Ethereum popularized EIP-1559 with dynamic base fees that adjust based on congestion. It smoothed out fee spikes, but you still need ETH in your wallet. When the network gets busy, gas costs can hit $100+ per transaction.

Plasma borrowed the concept and rebuilt it for a completely different purpose.

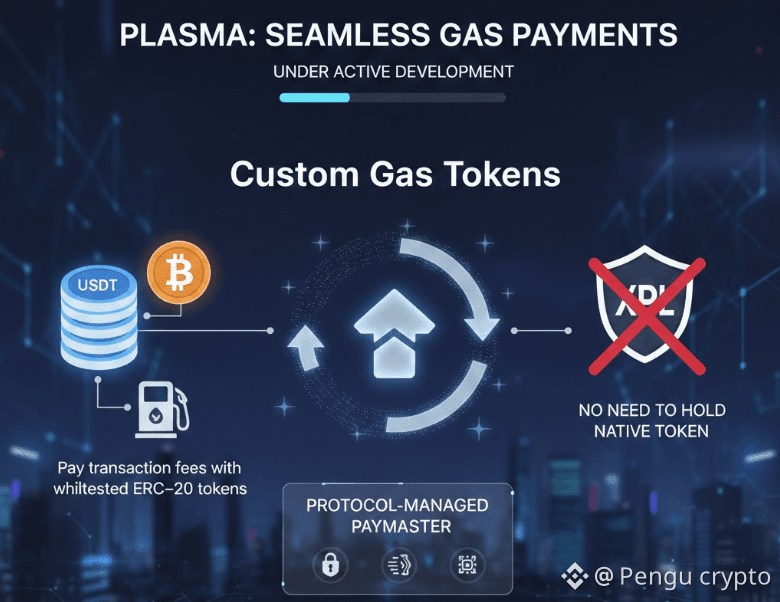

Pay Gas in What You Already Hold

Most blockchains force you to buy their native token before doing anything. Plasma doesn't. Through a paymaster contract, you approve USDT once and every transaction after that automatically deducts a small gas fee from your stablecoin balance. No XPL required. No token swaps. Just pay in dollars.

For Bitcoin holders, the same system works with bridged BTC. The paymaster converts what you need for gas at zero markup and handles validator payments automatically.

Three Levels

Basic USDT transfers cost nothing. The Plasma Foundation covers gas completely through the paymaster, with rate limits to stop abuse. This isn't a promotion. It's how the chain works.

DeFi operations like Aave lending, CoWSwap trades, or cross-chain bridges charge small fees, but again, you pay in USDT or BTC. The base fee adjusts up or down 12.5% per block depending on how full blocks are, same as Ethereum. Part of it gets burned to control spam.

Built for Different Users

Ethereum designed EIP-1559 for developers and dApp users who expect to hold ETH. That audience understands gas tokens and wallet management.

Plasma designed its model for remittance workers, merchants, and businesses moving stablecoins. These users think in dollars, not governance tokens. Confirmo moves $80 million monthly on Plasma because their clients can pay fees in the same USDT they're already transacting.

The system isn't more advanced. It just removes the step where normal people have to learn crypto plumbing before sending money.