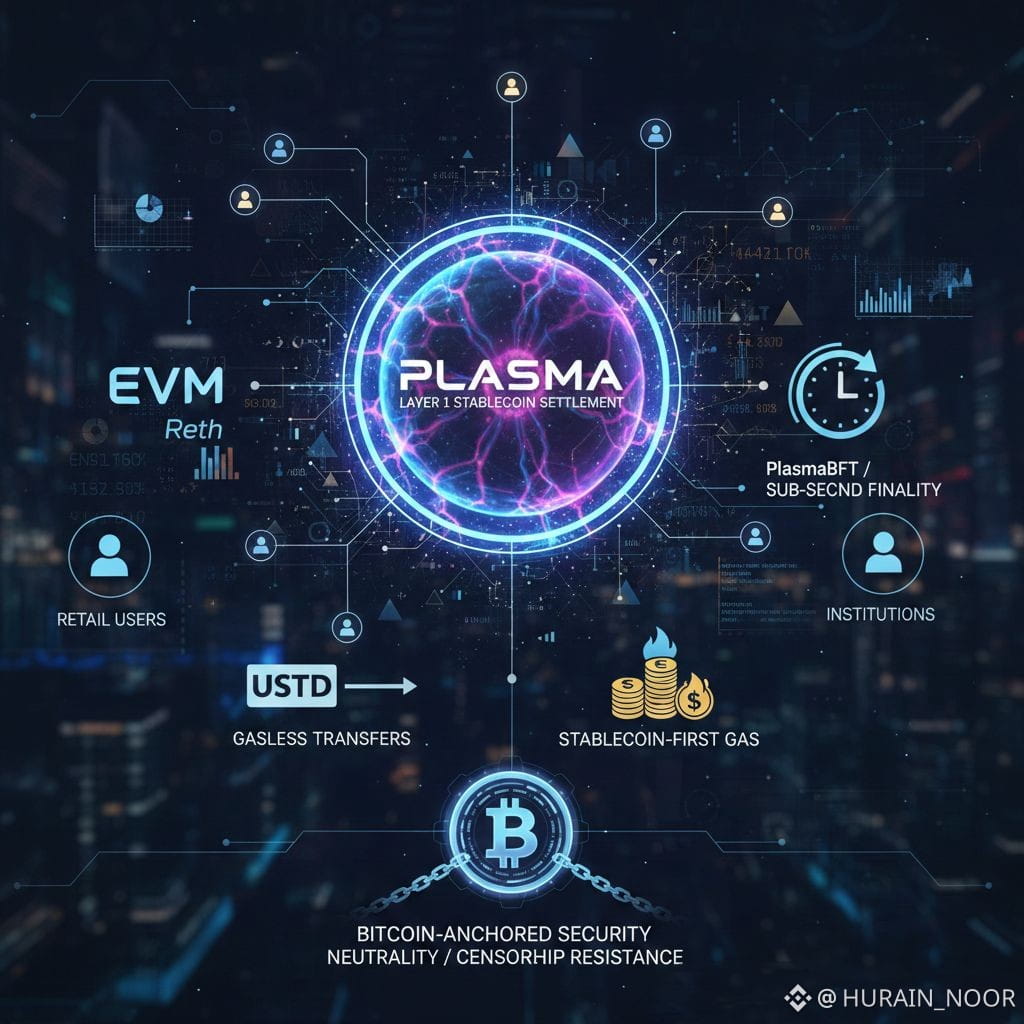

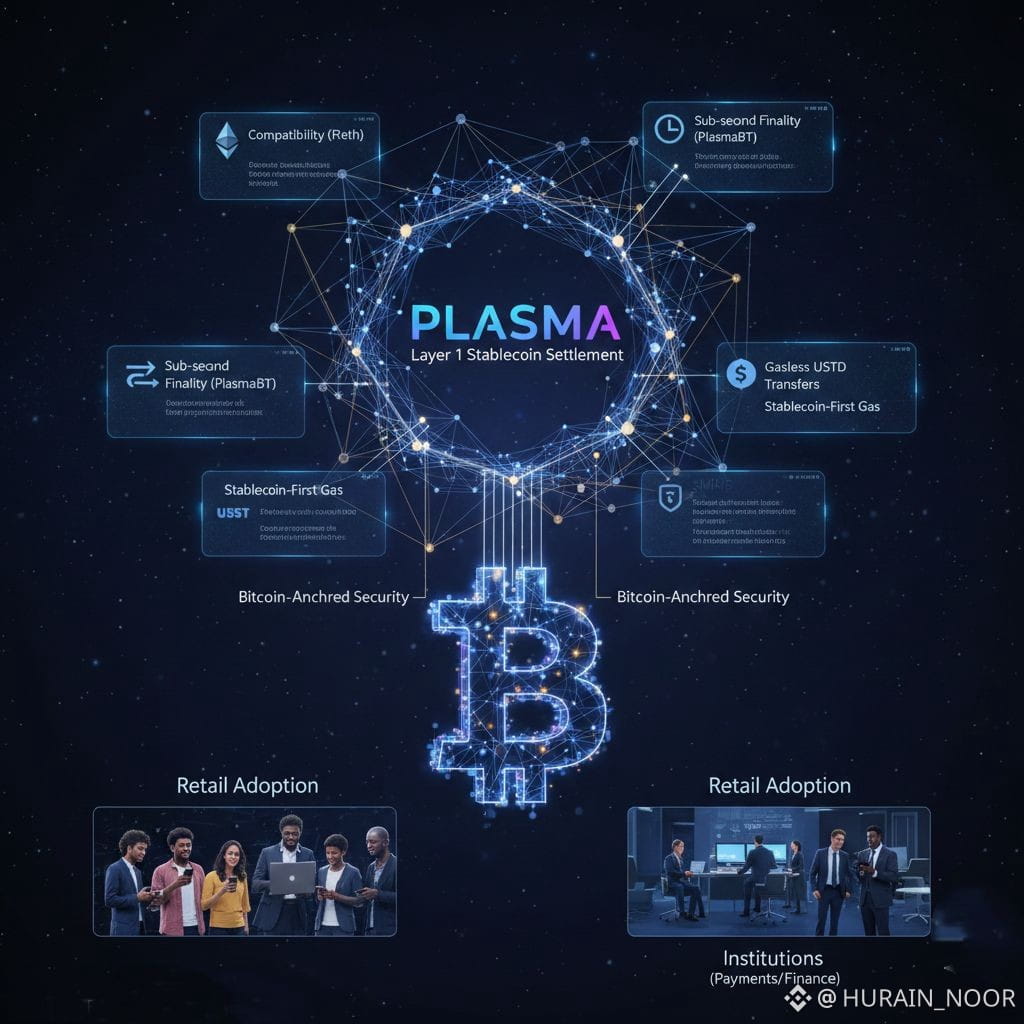

@Plasma is implicitly challenging a premise most Layer 1 networks avoid confronting: what if the core purpose of a blockchain isn’t building DeFi lego blocks or fueling token speculation, but delivering dependable, low-cost dollar settlement on-chain? Its technical decisions — full EVM support through Reth, sub-second finality enabled by PlasmaBFT, and native support for gasless USDT transfers — read less like branding and more like a tightly reasoned product strategy. The objective is not to reinvent money, but to supplant legacy settlement rails. The project brief and feature set make that intent clear.

From a payments perspective, EVM compatibility is a means, not a goal. It’s an access point. Plasma’s adoption of Reth reflects pragmatism: developers inherit battle-tested tooling, wallets, and composability without dragging along the fee volatility and UX failures typical of congested EVM chains. This matters because it allows payment-oriented primitives — paymasters, meta-transactions, and stablecoin-based gas — to operate within a familiar developer environment, while the chain itself is optimized around micropayments rather than speculative gas bidding. Reth’s modular architecture is what makes this redesign feasible.

PlasmaBFT’s sub-second finality is arguably more impactful than many market participants appreciate. In settlement systems, delay has a real cost — not just user friction, but capital immobilized while transactions remain pending. Faster finality reshapes liquidity behavior across exchanges, remittance channels, and merchant settlement cycles. As finality approaches instant, treasury management changes: on-chain float requirements shrink, working capital becomes more efficient, and FX hedging tightens. The metrics institutions will care about are block-to-finality latency and actual settlement times, not headline throughput.

Gasless USDT transfers represent both a major UX improvement and a potential economic vulnerability. Using relayers and a paymaster model eliminates a key onboarding hurdle — users no longer need to acquire a native token just to move money — which aligns closely with how people intuitively think about payments. At the same time, relayers become a bottleneck: someone must fund them, impose limits, and manage abuse. Whether this model becomes a sustainable payments primitive or an unsustainable subsidy depends on implementation details like rate limiting, quotas, and identity-linked allowances. Early documentation emphasizes gasless USDT; the real signal will be whether relayer economics and sponsored-transfer volumes scale organically.

Using stablecoins as the basis for gas fees is more than a UX tweak. Pricing fees in USDT aligns transaction costs with the asset being transferred, reducing mental overhead for users. But it also creates a new layer of market structure: someone must effectively market-make gas in stablecoins. Without proper liquidity and hedging, volatility in these costs will land on relayers or merchants. Watching the spread between on-chain stablecoin-denominated gas costs and off-chain fiat equivalents will reveal where friction or inefficiency persists.

Bitcoin alignment — anchoring security or settlement guarantees to Bitcoin — is a conscious economic and ideological choice. For institutions that prioritize neutrality and censorship resistance over native yield or raw speed, Bitcoin-backed security is appealing. The trade-off is reconciling Bitcoin’s confirmation and latency model with the expectations of fast execution. Plasma’s attempt to pair Bitcoin-style anchoring with a high-speed execution layer will surface trade-offs in areas like reorg handling, proof construction, and finality semantics. Comparing this design to other Bitcoin L2 approaches will clarify how Plasma navigates these constraints.

For institutional users, what ultimately matters is predictability: clearly defined settlement windows and auditable counterparty risk. Payment desks and custodians favor systems where timing and risk can be modeled precisely. By combining fast finality with stablecoin-native flows, Plasma simplifies settlement risk and treasury operations — assuming exchanges and custodians integrate in ways that reflect on-chain realities. Early indicators will include deposit and withdrawal latency at exchanges, custody documentation, and settlement activity from identifiable institutional wallets.

On-chain data will surface the truth long before marketing does. Key metrics are not abstract TVL figures, but sponsored transfer volume, the share of gas paid in stablecoins, average relayer cost per transaction, and the balance between retail micropayments and institutional settlement. Wallet cohort analysis is especially telling: repeated commercial activity following sponsored transfers suggests real product-market fit. One-off transfers point to experimentation, not adoption.

Oracle infrastructure and reconciliation mechanisms are critical but often overlooked. Payment systems require authoritative, auditable off-chain attestations — such as exchange settlement reports or fiat redemption confirmations — with stricter legal and latency requirements than DeFi price feeds. Plasma’s viability depends on an oracle layer capable of producing dispute-ready attestations, backed by slashing or legal enforcement. A hybrid model is likely: decentralized aggregation for integrity paired with legally accountable relays for large settlements. The emergence of oracle partners and their slashing parameters will be foundational signals.

Fee and token design implicitly define governance. Prolonged fee subsidies risk turning Plasma into a permanently loss-making payments platform; moving too quickly to full fees risks recreating the very friction it seeks to eliminate. The likely steady state is hybrid: stablecoin-denominated fees, targeted onboarding subsidies, and a competitive relayer market backed by bonding. Evidence of balance will show up in relayer profitability trends, how gas costs are split between merchants and relayers, and whether settlement volume steadily migrates from legacy systems.

Security concerns extend beyond code. Economic design flaws or legal disputes can be just as destabilizing. Failures in paymaster logic could halt settlement flows, while questions around stablecoin reserves can trigger on-chain bank-run dynamics. Because Plasma positions itself as settlement infrastructure, these risks are magnified. Effective oversight requires both on-chain monitoring — anomalies in relayer behavior, unexpected burns — and off-chain assurance, including reserve audits and legal covenants.

Market pricing will initially focus on token listings, incentives, and yield narratives. What actually matters is capital flowing into custody, security staking (if applicable), and liquidity committed to paymasters. The durable signal is recurring settlement activity and reduced reliance on off-chain float. Sustained growth in on-chain stablecoin settlement, faster reconciliation cycles, and expanding custodial integrations are what move Plasma from experiment to infrastructure.

For traders, Plasma has implications for stablecoin supply and demand in constrained corridors. Cheaper, faster settlement compresses arbitrage windows and reduces friction — fewer small inefficiencies, but cleaner basis trades and more predictable funding. For builders, the promise is more radical: design as if money moves instantly, without token overhead. This enables point-of-sale systems, streaming payroll, instant merchant settlement, and real-time FX strategies. The competitive edge will belong to teams building operational tooling, not just smart contracts.

A reasonable outlook is that within 12–18 months, Layer 1s will split between those optimized for speculative liquidity and those optimized for settlement. Plasma’s advantage is directional clarity. If exchanges and custodians embrace its relayer model and the network proves resilient in reserves and oracle design, institutional stablecoin settlement should migrate gradually. If not, relayers become a perpetual subsidy and the system remains stuck in pilot mode. Exchange integrations, sponsored-transfer retention, and relayer SLAs will be the deciding indicators.

Ultimately, Plasma’s bet is simple but risky: treat stablecoins as cash first and blockchain infrastructure second. That reverses common developer incentives, but mirrors how value actually moves in the real economy. The real safeguards won’t be found in whitepapers, but in three operational realities — consistent finality, credible oracle attestations, and sustainable relayer economics. All three are observable, on-chain and off. If the data trends align, Plasma reshapes settlement; if not, it stands as a valuable case study in the limits of decentralized payment design.