In a market as volatile as crypto, understanding stablecoins is not optional-it’s fundamental. Stablecoins act as the anchor of the crypto ecosystem, allowing investors to preserve value, manage risk, and deploy capital efficiently. If you want to invest safely and strategically, knowing what stablecoins are and how they really work is a must.

What Is a Stablecoin? The Core Concept Explained

A stablecoin is a type of cryptocurrency designed to maintain a stable value over time. Unlike highly volatile assets such as Bitcoin or Ethereum, stablecoins are typically pegged 1:1 to real-world assets like the US dollar, gold, or other fiat currencies.

Because of this price stability, stablecoins function as “digital cash” on the blockchain. They allow investors to move in and out of positions without returning to the traditional banking system, saving both time and transaction costs.

Why Stablecoins Matter in Crypto

Stablecoins play several critical roles in the crypto economy. They make cross-border payments faster and cheaper, removing currency conversion friction. They act as a bridge between Web2 and Web3, helping newcomers access DeFi, NFTs, and on-chain services without worrying about sudden price swings. During market downturns, stablecoins serve as a safe haven, preserving portfolio value. They also unlock passive income opportunities through lending, staking, and yield strategies.

How Stablecoins Work: Main Types and Mechanisms

To fully understand stablecoins, it’s important to recognize that not all of them are built the same. Their stability depends on how they are backed and managed.

Fiat-Collateralized Stablecoins

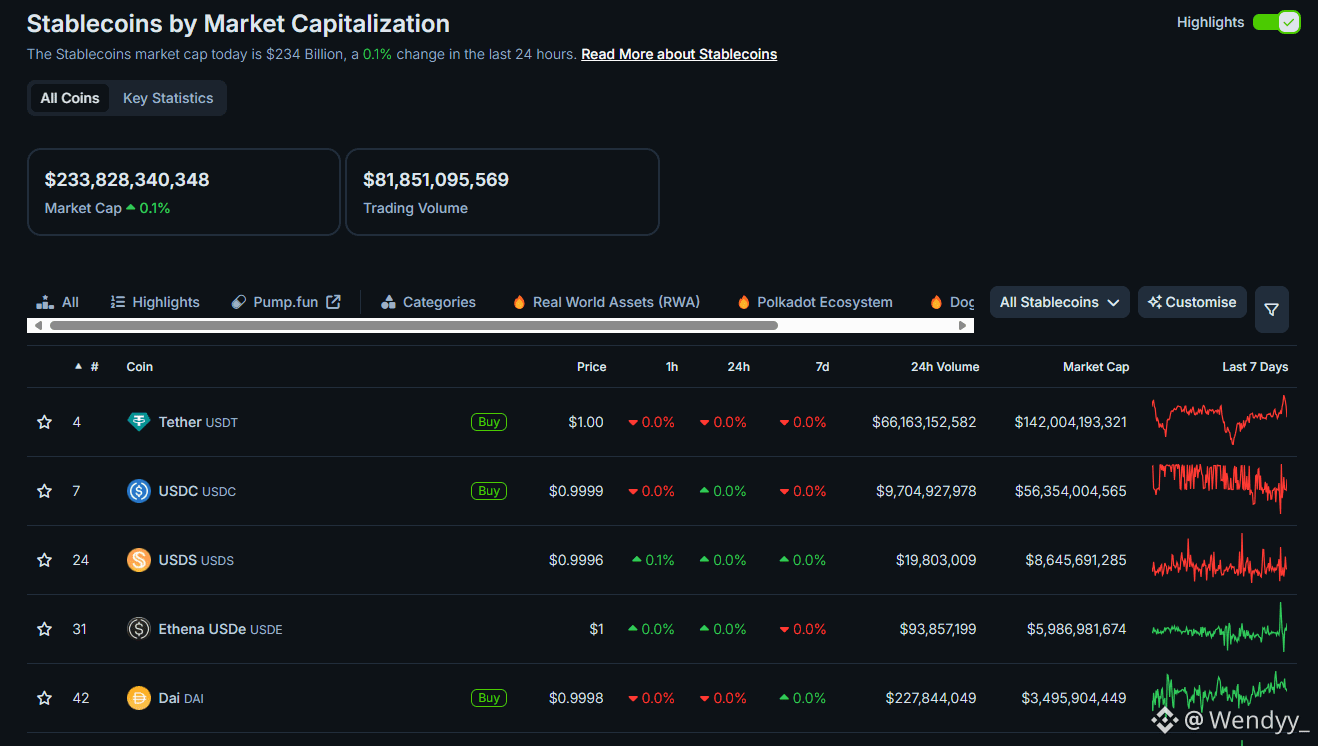

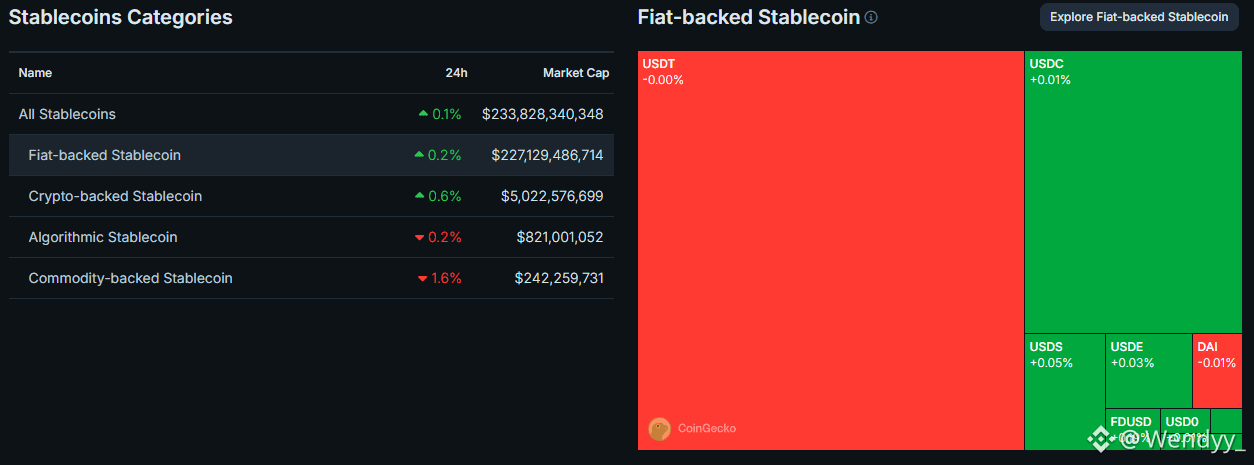

This is the most common and widely used category. Stablecoins like Tether (USDT) and Circle (USDC) are backed by fiat reserves or equivalent assets such as cash and government bonds. In theory, every token issued is supported by one real dollar held in reserve.

These stablecoins offer strong price stability and deep liquidity, but they also rely on centralized issuers and are exposed to regulatory and transparency risks.

Crypto-Collateralized Stablecoins

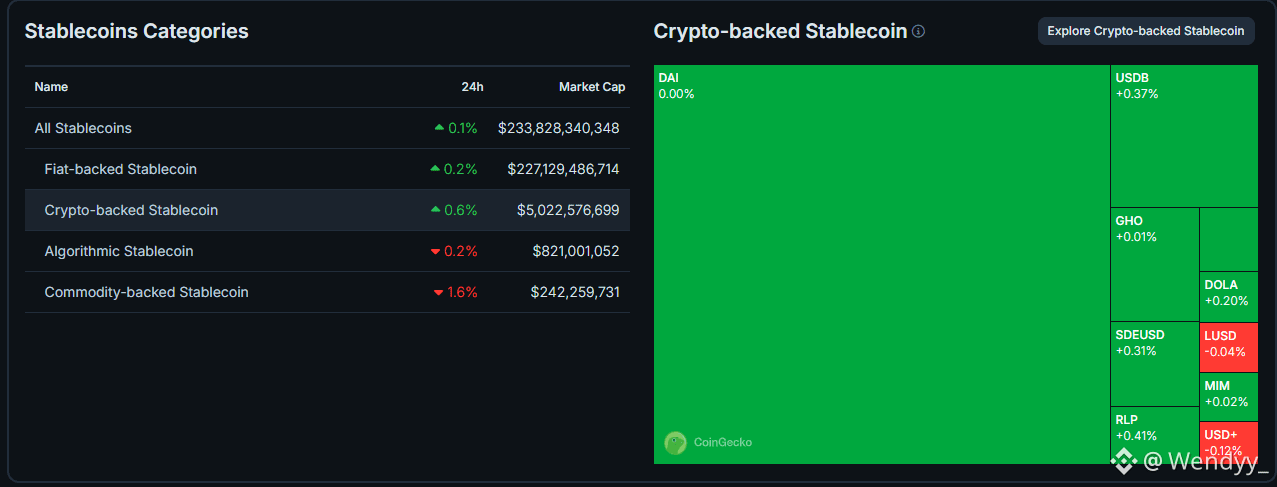

Crypto-backed stablecoins use digital assets like ETH as collateral and are governed by smart contracts. A well-known example is DAI, issued by MakerDAO. Because crypto prices fluctuate, these systems require over-collateralization. Users must lock up more value than they receive in stablecoins to protect the peg.

This approach is more decentralized but comes with liquidation risks during extreme market volatility.

Algorithmic Stablecoins

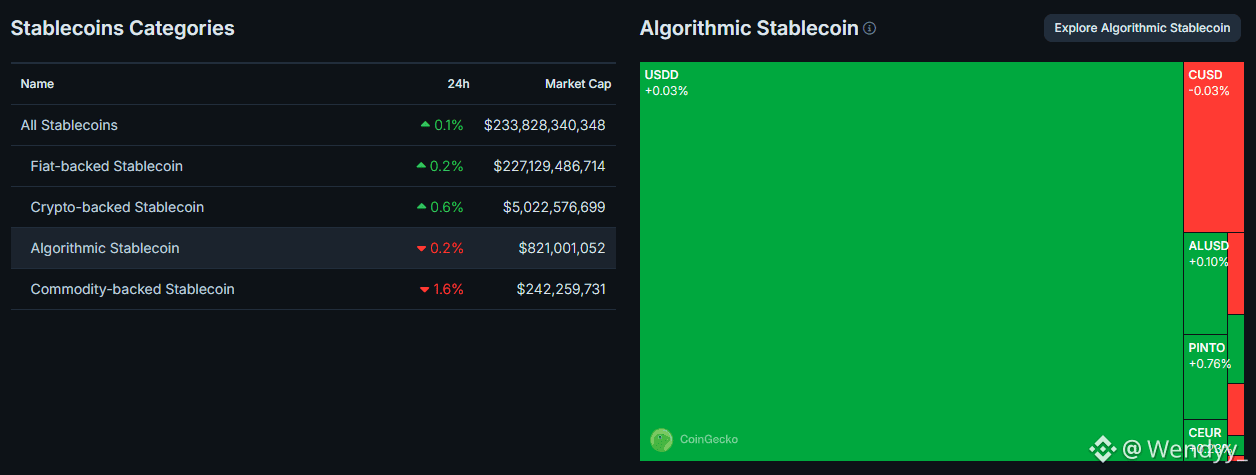

Algorithmic stablecoins aim to maintain their peg without direct collateral, using supply-and-demand algorithms instead. History has shown that this model is extremely fragile. The collapse of UST in the Terra ecosystem highlighted how quickly confidence can evaporate, triggering a complete loss of the peg.

Today, algorithmic stablecoins are viewed as high-risk experiments rather than safe stores of value.

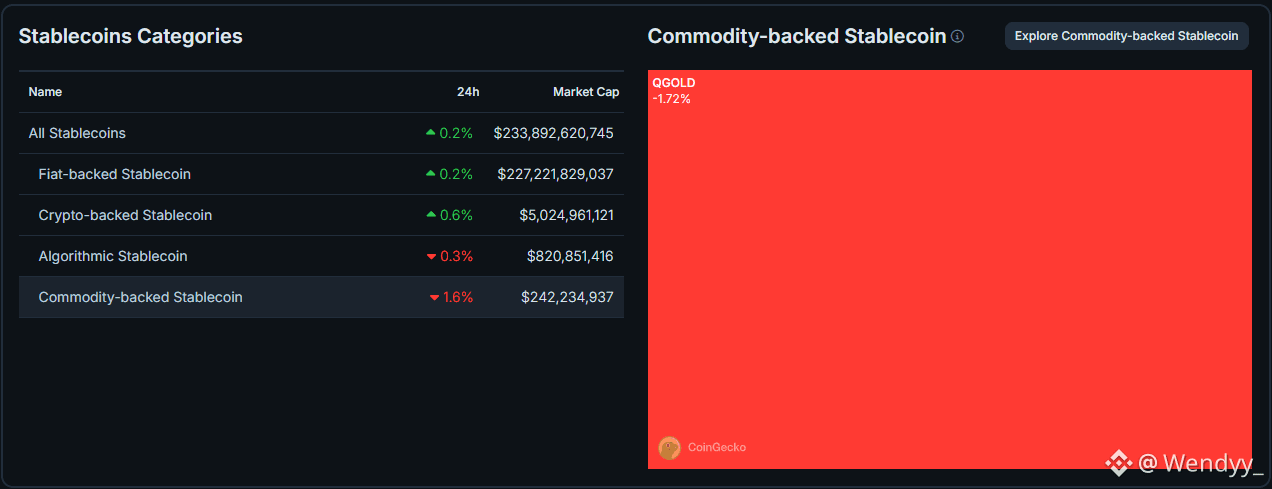

Commodity-Backed Stablecoins

Some stablecoins are pegged to physical assets such as gold. Tokens like PAXG represent ownership of real-world commodities stored in vaults. These appeal to investors seeking exposure to tangible assets while remaining within the crypto ecosystem.

Buying and Storing Stablecoins Safely

Stablecoins can be acquired through centralized exchanges like Binance using fiat via P2P or bank cards. They can also be swapped on decentralized exchanges such as Uniswap or minted through lending protocols by collateralizing crypto assets.

For storage, reputable non-custodial wallets offer greater control, while exchange wallets provide convenience for active traders. Security should always take priority, especially for long-term holdings.

Earning Passive Income With Stablecoins

Stablecoins don’t need to sit idle. Many investors use them to generate yield through lending platforms, centralized earn products, or DeFi protocols like Aave. Liquidity provision and yield aggregation strategies can further enhance returns, while launchpads and staking programs sometimes reward stablecoin holders with early access to new tokens.

These strategies can provide steady income, but they should always be evaluated for smart contract and platform risk.

Advantages and Risks You Should Understand

The biggest strength of stablecoins lies in their price stability and liquidity. They allow fast transactions, efficient portfolio management, and lower volatility exposure. However, risks still exist. Centralized stablecoins carry regulatory and issuer risk, while all stablecoins face the possibility of losing their peg under extreme conditions. Increasing regulatory scrutiny in major regions also adds long-term uncertainty.

Final Thoughts

Understanding what stablecoins are and the key factors behind their stability is essential for safe crypto investing. While they provide shelter from volatility and open doors to passive income, not all stablecoins are equally reliable. Choosing transparent, well-audited options and avoiding overexposure to any single issuer can help protect your capital.

Used wisely, stablecoins are not just a defensive tool-they are a strategic foundation for navigating the crypto market with confidence.

This article is for informational purposes only. The information provided is not investment advice