In a financial landscape increasingly dominated by stable assets, Plasma stands out as the Layer 1 chain engineered exclusively for their optimization. With its zero-fee USDT transfers and sub-second settlements, this blockchain isn't just another network—it's the infrastructure redefining how digital dollars move globally.

Plasma's Core Mission: Tailored for Stablecoin Dominance

Plasma was conceived to address a critical gap in crypto: while stablecoins like USDT have ballooned to trillions in annual volume, most blockchains treat them as afterthoughts. By prioritizing stablecoin-native features, Plasma delivers a system where transfers are instantaneous and costless for end-users, backed by institutional-grade safeguards. This focus stems from recognizing stablecoins as the bridge between traditional finance and decentralized systems, enabling everything from remittances to enterprise settlements without legacy frictions.

The network's architecture draws from proven tech but refines it for precision. Using a customized PlasmaBFT consensus—evolved from Fast HotStuff—it achieves over 1,000 transactions per second with block times under one second. Full EVM compatibility ensures developers can port existing tools seamlessly, fostering rapid app deployment centered on payments.

Decoding the Tech Stack: Efficiency at Protocol Level

At its heart, Plasma integrates stablecoin mechanics directly into the protocol, eliminating common bottlenecks. Zero-fee USDT transfers are powered by a built-in paymaster that subsidizes gas, rate-limited to prevent abuse while maintaining accessibility. Custom gas tokens allow fees in stablecoins or partner assets, reducing reliance on volatile natives and aligning with user preferences for stability.

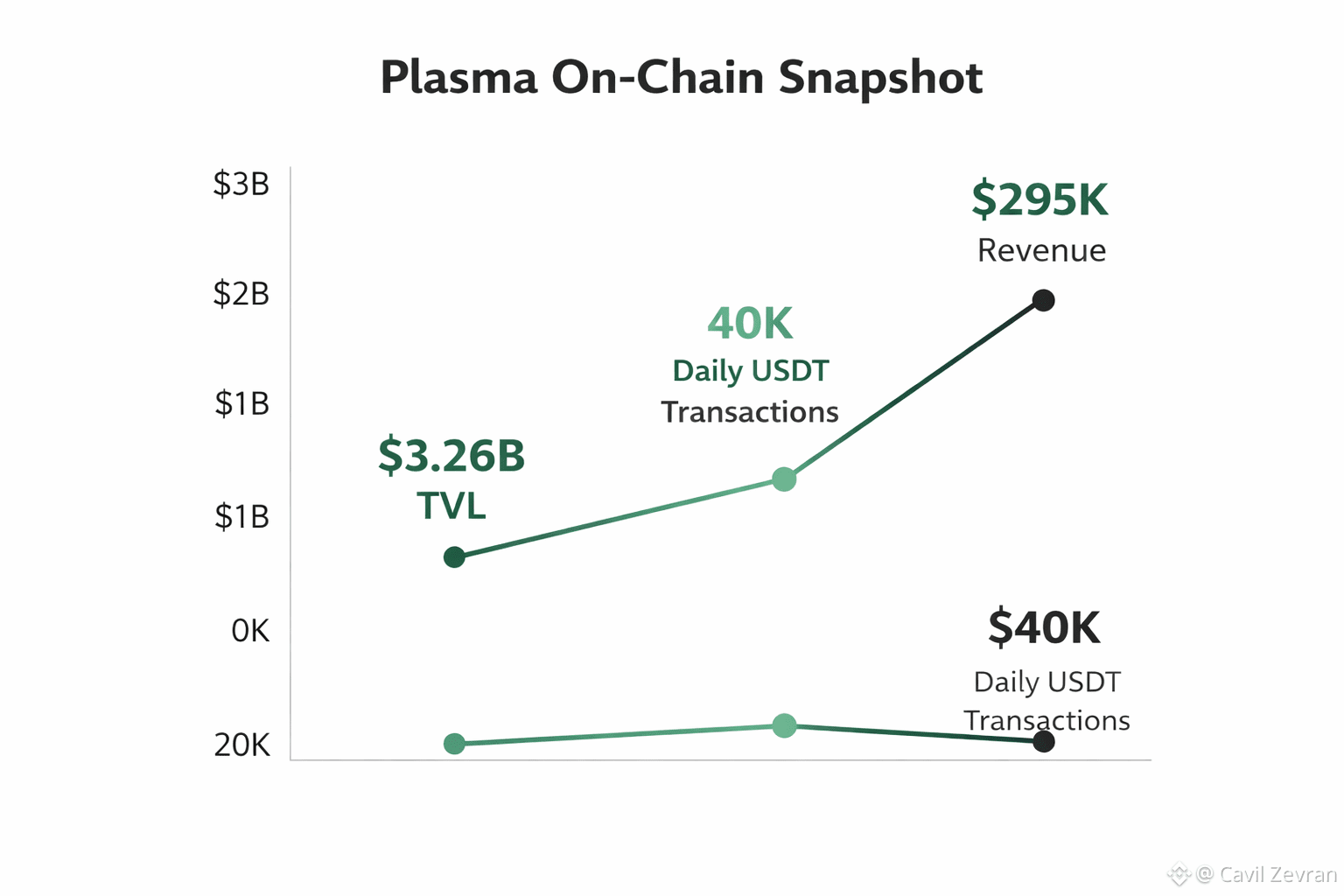

Security draws from Bitcoin's lineage via a native bridge, enabling BTC-backed collateral for enhanced trust. This hybrid approach combines Ethereum's programmability with Bitcoin's robustness, creating a resilient foundation for high-stakes transfers. On-chain, this translates to consistent performance: recent data shows average daily USDT transactions hovering around 40,000, underscoring real-world utility in payment flows.

On-Chain Metrics: A Window into Adoption Trends

Diving into plasmascan.to reveals telling indicators of Plasma's traction. Total value locked (TVL) sits at approximately $3.26 billion, reflecting substantial stablecoin deposits despite market fluctuations. Daily revenue generation nears $295,000, primarily from ecosystem activities beyond zero-fee paths, highlighting sustainable fee models in DeFi integrations.

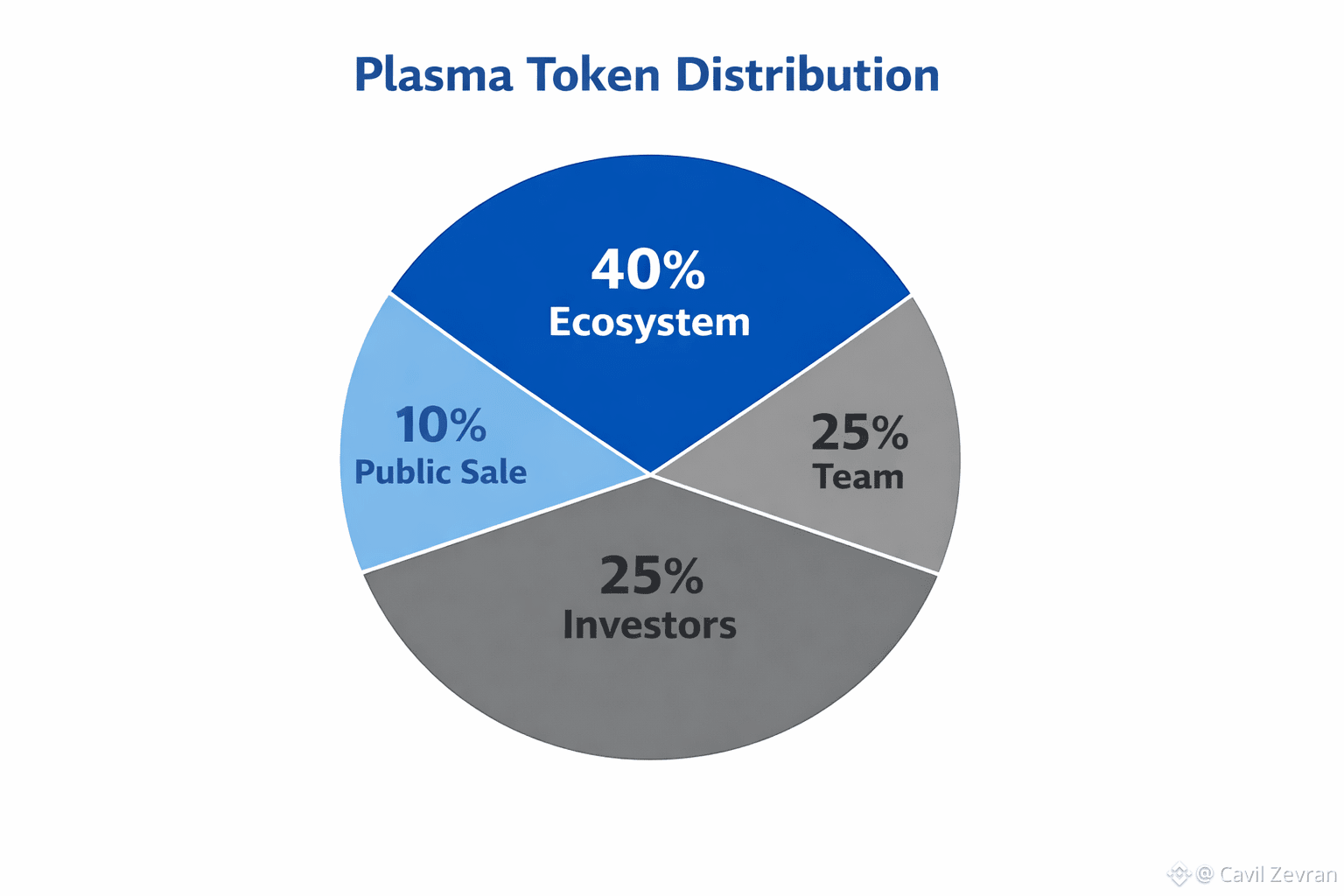

Tracking token flows, the circulating supply of XPL—Plasma's native asset for staking and governance—stands at about 2.2 billion out of a 10 billion total. Staking participation secures the network, with annual inflation starting at 5% to incentivize validators. Educational note: Tools like plasmascan allow users to monitor wallet balances and transaction histories, offering tutorials on querying metrics via APIs for deeper analysis—empowering anyone to verify chain health independently.

Connecting to Macro Forces: Stablecoins' Global Ripple

Plasma's design resonates with broader economic shifts, where stablecoins are poised to disrupt cross-border payments amid rising digital adoption. In regions with volatile currencies, zero-fee transfers could accelerate financial inclusion, mirroring how mobile money transformed Africa. Macro-wise, as central banks explore CBDCs, Plasma's infrastructure provides a decentralized counterpoint, potentially integrating with hybrid systems for seamless interoperability.

Observing the trade widget can offer additional market context for Plasma's native token dynamics within this evolving landscape. With backers like Tether and Peter Thiel, the chain positions itself at the intersection of crypto innovation and traditional finance, where stablecoin volumes could eclipse fiat rails in efficiency.

Evolving Ecosystem: Challenges and Horizons

While Plasma excels in specialization, scalability remains key as adoption scales. Ongoing developments in confidential transactions aim to add privacy layers without sacrificing composability, addressing regulatory and user concerns. Ecosystem growth hinges on partnerships, with over 100 countries and currencies supported via inbound ramps, paving the way for global reach.

Looking ahead, Plasma's Bitcoin-linked security could attract institutional inflows, bolstering its role in a multi-chain world. Yet, success depends on balancing zero-fee accessibility with anti-spam measures, ensuring long-term viability as stablecoin usage intensifies.

Discussion

1. How might Plasma's zero-fee model influence the competitive dynamics among Layer 1 blockchains focused on payments?

2. What on-chain metrics do you track to assess the health of stablecoin-centric networks like Plasma?