I start paying attention when markets get uncomfortable.

Calm periods hide weaknesses. Stress reveals design. After trading through multiple cycles, I’ve learned that the real test of infrastructure is not how it performs on launch day, but how it behaves when volatility spikes and assumptions break. That’s why resilience and incident response quietly became a serious topic around Plasma in 2024.

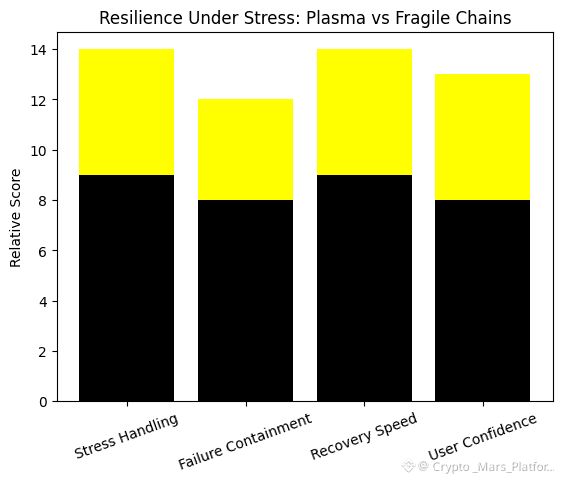

Resilience sounds abstract, but the idea is simple. When something goes wrong, how much damage spreads, how fast it’s contained, and how clearly users understand what’s happening. Many networks confuse speed with strength. They move fast until they don’t, and when they stop, everything stops with them. Plasma’s architecture appears to be designed with a different expectation: things will fail sometimes, so the system should fail in controlled ways.

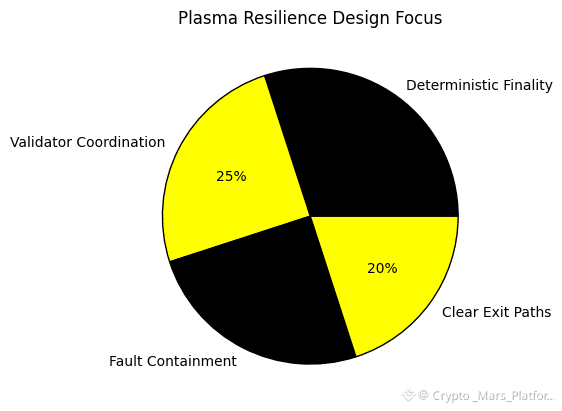

In technical terms, resilience is about limiting blast radius. Deterministic finality plays a role here. Once a transaction is final, it stays final. There’s no reorganization risk creeping in later. That reduces uncertainty during stress. Validator coordination also matters. A clearly defined validator set can respond faster to faults than loosely coordinated systems where responsibility is unclear.

Why is this topic trending now? Because the market learned the cost of downtime. Between 2022 and 2023, several fast-moving chains experienced halts, rollbacks, or extended instability during peak volatility. Traders noticed. Investors noticed. By 2024, resilience stopped being a theoretical concept and became part of due diligence. People began asking not just “how fast is it?” but “what happens when it breaks?”

@Plasma ’s design choices align with that shift. Instead of optimizing only for throughput, it emphasizes predictable behavior under load. Stablecoin-first settlement reduces volatility exposure at the protocol level. Fee predictability reduces panic-driven behavior. Clear exit mechanisms give users options if conditions deteriorate. All of this contributes to resilience without making noise.

Progress here has been incremental. There were no dramatic announcements in 2024 about revolutionary failover systems. Instead, Plasma development focused on tightening assumptions. Cleaner state transitions. Better validator accountability. More consistent settlement metrics. These aren’t features users brag about, but they shape how a network behaves when pressure builds.

From personal experience, I’ve learned that confidence during volatility comes from knowing the rules won’t change mid-trade. When infrastructure behaves predictably, you can focus on market decisions instead of operational fear. Networks that panic under stress push that panic onto users. Networks designed for stress absorb it.

There’s also a psychological aspect. Markets amplify uncertainty. If users don’t know what’s happening, they assume the worst. Resilient systems communicate through behavior. Transactions either settle or they don’t, clearly. Finality either arrives or it doesn’t, consistently. Plasma’s deterministic approach reduces ambiguity, which is often more dangerous than failure itself.

Technically, resilience is closely tied to observability. You can’t respond to incidents you can’t see. Plasma’s focus on transparent execution and measurable finality makes it easier to diagnose issues early. Early diagnosis reduces cascading failures. Cascading failures are what turn small bugs into systemic events.

For developers, resilience means fewer silent errors and clearer recovery paths. For traders, it means lower operational risk. For investors, it means fewer tail risks hiding behind impressive benchmarks. Plasma’s architecture seems to prioritize this alignment across participants rather than optimizing for a single metric.

Philosophically, resilience reflects humility. It assumes that systems are imperfect and users are rational. Instead of promising uninterrupted perfection, it aims for graceful degradation. That mindset feels mature. Early crypto celebrated invincibility. Mature crypto prepares for stress.

I’ve watched projects lose credibility not because they failed, but because they failed unpredictably. I’ve also seen trust survive outages when behavior was understandable and recovery was clear. The difference wasn’t speed. It was design philosophy.

In 2024, as capital became more selective, resilience quietly gained value. Traders stopped chasing chains that only worked in ideal conditions. They gravitated toward systems that stayed usable when conditions worsened. Plasma’s focus on controlled failure and predictable recovery fits that trend.

In the end, resilience isn’t about avoiding problems. It’s about containing them. Markets will always find ways to surprise systems. The question is whether the system surprises users in return. Plasma’s approach suggests it tries not to.

Trust grows when bad days don’t become disasters. Over time, that matters more than peak performance. In trading, survival compounds. Plasma’s resilience philosophy feels built around that simple truth.