In the volatile world of cryptocurrencies, the term 'bear market' is often mentioned, but few new investors truly understand its implications. Many entered the market in 2020-2021, or in 2024-2025, periods of euphoric rises, and have not experienced the intense bearish phases that have marked the history of cryptos. This article, inspired by a detailed thread on X (formerly Twitter), aims to demystify what a true bear market is, its consequences on prices, projects, and investor psychology, while providing advice on how to prepare for it.

Definition of a Bear Market:

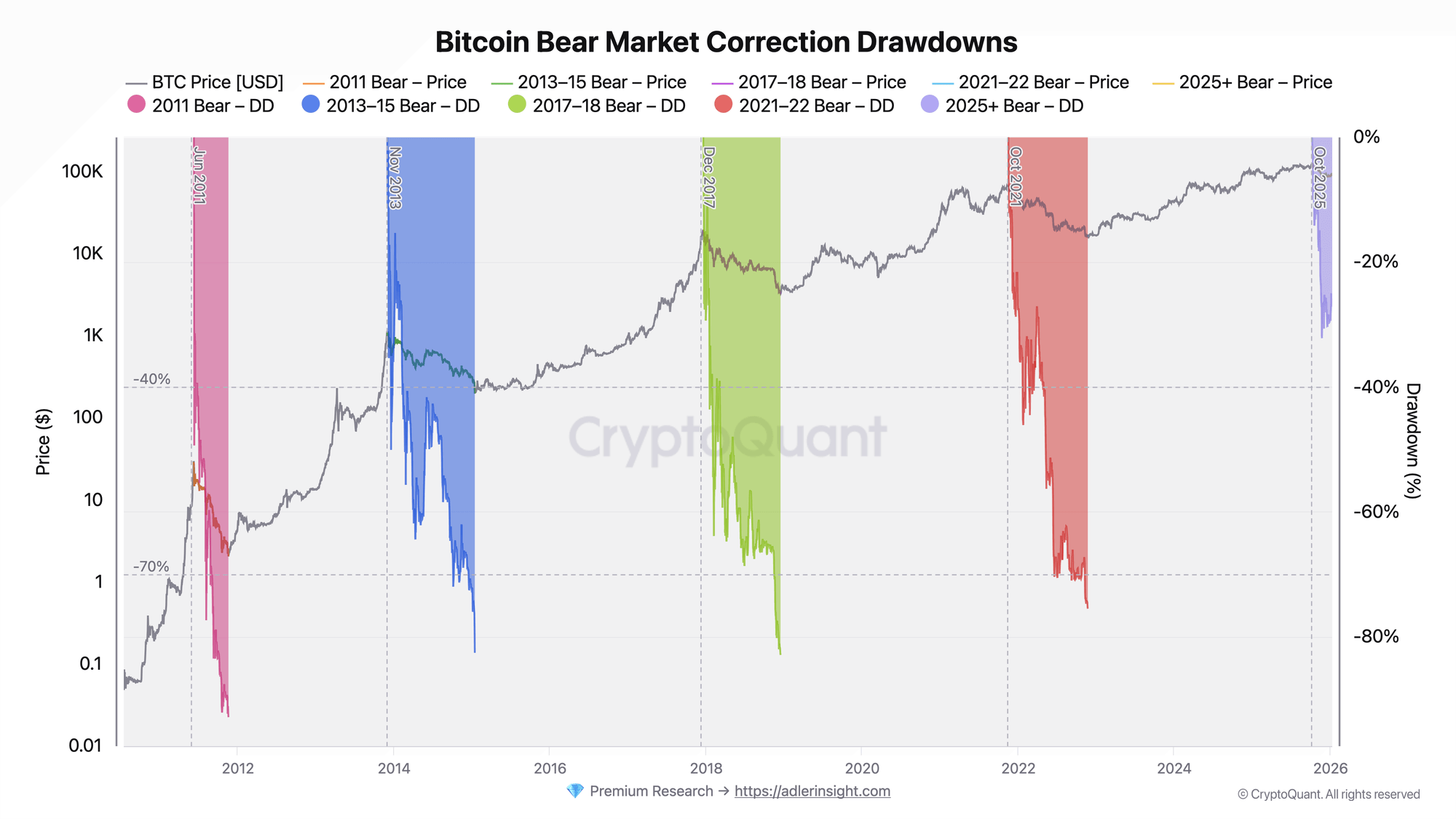

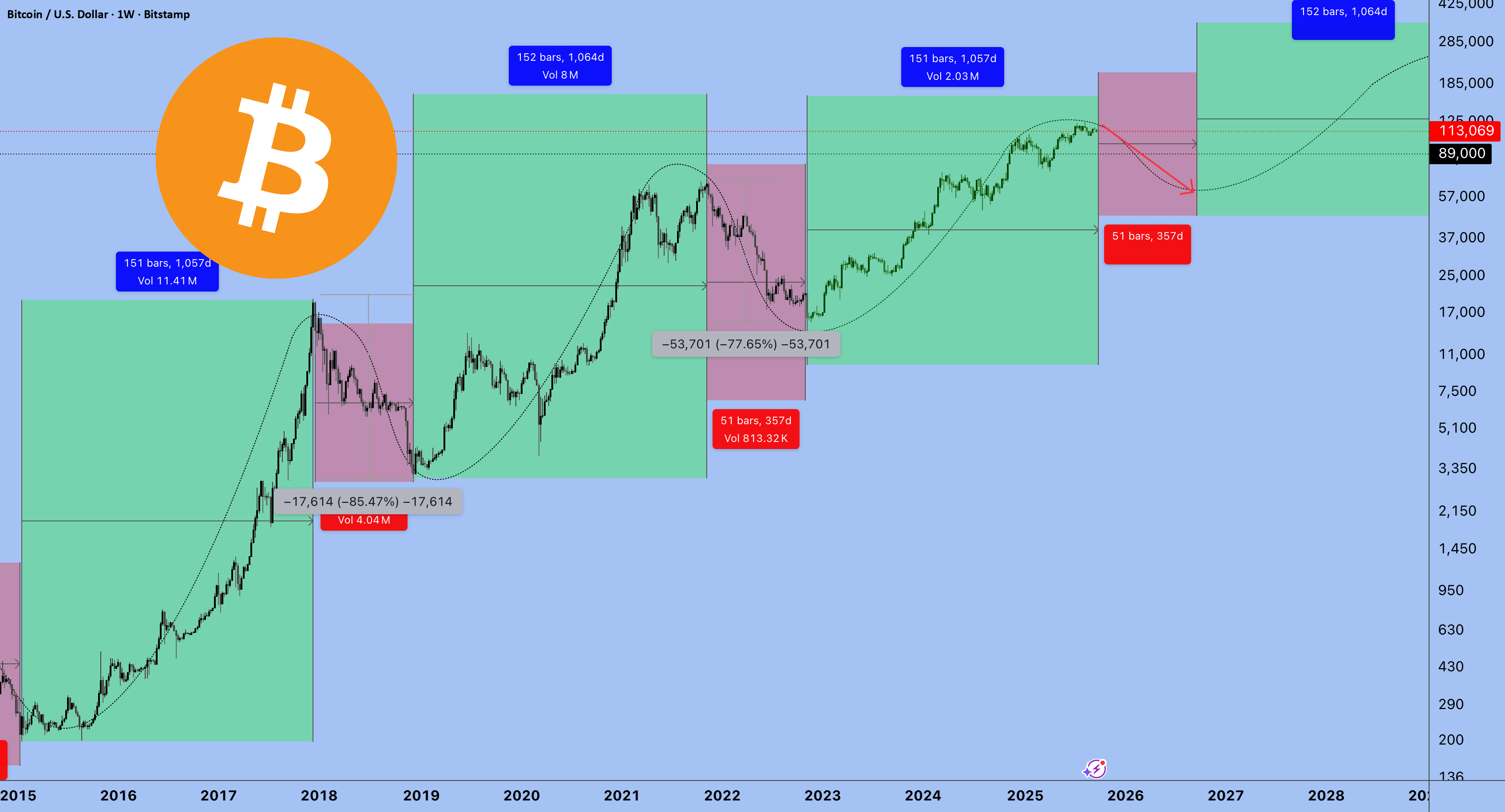

A bear market is not a mere passing correction, but a prolonged period of price decline that alters the short, medium, or even long-term trend. It's not about crying wolf at every small dip, a common mistake among some analysts. In the cryptocurrency sector, these bearish phases are cyclical and have struck several times. Bitcoin ($BTC ), the pillar of the market, has experienced massive retracements of -80 % to -90 % during past bear markets, such as those of 2013-2015 and 2018-2019. But these events aren't limited to these well-known periods; the history of cryptos is marked by such cycles. Here’s a visual overview of the major historical drawdowns of Bitcoin during bear markets:

The Impact on Altcoins and the Global Market:

Altcoins, these alternative cryptocurrencies to Bitcoin, often suffer even more dramatic declines. During the bear market of 2018-2019, the total market capitalization of altcoins plunged by 92 %, despite the arrival of new projects that artificially inflated this value. Many projects, once at the peak of hype, have lost more than 99 % of their value and still struggle to regain even a fraction of their past glory. Let's take a few concrete examples from the top 100 of December 2017 (based on historical snapshots from CoinMarketCap around December 17, 2017):

$HC (HyperCash, formerly Hcash), 20th place → Still ultra-marginal (0.002, market cap <100k, market cap <100k, market cap <100k, loss >99.99 % since ATH).

$EMC (Emercoin), ~40th → Price ~0.09-0.10 $, ranking >5000, vegetative survival (loss >99 %).

$PAY (TenX), 47th → ~0.0015 $, zombie project (loss >99.9 %).

$DRGN (Dragonchain), 85th → ~0.009, market cap 3−4M, market cap ~3-4M, market cap ~3-4M, one of the few that held on a bit (loss >99 %).

Let's now move on to more recent examples from the top 100 in May 2021 (ATH period for many):

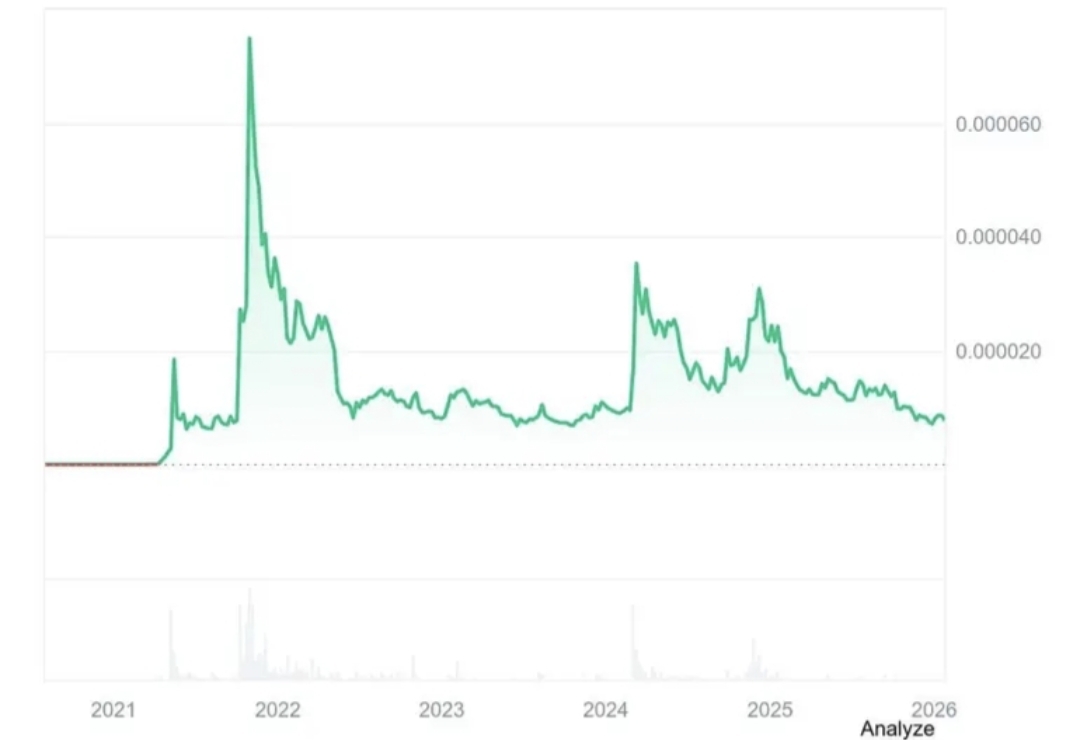

$SHIB (Shiba Inu), entered the top 10-20 at the end of 2021 → Despite memorable pumps, it remains far from its absolute ATH (loss >90-95 % from the peak in 2021, and stagnant or declining in relative bear phases post-2022).

Here's the price evolution of SHIB since its peak:

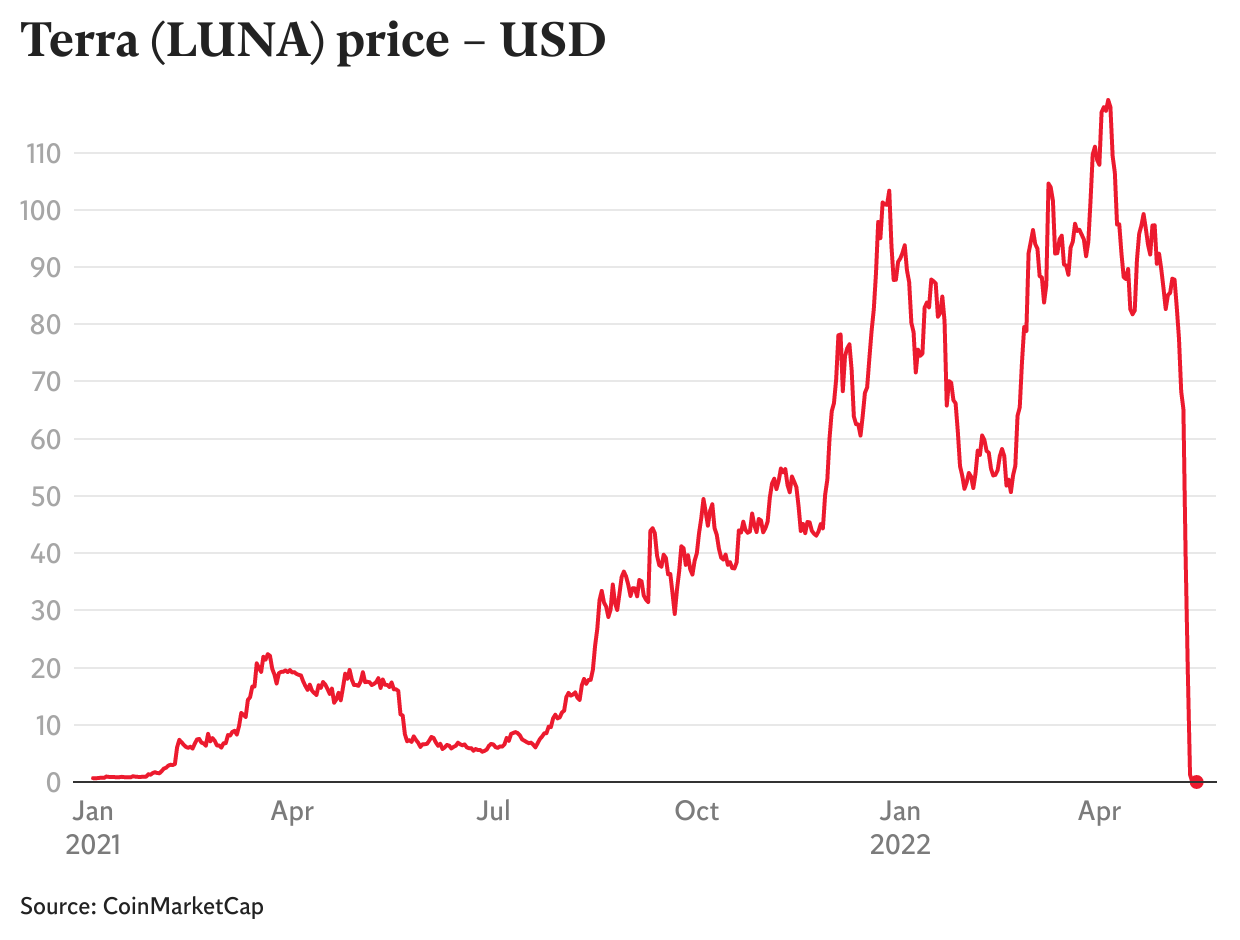

$LUNA (Terra) $LUNC, top 5-10 in May 2021 → Total crash in 2022 → LUNA 2.0 exists but is worth mere fractions of a cent compared to the old ATH (~$119 → nearly zero effective for original holders, loss ~100 %). The iconic LUNA crash:

$FTT (FTX Token), top 20-30 → Completely dead after the FTX bankruptcy at the end of 2022 → No longer tradable on major exchanges, no residual value for most. The brutal collapse of FTT:

$CRO (Crypto.com Coin), top 10-20 → Loss >90 % since ATH 2021, despite surviving thanks to the exchange (but very far from its peak).

$AMP (Flexa) or $CEL (Celsius), in the top 100 → Celsius imploded in 2022 (dead project, token worthless), AMP lost >95-99 % and remains marginal.

Many others from the top 100-200 of 2021 (like SafeMoon, Squid Game token, Bitconnect-like modern scams, or countless DeFi farms) have simply disappeared or have been delisted. Platforms like Pump.fun (Solana) have accelerated the phenomenon: according to CoinGecko (report January 2026), more than 53 % of tokens launched since mid-2021 are inactive or 'dead' by the end of 2025, with a shocking record of 11.6 million projects erased in 2025 alone (often meme coins, rugs, or automated pump-and-dumps on Solana/Base). Massive (or not) 'rug pulls' like Mantra (OM) in 2025 (~$5.5 billion evaporated in a massive dump) or LIBRA (politically promoted, crash -96 % in hours) illustrate that the purge continues, faster and more violently than ever. Even the 'solid' ones from the top 30-50 of 2017-2021 have experienced drawdowns of -80 to -99 % before partial rebounds ($ETH , ADA, XRP, SOL...), but for the vast majority of altcoins from those times, the reality is ruthless: total disappearance, survival in inactive micro-cap, or infinite dilution. The bear market (and the subsequent cycles) spares no one; it simply accelerates the elimination of the weak. History repeats itself with every hype, but with volumes and speed multiplied thanks to easy launchpads.

The Inevitable Purge and its Consequences:

A bear market is a healthy purge for the market: it eliminates weak projects, wild speculation, and artificial bubbles. However, this purge hurts. Imagine a scenario where everything declines, relentlessly, for months, even years. 95 % of the cryptos shilled today could disappear, leaving an endless wait for the survivors. The market has professionalized since 2017, with increased utility for altcoins thanks to decentralized finance. Yet, history repeats itself: bull cycles do not last forever, and a new bear phase is likely.

The Psychological Aspect: Are You Ready?

Beyond the numbers, the bear market tests the mental resilience of investors. Taking a -90 % hit on your portfolio? Waiting 2 or 3 years to see peaks again? Many underestimate this impact. Tragic stories abound on platforms like Reddit: ruined investors, having lost their savings, their morale, and even family or friendship relationships. The bear market amplifies mistakes like excessive debt or impulsive investing. Ask yourself these questions:

Are you aware that the current dynamics are temporary?

Do you respect the saying 'Only invest what you can afford to lose'?

Do you have a strategy to protect yourself?

Tips for Surviving and Thriving

Don't quit your job to live off a 'crypto income' after quick gains. Adopt a cautious approach:

Be patient: Cycles take time.

Adopt a strategy: Diversify your portfolio beyond cryptos.

Limit leverage: Avoid risky borrowing that amplifies losses.

Take profits: Don't HODL everything; secure gains. Don't hold everything hoping for 100×.

Build a diversified portfolio: Mix cryptos, stocks, real estate, etc.

Keep learning: Make independent decisions, without blindly following influencers.

Accept that patience is one of the few skills that truly pays off in this market.

In 2017, few warning voices were raised on social media. Today, with an abundance of resources (videos, articles, testimonials), you have all the tools to avoid the traps of euphoria. Listen to the veterans of past cycles and do not repeat their mistakes.

In conclusion

A bear market is not the end of the crypto world, but a necessary step for its maturation. Prepare yourself mentally and financially, and turn this phase into a buying opportunity for solid projects. As Esprit Cryptique says: "Enjoy it and don't make the same mistakes."

When I read the thread from Esprit Cryptique for the first time in November 2021, I was still very new to the space. I found the words harsh, almost pessimistic.

And then time passed... and I understood.

So yes, bear markets hurt. Very much sometimes. But they are also the moments where real portfolios, real knowledge, and real fortunes for tomorrow are built. The market does not reward the impatient, the dreamers, or those who follow the crowd.

It rewards those who stay, who learn, who protect their capital, and who buy fear when everyone sells. So breathe. Prepare yourself. And above all: don't let fear make you exit at the worst moment. Cycles come and go. Solid projects return. And those who held on... often end up smiling. Enjoy the calm. Accumulate wisely.

And we'll meet on the other side 🌞.

#bearmarket #MarketCorrection #CZ #Binance