The volatility of the cryptocurrency market has once again captured everyone's attention. Bitcoin (BTC/USDT) experienced a sharp decline, plummeting from the $90,600 region and finding crucial (albeit temporary) support at $75.719,90, before a recovery attempt. But what does this movement teach us about the need for precise technical analysis tools and a strategic outlook?

The volatility of the cryptocurrency market has once again captured everyone's attention. Bitcoin (BTC/USDT) experienced a sharp decline, plummeting from the $90,600 region and finding crucial (albeit temporary) support at $75.719,90, before a recovery attempt. But what does this movement teach us about the need for precise technical analysis tools and a strategic outlook?

Unraveling the "Drop": The Raw Reading of the Data

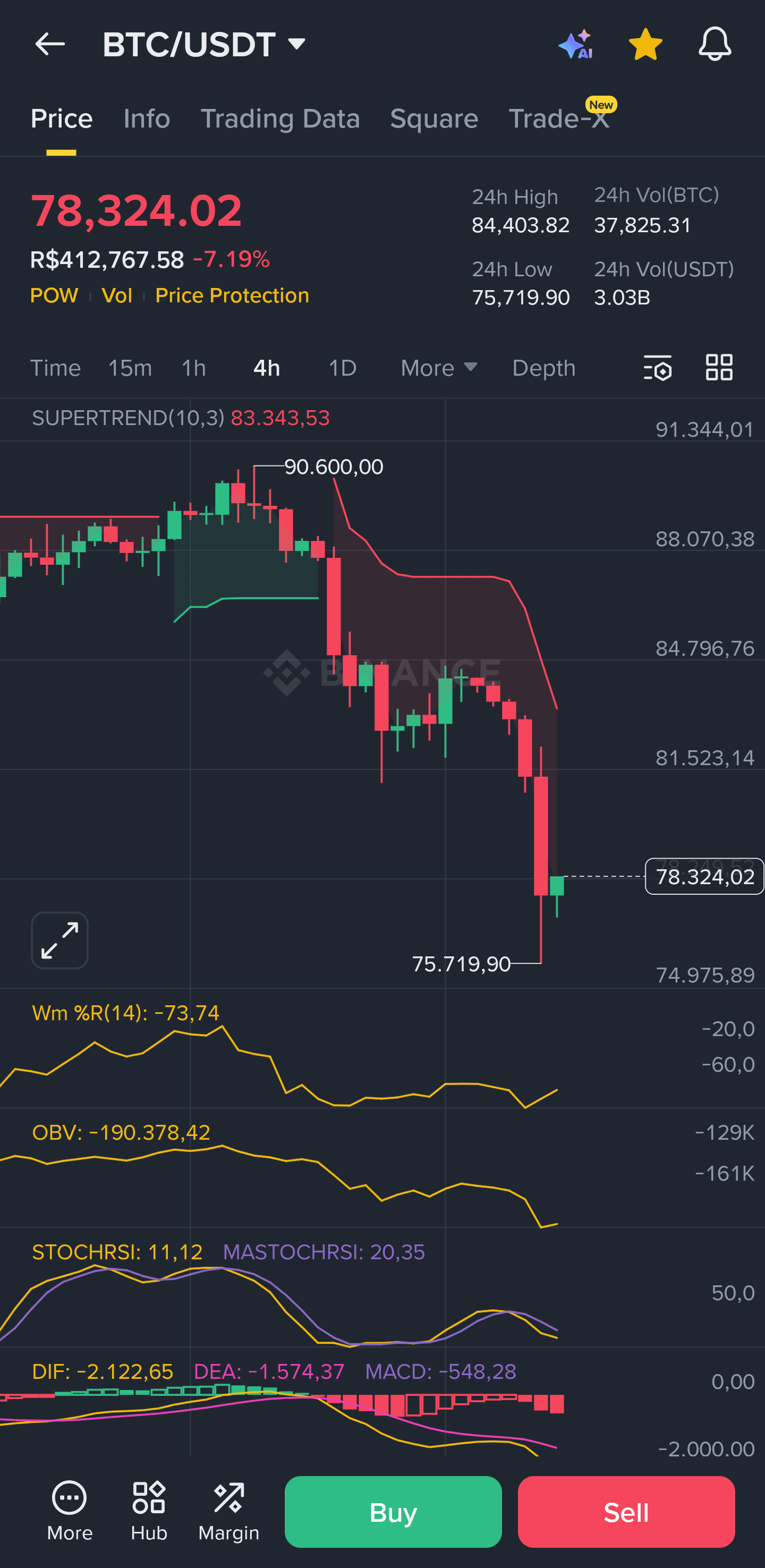

By observing the chart, we can trace the journey of a capitulation and an immediate reaction. The Supertrend indicator, crucial for identifying the dominant trend, firmly remained in "Sell" mode (red), with a clear resistance line at $84.076,31. This reinforces that, despite the recent relief, the short-term downtrend remains intact as long as the price stays below this level.

The candles tell a story of intense selling pressure followed by rapid absorption. The long lower shadow (wick) on the candle's low demonstrates that, upon reaching $75.719,90, there was strong demand, pushing the price back to the $79.110 region. This is classic liquidity-seeking behavior.

Signs of Recovery or Just a Breath? The Importance of Secondary Indicators

Analysis cannot stop at price and trend. Secondary indicators provide a more complete picture:

StochRSI (27,05): This oscillator was in oversold territory, a common signal that a reversal or, at the very least, a price bounce may be on the way. The confluence of indicators here is vital.

MACD: Although the histogram was still "in the red", the stabilization of the DIF (blue line) at -2.184,89 suggests that selling pressure may be losing momentum. Still, the absence of a "Golden Cross" (bullish crossover) in the MACD calls for caution.

OBV (On-Balance Volume): Volume continues to decline (-189.036,63). This is a warning. A strong and sustainable recovery is typically accompanied by a significant increase in buying volume. The current recovery, without this volume support, may be viewed as a "short squeeze" or simple technical relief, and not a definitive change in trend.

BTC67,097.44-2.52%

BTC67,097.44-2.52%