Over the last five years, Africa has emerged as one of the fastest growing

regions for cryptocurrency adoption in the world. This growth has been caused due to a range of social economic factors including not enough traditional banking, high inflation, heavy restrictions and a young technical people in population eager to leverage digital financial tools.

NOW LETS SEE THE KEY DRIVERS

Many African countries have large unbanked populations.

Cryptocurrencies, accessed via mobile phones, provide alternative financial

services to those without bank accounts.

Hedge Against Inflation & Forex Challenge

Persistent of the currency depreciation in countries like Nigeria and

Egypt not in larger adoptions has pushed residents to use stablecoins such as

$USDC and $USDT and cryptos as a store of value and a hedge against local currency volatility.

Crossborder Remittance

Cross border payments through traditional channels can be a bit of

expensive that most African can not handle the pressure. Cryptocurrency transfers often cost less and make the transaction even more faster than traditional way of tranferrring money faster, making

them an attractive.

Mobile Penetration & Youth Engagement

Africa’s high mobile phone usage and a large youth population have

helped drive crypto awareness and usage at the grassroots level.

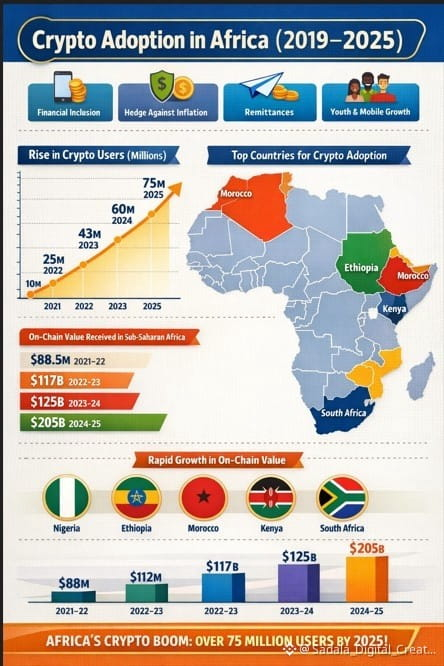

Top African countries by adoption rankings (Global Index):

• Nigeria(top 3 worldwide)

• Ehiopia(fastest growing)

• Morocco

• Kenya

• South Afrioca

Top African Countries Leading Adoption

The following are the some of countries that have seen significant

crypto adoption:

Nigeria: Africa’s largest crypto market, with millions of holders.Ranked at the

2nd globally in the Global Crypto Adoption Index (2024). Receives

large volumes of on-chain value, largely driven by stablecoin transfers.

Ethiopia: Ranked second in Africa and among the fastest growing markets.

Morocco: Emerged as one of the top adopters despite regulatory headwinds.

Kenya: Crypto adoption has grown hand-in-hand with mobile money usage.

South Africa: Combines a developed financial sector with strong crypto engagement.

On-Chain Value Growth Trends (2021 – 2025)

The growth of these shows how crypto adoption and the transaction values

received in Sub Saharan Africa have come to use.

NOW LETS WHAT ARE THE CHALLENGES THAT AFRICA IS FACING ON THE CRYPTO ADOPTION.

Regulatory uncertainty:

Some countries like Tunisia have seen legal ambiguities, affecting broader usage.

Cybersecurity risks: Increased crypto

activity has also attracted cybercrime concerns, and this is because majority are using digital platform like mobile phones, tablets and hand held device for engaging with crypto transactions.Market volatility:

Price swings can deter risk and build resistance for many countries to engage.

CONCLUSION

Crypto adoption in African countries is or has grown exponentially for

the past five years. Educational and Awareness seminar has play a great role on

this achievement What started as a relatively small digital asset ecosystem has

now become one of the most dynamic markets in the global world specifically

for one on one or p2p cases. By early 2025, millions of Africans across Nigeria, Kenya, South Africa, Ethiopia, and other nations are now engaging with digital currencies to manage transaction and cross border transfer in the decentralised finance by utilizing Decentralized Apps into Decentralized finance.