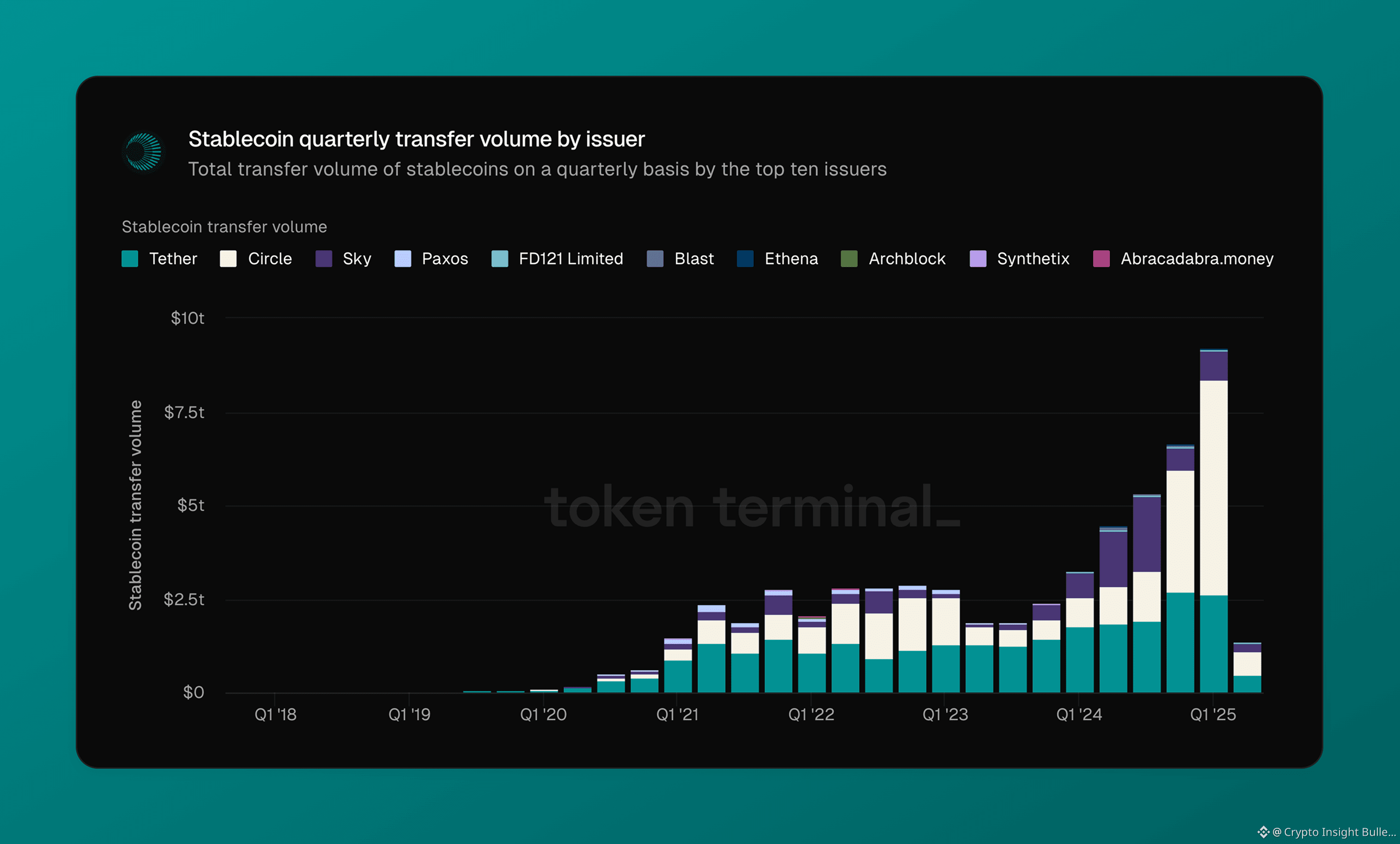

The crypto landscape of 2026 is unrecognizable compared to the early days of Ethereum scaling. For years, the term Plasma was relegated to the history books of blockchain researcha 2017 concept that promised much but was eventually overshadowed by the rise of Rollups. However, in a stunning turn of events, Plasma has been reborn. Not as a complex Layer 2 scaling solution, but as a purpose built, high performance Layer 1 blockchain specifically engineered for the trillion-dollar stablecoin economy.

I’m sharing my personal journey exploring the new Plasma (XPL). We aren't just looking at another Ethereum killer we are looking at the first chain that treats stablecoins as first-class citizens at the protocol level.

A Personalized Shift in Perspective

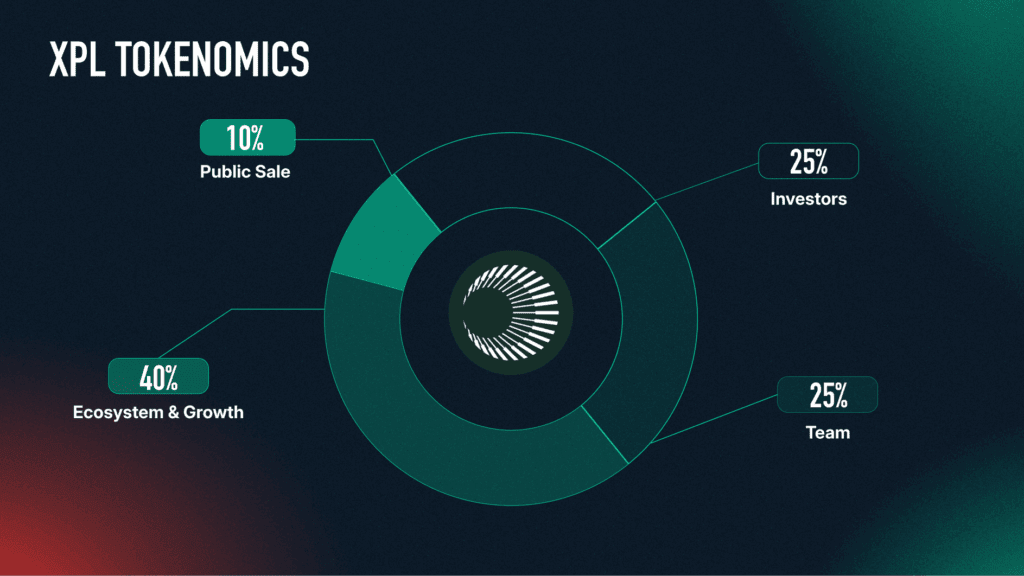

When I first heard that a project was reviving the Plasma name, I was skeptical. I remembered the data availability challenges and the complex exit games of the original Plasma MVP. But after digging into the documentation and testing the devnet. I realized this is a completely different beast.The new Plasma (XPL) is a Peter Thiel backed Layer 1 that has quietly secured a $373 million stablecoin fund and is launching with nearly $2 billion in USDT liquidity available from day one. This isn't just a technical upgrade it's a massive injection of economic energy into a payment focused infrastructure.

The Architecture: Why It’s Different

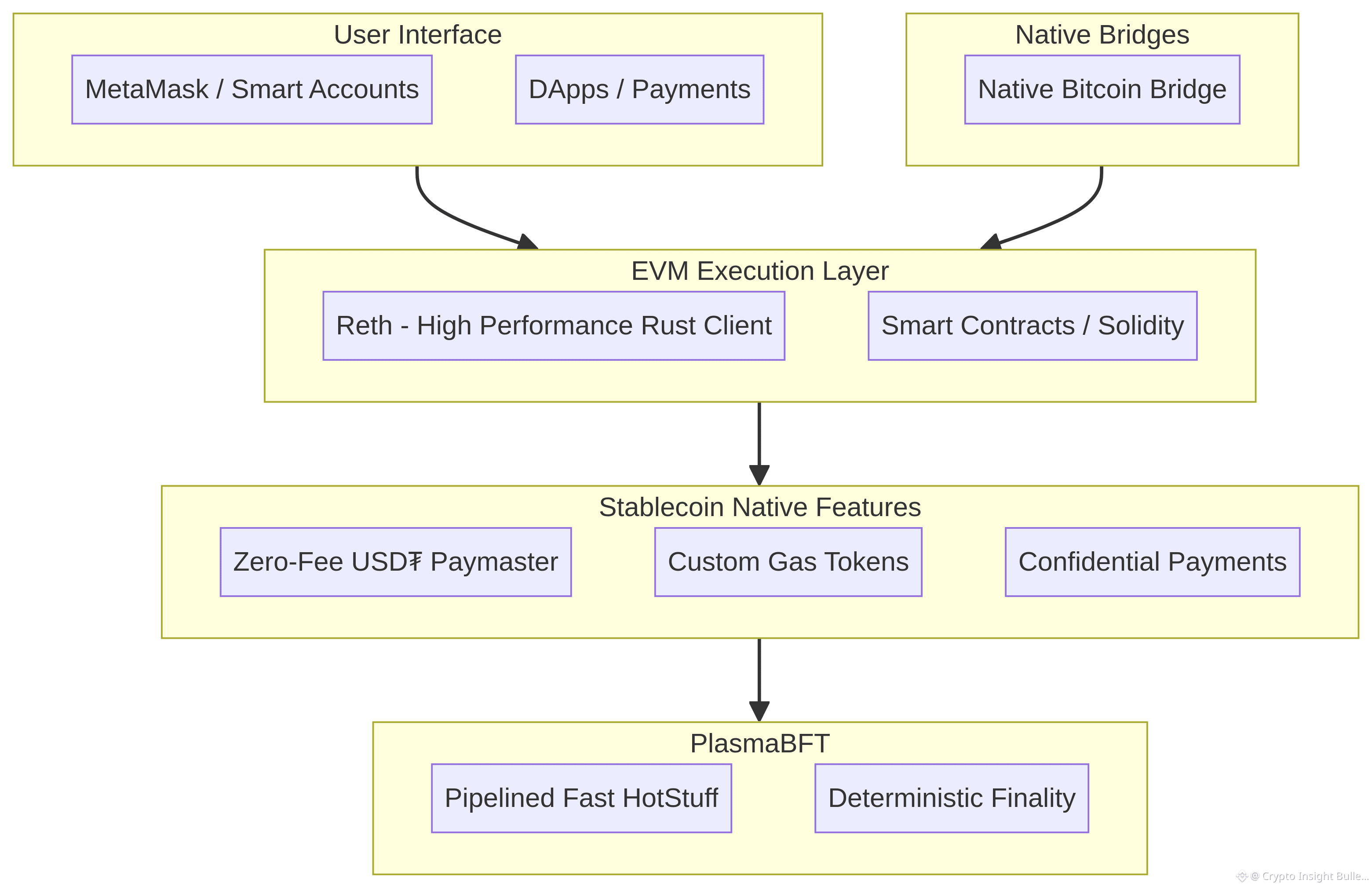

To understand why Plasma is gaining so much traction, we have to look under the hood. Most chains are general purpose, meaning they treat a stablecoin transfer the same way they treat a complex DeFi swap or an NFT mint. Plasma changes this by embedding stablecoin specific features directly into its core.

The Plasma Stack

The following diagram illustrates how the different layers of the Plasma ecosystem interact to provide a seamless payment experience:

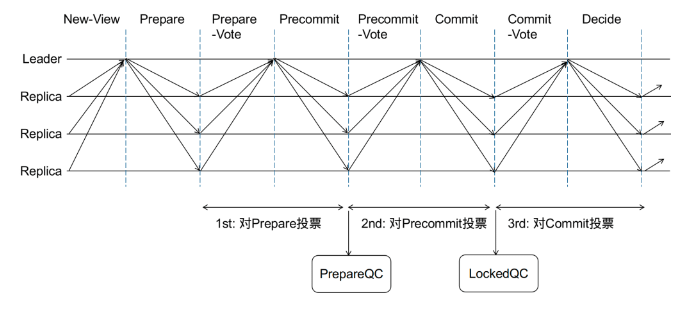

1. The Consensus: PlasmaBFT

At its heart, Plasma uses PlasmaBFT, a pipelined implementation of the Fast HotStuff consensus algorithm. Unlike traditional designs where blocks are proposed and voted on sequentially Plasma parallelizes these stages. This results in deterministic finality within seconds, making it feel as fast as a traditional payment processor like Visa.

2. The Execution: Reth-Powered EVM

Plasma doesn't reinvent the wheel when it comes to smart contracts. It uses Reth, a high-performance Ethereum execution client written in Rust. This means full EVM compatibility. If you use MetaMask, Hardhat, or Foundry, you are already a Plasma developer.

Stablecoin-Native Features: The Killer App

What truly sets Plasma apart is how it handles the friction of crypto payments. We've all been there: trying to send $10 in stablecoins but realizing we don't have enough of the native token (like ETH or SOL) to pay for gas.

Step by Step: My First Experience on Plasma

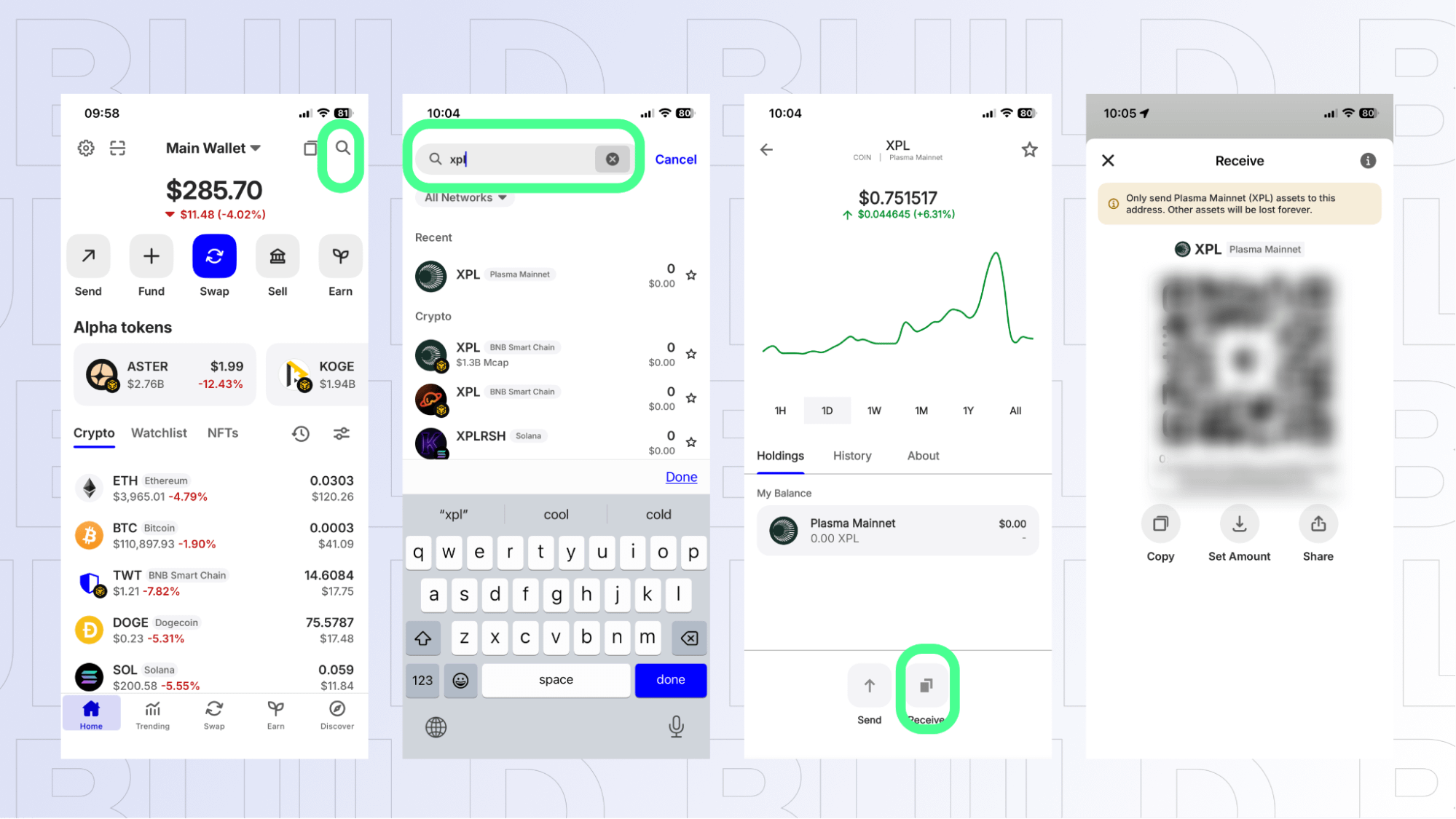

To give you a real feel for how this works, here is the step by step flow I experienced when setting up a payment on the Plasma network:

Connecting the Wallet: I used my standard MetaMask wallet. Since Plasma is EVM compatible, adding the network was a one click process.

The Bitcoin Bridge: I tested the native Bitcoin bridge. Unlike wrapped BTC solutions that rely on centralized custodians, Plasma’s bridge is trust-minimized and non custodial. I could see my real BTC moving into the EVM environment to be used as collateral.

Sending Gasless USDT: I sent a test transaction of 50 USDT. To my surprise, the transaction went through with zero gas fees. The protocol's paymaster automatically recognized the transfer call and covered the cost.

Conclusion: A New Standard for Payments

The Resurrection of Plasma is more than just a clever branding move. It represents a shift toward specialized infrastructure. While other chains try to be everything to everyone, Plasma is laser-focused on being the global rail for stablecoin payments.With $2 billion in liquidity and a technical stack built for speed and privacy, it’s clear that the 15 days ahead of us will be filled with groundbreaking discoveries. Tomorrow, we will dive deeper into the Liquidity Moat explaining how that $2 billion USDT day one liquidity changes the game for DeFi and global commerce.