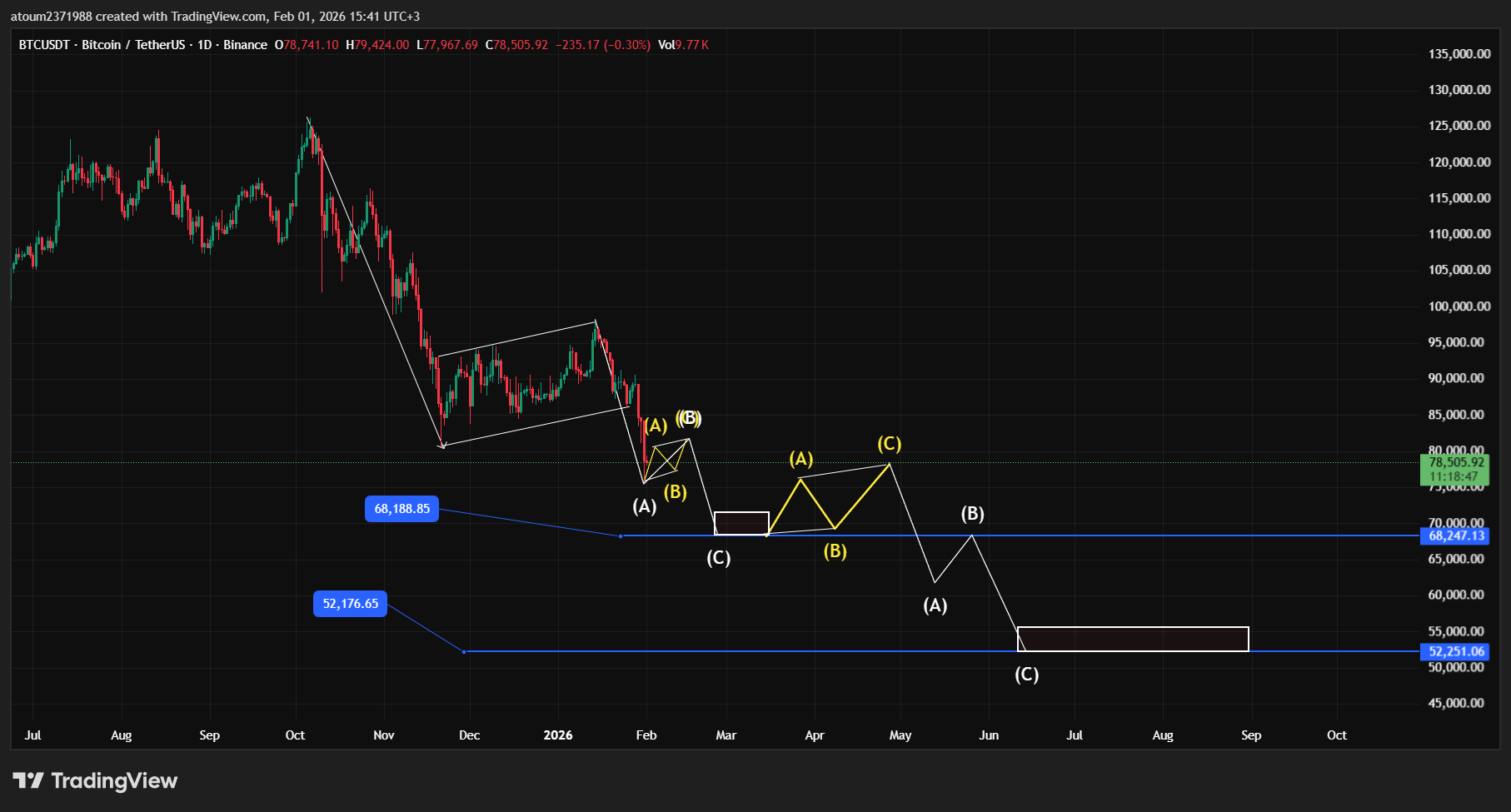

I previously set the targets for the second bullish wave to around $68,000 as the first target and $52,000 as the second target for Bitcoin after we spent more than two months in a significant correction between the $80,000 and $98,000 zones, which we delineated and identified its waves. We repeatedly warned of a potential drop at any moment, and I explained all the models and probabilities, always leaning towards a drop unless we reclaim the $107,000 zone.

Therefore, caution should be exercised at this time because the wave has not yet ended, and the price has not stabilized clearly. You see in the attached image a detailed scenario for the decline. It is expected that we will experience a three-wave or five-wave correction in the current area before the next drop to 68,000 dollars, and we could drop directly, so caution is advised.

After that, we should have a significant correction before visiting the 52,000 dollar area, whether it is a three-wave or five-wave correction. In these two corrective areas, speculative opportunities will be available and good for quick daily trades, while adhering to risk management and using stop-loss to protect your balance.

*This is the current scenario for the bear market and it is subject to error and accuracy, and it is not required for the price to move in the exact manner illustrated; rather, it is a conception of price movement and target areas at the peak of the decline. This is neither a recommendation nor financial advice.

Note: We do not ride the wave; we are in the heart of the waves, reading them before they occur. This is our specialization in wave analysis and price action. I announced in my live broadcast two months ago that we are in a bear market, and I had been avoiding trades because I know the level of risk in this area due to my long experience in this market. I have witnessed the seasons of decline and rise firsthand in the past.

* I will update the analysis according to what the chart dictates to us, and anything is possible. The market might improve at any moment, or we may stick to this analysis until further notice. Stay well.