Markets did not crash because of one bad candle They fell because expectations changed suddenly.

Gold silver and Bitcoin all dropped together and that usually confuses people. These assets are supposed to behave differently. When everything sells at the same time it means the problem is not the asset. The problem is liquidity and policy expectations.

The first trigger came from policy related headlines. Markets reacted to news that Donald Trump is expected to nominate Kevin Warsh as the next Federal Reserve chair. This mattered because Warsh is viewed as less aggressive on rate cuts compared to what markets had priced in. In simple words investors suddenly realized that money may not get cheaper anytime soon.

When rate cut expectations fade the US dollar strengthens. A stronger dollar is bad for non yielding assets. Gold and silver do not produce income. They rely on weaker dollars and easier policy. Once the dollar firmed up investors rushed to reduce exposure.

Gold saw its worst single day decline in decades. Silver fell even harder because it is thinner and more speculative. These moves were not emotional. They were mechanical. Large funds unwound positions that were built around the assumption of easier policy ahead.

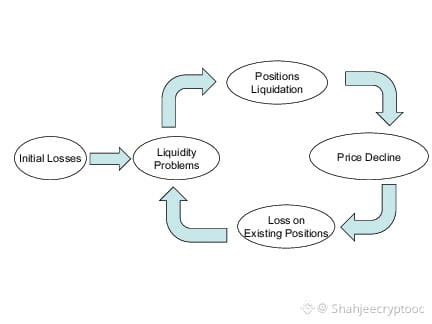

Once metals started falling margin calls followed. When leverage is involved price does not gently adjust. It drops fast. This is why silver collapsed far more aggressively than gold.

The next phase was liquidity stress. When big positions unwind in one market they force selling in others. Traders need cash. Funds reduce risk across the board. That is when crypto gets dragged in even if the original news was not about Bitcoin.

Bitcoin sold off not because its story changed but because its positioning did. In recent months Bitcoin had started behaving more like a risk asset similar to tech stocks. During risk off phases anything liquid gets sold first.

This is why Bitcoin failed to act as a hedge in this move. When fear rises fast correlations go to one. Gold silver crypto stocks all drop because liquidity dries up.

Over eight hundred million dollars in long positions were wiped out in crypto markets during the US session. That liquidation pressure accelerated the move. Forced selling always exaggerates price action.

There is also a psychological layer here. Many traders were positioned for easing conditions. When that belief cracked confidence vanished. This is how sentiment flips. Not slowly but instantly.

This does not automatically mean a long term bearish trend. It means markets are repricing risk. The difference matters. Repricing creates sharp moves. Trends take time.

What happens next depends on follow through. If policy signals continue to lean tight markets may stay heavy. If officials soften language volatility can cool quickly. The key takeaway is this sell off was driven by expectations not fundamentals breaking overnight.

Ignoring policy context leads to bad decisions. Overreacting leads to worse ones. Smart money watches how liquidity behaves after the shock not during it.

The real message of this move is simple. In modern markets narratives change faster than charts. And when expectations shift everything moves together whether it makes sense emotionally or not.

#market #USPPIJump #BitcoinETFWatch #WhoIsNextFedChair #USIranStandoff