risk

Many traders do not realize:

Every slow settlement = hidden risks

Missed arbitrage opportunities

Slippage in over-the-counter trading

The gap between centralized exchanges (CEX) and decentralized finance (DeFi)

The model of Plasma has obvious advantages in this regard:

Stablecoin transfers = predictability

No need to worry about “What is today's transaction fee?” This is not about:

Liquidity flows smoothly

This is especially important for the following parties:

Over-the-counter traders

Market makers

High-frequency stablecoin trading

4. XPL and trading: wrong expectations, right roles

Here’s a crucial clarification.

It is wrong to view XPL as the following behavior:

“The next 100x trade”

“High-frequency trading on daily charts.”

The role of XPL is:

Network security

Economic balance

Support stablecoin traffic

From a trading perspective:

$XPL The value derives from network usage

And not just speculative trading volume

That is to say:

As stablecoin traffic increases,

Network demand will also increase.

Although slow,

But sustainable.

5. The next phase of liquidity:

“Reduce noise, increase transaction volume”

In the cryptocurrency market, people often say:

The louder the noise = the greater the risk

The quieter the system = the higher the transaction volume

Stablecoin trading belongs to this category.

This is where Plasma stands:

Reduce marketing noise

Reduce “breaking news”

But increase real capital flows

For traders, this means:

Fewer surprises,

More control.

6. Future trading architecture: even exchanges will experience delays

If blockchains like Plasma can scale,

In the future, we may see:

Settlement independent of exchanges

Direct transaction flow from wallet to wallet

Market structure driven by stablecoins

Among them:

Fast transaction speed

Settlement costs are low and reliable

But blockchain is just the backend

The final conclusion for traders

Plasma does not tell traders:

“We will make you rich.”

It simply says:

“We will make your transaction infrastructure more convenient.”

The fact is:

The profits from trading come from strategies,

But losses often stem from infrastructure.

@Plasma is dedicated to alleviating this disadvantage.

Reduce friction,

Clear settlements,

And strategies prioritizing stablecoins.

This is its true trading advantage.#Plasma