Since Satoshi Nakamoto published the white paper in 2008, cryptocurrencies have evolved from a marginal experimental tool to a mature stage

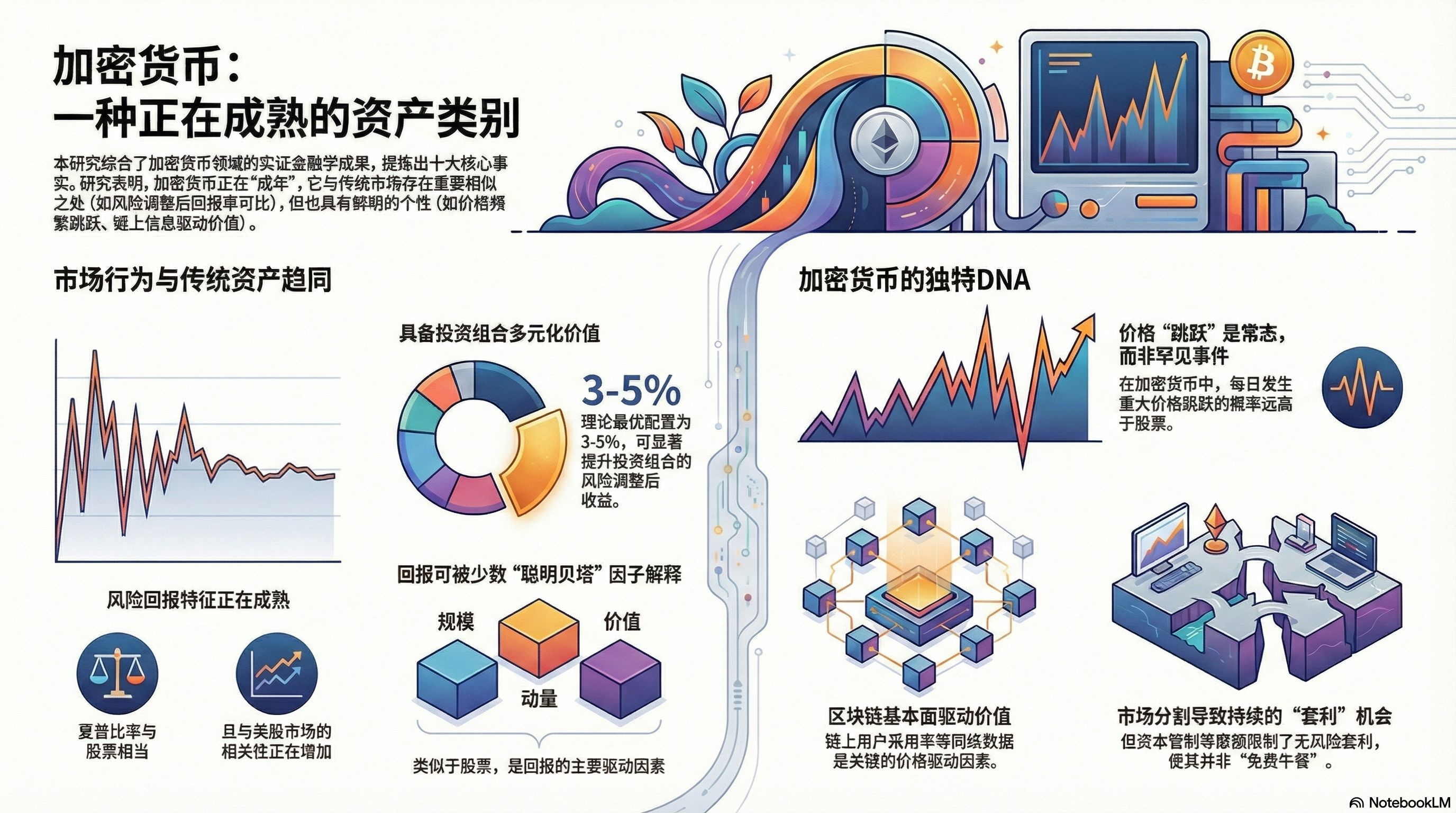

The underlying patterns can be summarized in ten typical facts

1. Risk and Return: High volatility but 'very fair'

First, it is found that although cryptocurrencies are highly volatile, they are 'rational' from a financial perspective.

• Fact 1: The returns and volatility of cryptocurrencies are indeed an order of magnitude higher than stocks, but their Sharpe ratio (risk-adjusted return) is actually very close to that of the U.S. stock market. This means that the high returns you receive are essentially a fair compensation for the extremely high risks you are taking.

• Fact 2: It is integrating with the mainstream financial system. Before 2020, it had almost no relationship with stocks, but after 2020, its correlation with U.S. stocks soared from 2% to 37%, and it can significantly reflect inflation expectations.

2. Portfolios: Why Do You Need to Allocate It?

Calculated its actual value in the portfolio through the model.

• Fact 3: Even though correlations are rising, adding a small amount of cryptocurrency can still significantly optimize portfolio returns. Calculations show that the theoretically optimal allocation ratio for retail investors is about 3.1%, and for institutional investors, it is about 5.5%.

3. Market Drivers: What Determines Price?

Looking for "factor" patterns like the stock market.

• Fact 4: The C-4 factor model (market, size, momentum, and value factors based on on-chain data) can explain most of the return variations.

• Fact 7: The economic activity of the blockchain itself is a core driver. Specifically, the on-chain user adoption rate (growth of new addresses) can explain about 8% of the return changes.

4. Unique Market Characteristics: Jumps and Model Transparency

Cryptocurrencies have some very "anti-traditional" characteristics.

• Fact 5: Its price movements are highly discontinuous. Unlike the occasional crashes in the stock market, **"common disasters" (frequent large price jumps)** in cryptocurrencies are the norm, which poses significant challenges for risk management.

• Fact 6: It has been proven that in cryptocurrency research, "less is more." A simple transparent model (glass box model) that includes higher-order terms is entirely on par with complex deep learning "black box" models in explanatory power and has greater economic interpretability.

5. Market Operations and Efficiency: The Continuation of Old Problems

Despite the technology being new, "old problems" still exist.

• Fact 8: Market inefficiencies still exist. Due to exchange fragmentation and capital controls, price differences between different platforms still exist, and this so-called "arbitrage opportunity" is actually a compensation for extremely high execution risks.

• Fact 9: Perpetual contracts have become mainstream. The profit margin from the once very profitable "arbitrage trading (Carry Trade)" has significantly compressed since 2024, and by 2025, negative returns have even appeared.

6. Conclusion: From "Hype" to "Compliant Assets"

• Fact 10: Regulation is making the market better. With the introduction of the 2025 (GENIUS Act) and more rigorous accounting standards (such as fair value accounting), market transparency and institutional confidence are significantly improving.

In summary, cryptocurrencies have bid farewell to the phase of pure speculation and hype. It has grown into a legitimate asset class with unique attributes (such as on-chain driving and frequent jumps) but also follows traditional financial logic.

The above research report is from *Nicola Borri, Yukun Liu, Aleh Tsyvinski, and Xi Wu*