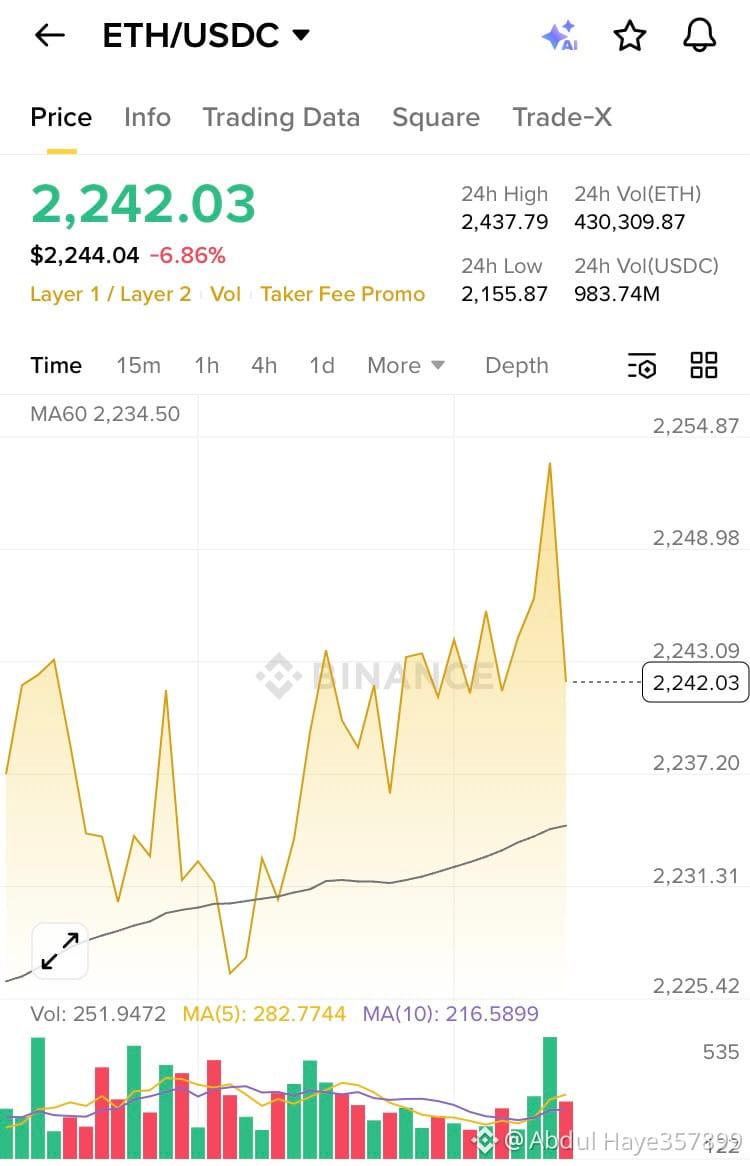

$ETH ETH’s recent drop of roughly 6–7% is not a random move, nor is it evidence of some hidden collapse; it is a textbook short-term market reaction driven by technical rejection, momentum loss, and broader risk sentiment. ETH attempted to push above the 2,430–2,450 resistance zone but failed to hold that level, which immediately triggered profit-taking from short-term traders. This rejection is visible on lower timeframes where price printed a sharp upside move without sustained follow-through, a classic sign that buyers were running out of strength. When price cannot consolidate above resistance, it signals that demand is insufficient to absorb sell pressure, and the market naturally moves lower to search for liquidity. Volume behavior confirms this: selling volume expanded on the downside while buying volume weakened after the push up, indicating distribution rather than accumulation. This is not how strong breakouts behave. In addition, $ETH is currently not leading the market; it remains highly correlated with Bitcoin and typically underperforms BTC during periods of uncertainty. When Bitcoin stalls or pulls back, $ETH tends to fall harder due to its higher risk profile, greater leverage exposure, and stronger retail participation.

#WhenWillBTCRebound #MarketCorrection #BitcoinETFWatch