Anatomy of the controlled crash of Bitcoin below $80,000 and the invisible mechanisms of institutional manipulation

📅 February 1, 2026

✍️ Author: Scarlett528

The global crash and the psychological barrier of $80,000

In the last week of January 2026, the world of cryptocurrencies witnessed an event that many analysts refer to as the 'Great Redistribution.' Bitcoin, the leading digital currency, experienced a dramatic drop, breaking the psychological support of $80,000 and reaching levels of $78,159 – the lowest value since April 2025. This crash is not just a market correction; it represents the erasure of over 30% of the asset's value compared to the historical peak of $126,000 reached in October 2025. For the Bulgarian crypto community, which traditionally takes active positions on the Binance platform, this movement served as a catalyst for a wave of theories suspecting a coordinated attack against small investors.

The analysis of the market structure shows that the decline was accelerated by extremely low liquidity and a lack of interest from retail buyers, making the price vulnerable to aggressive sell-offs by institutional actors. While official financial channels explain the situation with macroeconomic factors, on-chain data reveals a more sinister picture: a strategic 'shaking out' of the market aimed at transferring assets from 'weak hands' to large portfolios at significantly lower prices.

Price dynamics of key assets in January 2026.

This table illustrates the scale of destroyed value. Within just 24 hours at the end of January, the market capitalization of cryptocurrencies shrank by $111 billion, and liquidated positions in the derivatives markets exceeded $1.6 billion. These figures are not coincidental; they are the result of cascading liquidations that are often used to artificially suppress the price below key support levels.

Kevin Warsh's nomination: Political chess and the end of cheap money

A central element in the narrative of the January crash is the nomination of Kevin Warsh for the next chairman of the U.S. Federal Reserve. President Donald Trump announced his choice on January 30, 2026, describing Warsh as a 'central character' who will change the way the central bank functions. Warsh, a former Fed governor with a reputation as an inflation 'hawk,' has always supported a smaller balance sheet for the Federal Reserve and stricter monetary policy.

For the crypto market, this appointment sounded like a death sentence for liquidity. Bitcoin historically thrives in an environment of expanding fiat balances, and the nomination of a person calling for 'regime change' and a reduction in the money supply led to an immediate withdrawal of capital towards the dollar. The dollar index (DXY) rose by 0.75% as investors began to calculate higher interest rates for a longer period.

However, there is serious suspicion of double play. While officially Warsh is a 'hawk,' in 2025 he began publicly supporting Trump's calls for a quicker rate cut, criticizing Jerome Powell for his caution. This controversial position suggests that Warsh may be preparing for the role of 'controller of chaos' – deliberately provoking short-term market panic to justify radical changes in banking regulation and the introduction of new financial instruments that would benefit large banks at the expense of decentralized assets.

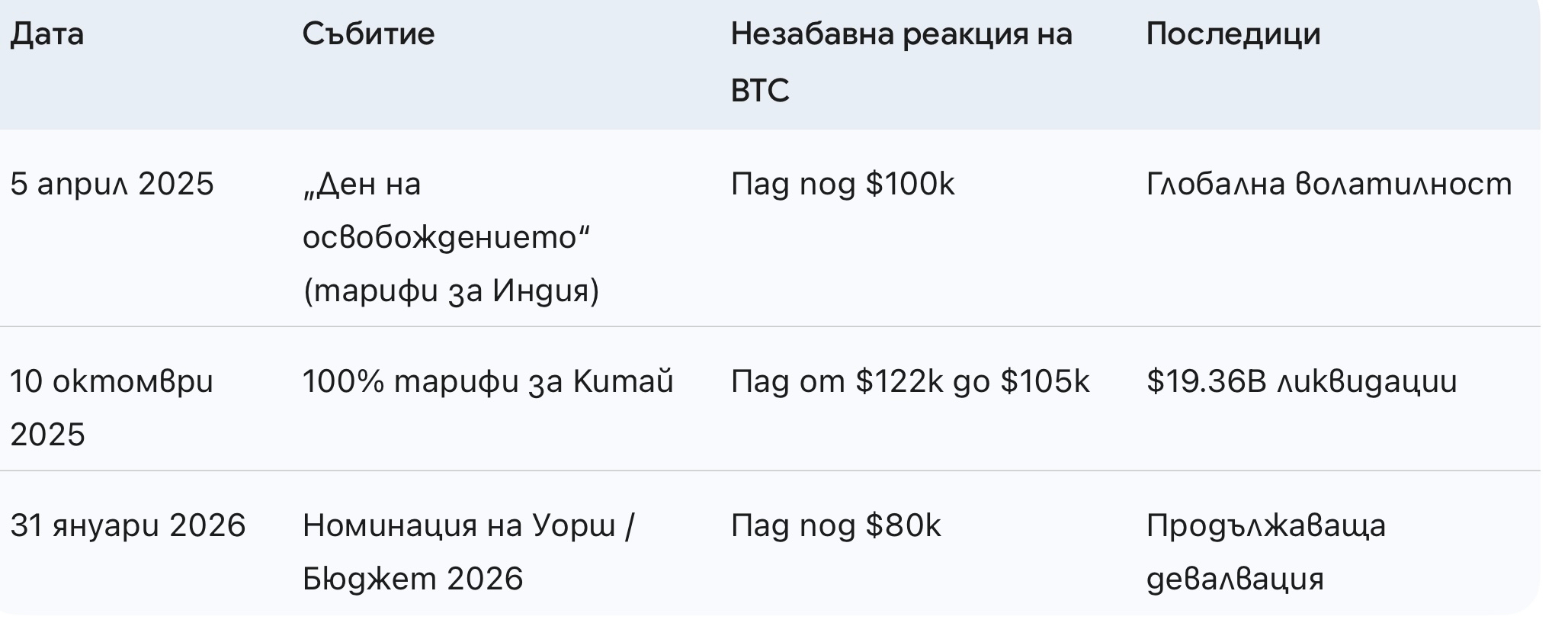

The shadow of 'Liberation Day': Tariff wars as a tool for control

The crash of 2026 cannot be understood without considering the legacy of the so-called 'Liberation Day' – the term under which the Trump administration introduced aggressive tariff packages in 2025. The announcement of 100% tariffs on Chinese imports on October 10, 2025, triggered the largest stock market crash since the pandemic, wiping out $2 trillion in global wealth.

Bitcoin, which was initially seen as a hedge against such shocks, was dragged into a liquidation spiral. On October 10, 2025, BTC fell from $122,000 to $105,000 in just hours. In January 2026, the market returned to these levels of 'post-liberation' shock. The conspiracy theory here is related to the so-called 'insider trading': data shows that wallets linked to large market makers opened massive short positions minutes before Trump's official posts on Truth Social. One specific trader, identified with wallet 0xb317 on Hyperliquid, made between $160 and $200 million by closing his positions right at the bottom of the crash.

Timeline of tariff shocks and market reactions

This model of 'management through shock' shows that the crypto market has become a hostage to the geopolitical maneuvers of the U.S. It is claimed that tariffs are used as a mechanism to pump liquidity from digital assets back into the U.S. dollar to finance the growing government deficit, which reached critical levels in 2025.

The institutional exodus: Where did the money from the ETFs go?

January 2026 marked the most severe period of outflows from spot Bitcoin ETFs since their inception. In the week between January 20 and 26, institutional investors withdrew over $1.1 billion. Most concerning is that 92% of these outflows were concentrated in products from BlackRock (IBIT), Fidelity (FBTC), and Grayscale (GBTC).

This was not a panic flight of small investors, but a precise repositioning by major asset managers. Instead of supporting the crypto market, these institutions began massively directing capital towards tokenized versions of gold, silver, and uranium. This phenomenon raises the question: Did institutions use Bitcoin merely as a temporary capital reservoir while waiting for the stabilization of traditional commodity markets? Analysts from Wincent and Kaiko point out that the market depth of Bitcoin has dropped by 30% below the levels from October 2025, which is a symptom of deliberate liquidity draining.

Details on outflows from ETFs (January 2026)

* Fidelity (FBTC): -$757.20 million.

* BlackRock (IBIT): -$508.7 million.

* Grayscale (GBTC): -$289.8 to -$408.10 million.

* Ark 21Shares (ARKB): -$48.90 million.

This coordinated sell-off coincided with a period of 'whale silence.' While the ETFs were being emptied, large portfolios holding over 1,000 BTC were net sellers throughout 2025, dumping a total of 161,294 BTC onto the market. This process of 'distribution' typically occurs before major crashes, suggesting that 'smart money' knew about the impending drop below $80,000 long before it happened.

The theory of the 'Dead Internet' and algorithmic suppression of spirit

One of the most intriguing theories circulating among the Bulgarian community in Binance Square is related to the so-called 'Dead Internet Theory.' According to it, since around 2016, a large part of the activity on the internet has been generated by bots and AI models aimed at manipulating public opinion and consumer behavior. In the context of the January crash, this theory takes on a financial dimension.

A strange anomaly is observed: despite the massive drop in price, social networks were devoid of the usual enthusiasm for 'buying the dip.' Instead, platforms were flooded with pessimistic analyses generated by anonymous profiles that imitated human behavior but followed clear algorithmic patterns for sowing fear (FUD). Analysts suggest that AI bots from Grok and other large language models were used for 'subconscious programming' of investors to sell their assets, supporting the narrative that Bitcoin is 'old news from three years ago.'

This algorithmic suppression of sentiment works hand in hand with low network activity. Willy Woo describes the Bitcoin network in January 2026 as a 'ghost town,' with record-low transaction fees and a lack of new addresses. In such an environment, it is easy to control the price, as there is no organic resistance from small participants who have been isolated in their digital 'echo chambers' fed by artificial content.

The mechanism of 'CME gaps' and liquidation traps

From a technical standpoint, the drop to $78,000 was predicted through the analysis of futures markets. At the beginning of 2026, a significant gap formed in the CME (Chicago Mercantile Exchange) charts between the levels of $90,000 and $88,500. In the world of institutional traders, there is an unwritten rule that these gaps must always be filled.

Speculations suggest that major exchanges and hedge funds exploited the low liquidity during weekends to 'push' the price through these gaps, triggering a wave of automated margin calls. On January 31, Bitcoin fell from $84,356 to $75,644 in just hours, passing through zones of 'thin' liquidity where there were no buy orders. This was not a market sale, but a mechanical deleveraging event designed to clear long positions and allow institutions to accumulate assets at levels below MicroStrategy's strategy ($75,979).

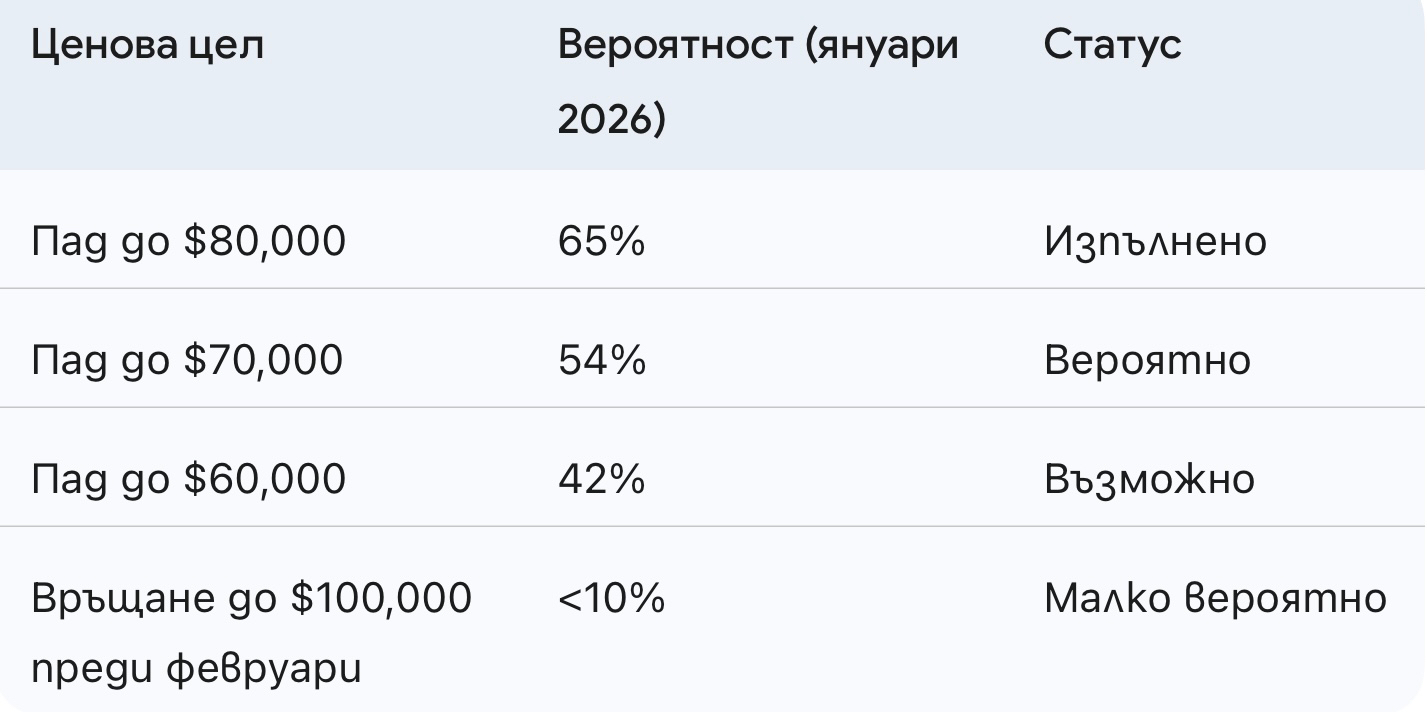

Probabilities for the price bottom in 2026 (according to Polymarket)

These data show that the prediction market was pre-set for a bearish scenario, which is often used as a tool for a self-fulfilling prophecy. When the majority believes in the decline, the liquidity for purchases disappears, leaving the path for the price downward completely open.

The Bulgarian community in Binance: Reactions and survival

In Bulgaria, crypto enthusiasts have always been known for their resilience and skepticism towards official financial institutions. However, the drop below $80,000 sparked serious discussions in Binance Square Bulgaria. While some see this as the 'golden pit' for accumulation, others are worryingly silent.

Official data from Binance shows that on January 22, around $4 billion in BTC were moved between large players, indicating that despite the price drop, 'whales' are in a state of high activity, preparing for the next phase of the cycle. For the Bulgarian investor, it is important to monitor not only the price but also the incoming flows to the exchanges. The 'Whale Inflow Ratio' indicator is currently at a 10-month high, signaling that any price increase to $85,000 - $88,000 is likely to be used for new sell-offs by large holders.

Additionally, the introduction of futures on gold and silver backed by USDT on Binance on January 8, 2026, provided Bulgarian traders with an alternative risk management tool. Many local investors began diversifying their portfolios, moving capital from volatile altcoins to tokenized commodities, further contributing to the pressure on Bitcoin's price.

The geopolitical puzzle: Tensions with Iran and the U.S. budget

We cannot ignore the influence of the international scene. In January 2026, tensions in the Middle East reached peak points, with warnings from Iran about possible strikes against Israel, despite threats of military action from the U.S. Traditionally, such events should have pushed Bitcoin up, similar to gold. The reality, however, was the opposite: cryptocurrencies behaved like 'risk assets,' not 'safe havens.'

This change in behavior is key to the conspiracy theory. It is claimed that Bitcoin has been deliberately 'tamed' through the introduction of ETFs, which have tightly linked it to the traditional banking system and the stock market. Now, instead of serving as an exit from the system, Bitcoin has become part of it, reacting to every movement of interest rates and every statement from the Treasury Secretary. Concerns about a government shutdown in the U.S. at the end of January 2026 only intensified this negative effect, prompting investors to trust 'hard' assets like gold, which reached record levels around the same time.

Conclusion: 1000 days to a new peak?

The crash of Bitcoin below $80,000 in 2026 is not the end of cryptocurrencies, but rather the end of their 'wild freedom' phase. All evidence – from Kevin Warsh's nomination to record sell-offs from whales and ETF outflows – points to one thing: a coordinated effort to consolidate the market under institutional control.

Analysts like Richard Hodges from Ferro BTC Volatility Fund warn that investors may not see a new historical peak in the next 1000 days. This 'freezing' of the market is necessary for the big players to clear excess leverage and recalibrate the global financial architecture in the context of high inflation and tariff wars.

For the Bulgarian Binance community, the strategy is clear: a critical attitude towards information on the web, avoiding the traps of high leverage, and understanding that in a world of 'dead internet' and algorithmic manipulation, patience and real data are the only tools for survival. Bitcoin at levels below $80,000 may be a 'golden opportunity,' but only for those willing to wait out this turbulent geopolitical cycle. The path to $225,000, predicted by some optimists, passes through the 'valley of shadows' of 2026.

#bitcoin80k #BinanceBulgaria #WhaleAlert #KevinWarsh #Deadinternettheory