The Japanese yen has been under pressure for a long time.

Every time it weakens, the same debate returns.

Is a weak yen bad for Japan, or is it helping the economy?

Recent comments from Japanese Prime Minister Sanae Takaichi brought this debate back into focus.

But her clarification is important and widely misunderstood.

This is not about choosing a strong yen or a weak yen.

It is about something deeper.

What Takaichi Actually Meant

After public reaction to her remarks, Takaichi clarified her position clearly.

She did not say that a strong yen is always good.

She did not say that a weak yen is always bad.

Her message was simple.

Japan needs an economic structure that can survive currency volatility.

In other words, the goal is not to control the exchange rate.

The goal is to build resilience.

Why Yen Weakness Is Not Always Negative

A weaker yen creates problems.

Imported goods become more expensive.

Household costs rise.

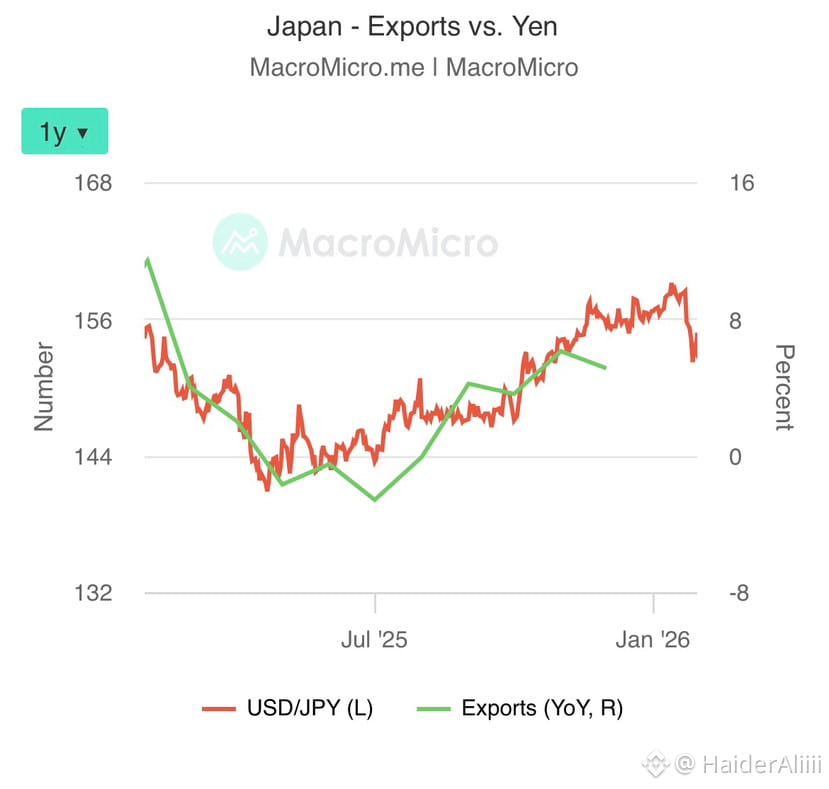

But it also creates advantages.

Japanese exports become more competitive.

Foreign buyers pay less in their own currency.

Export revenues rise when converted back to yen.

This is why Takaichi pointed out the opportunity for exporters.

The Automotive Industry Example

One key sector she mentioned was automobiles.

Japan’s car industry is highly exposed to global trade.

Especially to the United States.

With U.S. tariffs and trade pressure, margins can tighten quickly.

A weaker yen acts as a cushion.

Even if tariffs increase costs, currency weakness offsets part of the impact.

This gives exporters breathing room.

That is not ideology.

That is arithmetic.

Why Policymakers Avoid Simple Labels

Calling a currency “good” or “bad” is misleading.

Exchange rates affect different groups differently.

Exporters benefit from weakness.

Consumers prefer strength.

Governments care about stability.

This is why Takaichi emphasized resilience over direction.

An economy built only for a strong yen struggles when it weakens.

An economy built only for a weak yen struggles when it strengthens.

Resilience means surviving both.

What This Signals About Japan’s Strategy

Japan is not signaling panic.

It is signaling adaptation.

Instead of fighting volatility aggressively, policymakers are focusing on structure.

Diversified exports

Flexible supply chains

Global competitiveness

Policy coordination

This approach accepts that currency swings are part of modern markets.

Why Global Markets Are Watching Japan Closely

Japan matters more than many people realize.

It is a major exporter.

A major creditor nation.

A key player in global liquidity.

When Japan talks about currency resilience, markets listen.

It reflects a broader global trend.

Countries are preparing for volatility, not stability.

What This Means Beyond Japan

This is not just a yen story.

Many economies are facing the same challenge.

Currencies move fast.

Geopolitics shifts trade routes.

Interest rates diverge.

Building systems that work across currency cycles is becoming essential.

Japan is simply saying it out loud.