Expectations about Bitcoin are very high among people, but the full truth is known only by major investors and market whales.

Have you ever imagined that the price could drop from 128,000... towards 70,000?

It may seem unreasonable, but in reality, it is a golden opportunity for those who missed entering early in the previous movement.

Life offers opportunities for everyone, but the decision is yours: Will you seize it or let it slip away?

I am starting to enter early from these areas targeting 148 thousand…

And a day will come when you will remember this article. 🔥

Current Bitcoin behavior on the daily time frame is neither random nor emotional; it is organized, mechanical, and deeply rooted in liquidity dynamics that have repeated in every major Bitcoin cycle.

What seems like weakness on the surface is a critical moment of preparation.

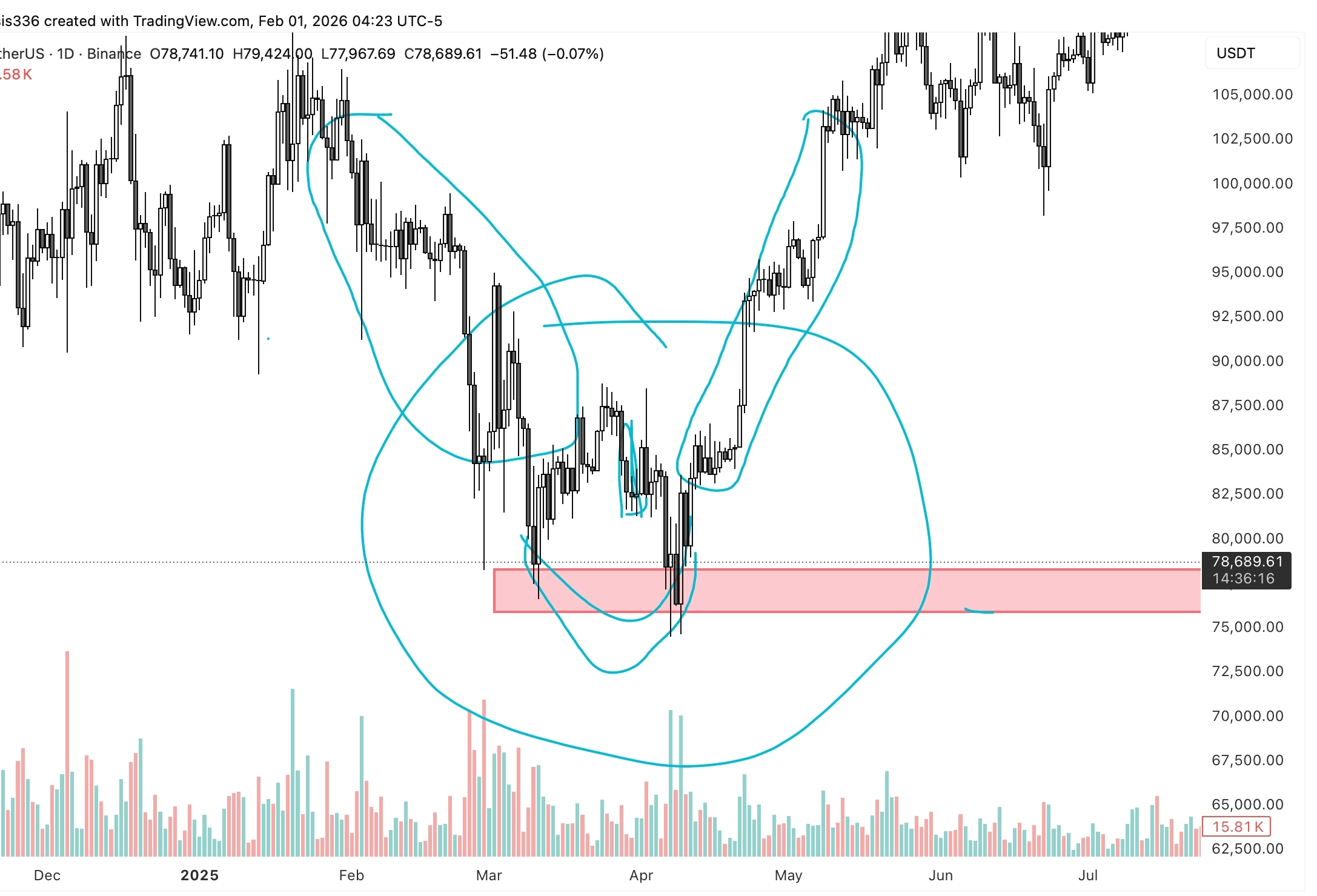

The chart you are watching captures one of those moments: a phase where the price pressures traders' psychology while setting the stage for a major directional move.

The pivotal question now is simple yet powerful:

Is Bitcoin entering a long-term bearish phase?

Or is this decline calculated to flush out the late buyers before resuming the rise to much higher levels?

Your view that the 77 thousand zone represents the last shake before a rally towards 148 thousand strongly aligns with Bitcoin's historical behavior during major bullish cycles.

We will review this hypothesis based on the structure of the daily frame, channel dynamics, liquidity theory, market psychology, and cycles—without noise or short-term exaggeration.

The daily frame is where institutional intentions show.

Smaller time frames are dominated by leverage, noise, and emotion, while the daily chart reflects capital rotation, hedging, accumulation, and distribution.

On the current daily BTC chart, critical elements stand out:

A descending channel directs price movement

Sharp rejection from the upper boundary of the channel

Strong break of mid-channel support

A direct approach to a historic demand zone near 77 thousand

Expansion in volatility after a compression phase

This mix is not bearish by nature.

In Bitcoin's history, it often indicates the late phase of corrections within broader bullish markets.

From a higher time frame perspective, Bitcoin's move towards 77 thousand looks closer to a final liquidity sweep within a major bullish cycle, not a failure in trend.

The sharp collapse on the daily frame has flushed out long positions, invalidated the breakouts of the latecomers, and reset the market positioning—classic features of a correction phase, not a total peak.

The price did not collapse in chaos; rather, it moved with structure and intent, indicating a transfer of coins from weak hands to strong.

Ultimately, no sustainable Bitcoin rally has begun without first creating maximum degrees of doubt.

This phase does just that: it breaks confidence, pressures sentiment, and flushes leverage.

And if history continues to echo its rhyme, this period will later be viewed not as the beginning of a bear market, but as the last major shake before resuming price discovery.

Let me show you examples from the past…

I hope you like this example 😄

In summary: enter early and forget about it for a year, then come back to see when the price reaches 144 thousand.

Good luck on your journey 🚀