$AUCTION is a clear example that not every big dip is a buying chance. This coin peaked and then kept falling for almost two years. From the top to the recent lows AUCTION is down around 95 to 97 percent. The important detail is not the drop itself but the failure to recover. Even after multiple market phases price never reclaimed major weekly levels. Many traders kept averaging because the project looked legit and liquidity was still visible. But the chart kept bleeding. This is how slow rug pulls work. No sudden collapse just steady distribution while people stay hopeful. Time quietly destroys the position.

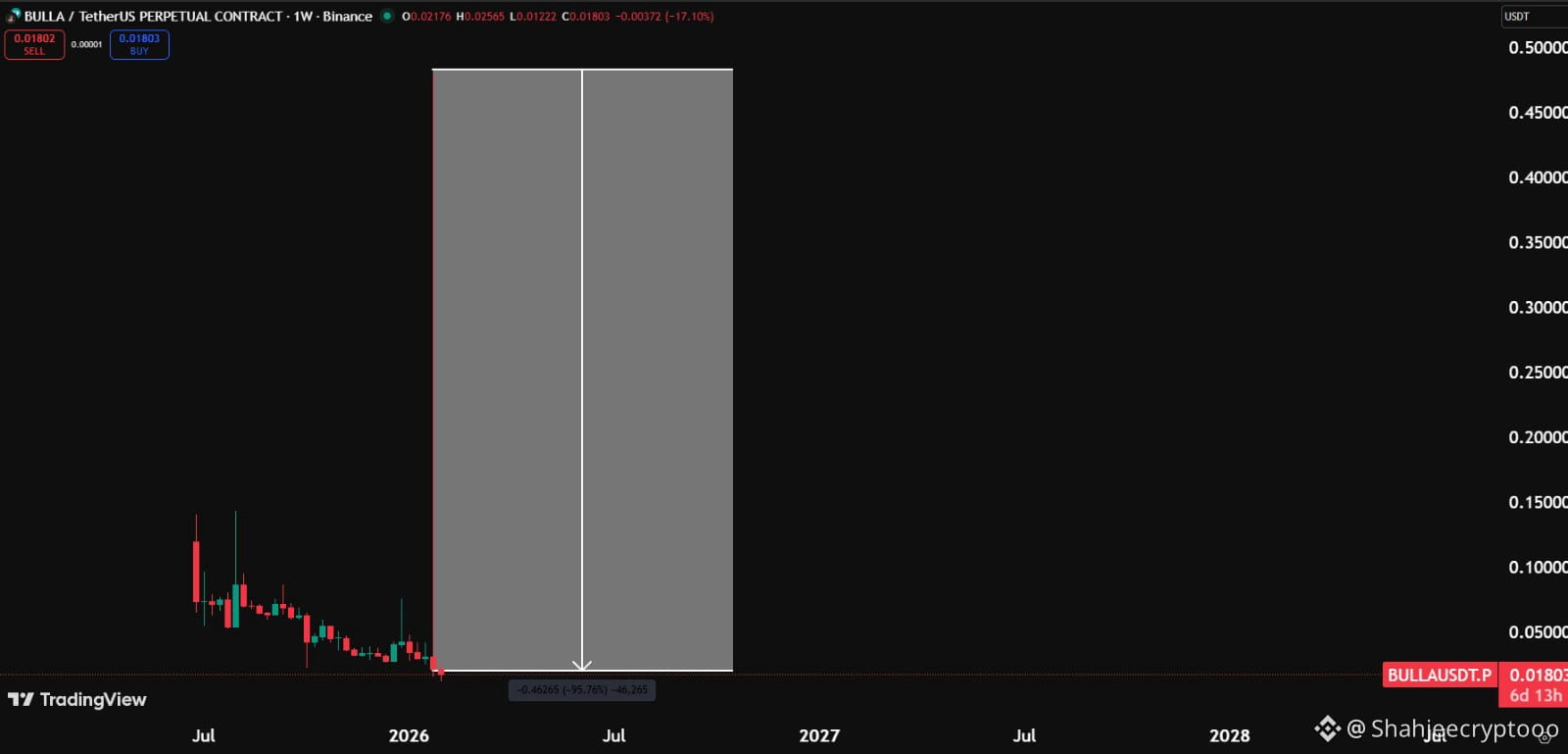

$BULLA shows the other extreme. This was not slow. Price dropped almost 95 percent in a very short time and went close to zero levels. Charts like this usually share the same pattern. Thin liquidity hype based demand and no strong buyers underneath. Once selling starts there is nothing to absorb it. Many traders think stop losses will protect them but in these dumps price moves faster than execution. By the time the chart looks broken the loss is already locked in.

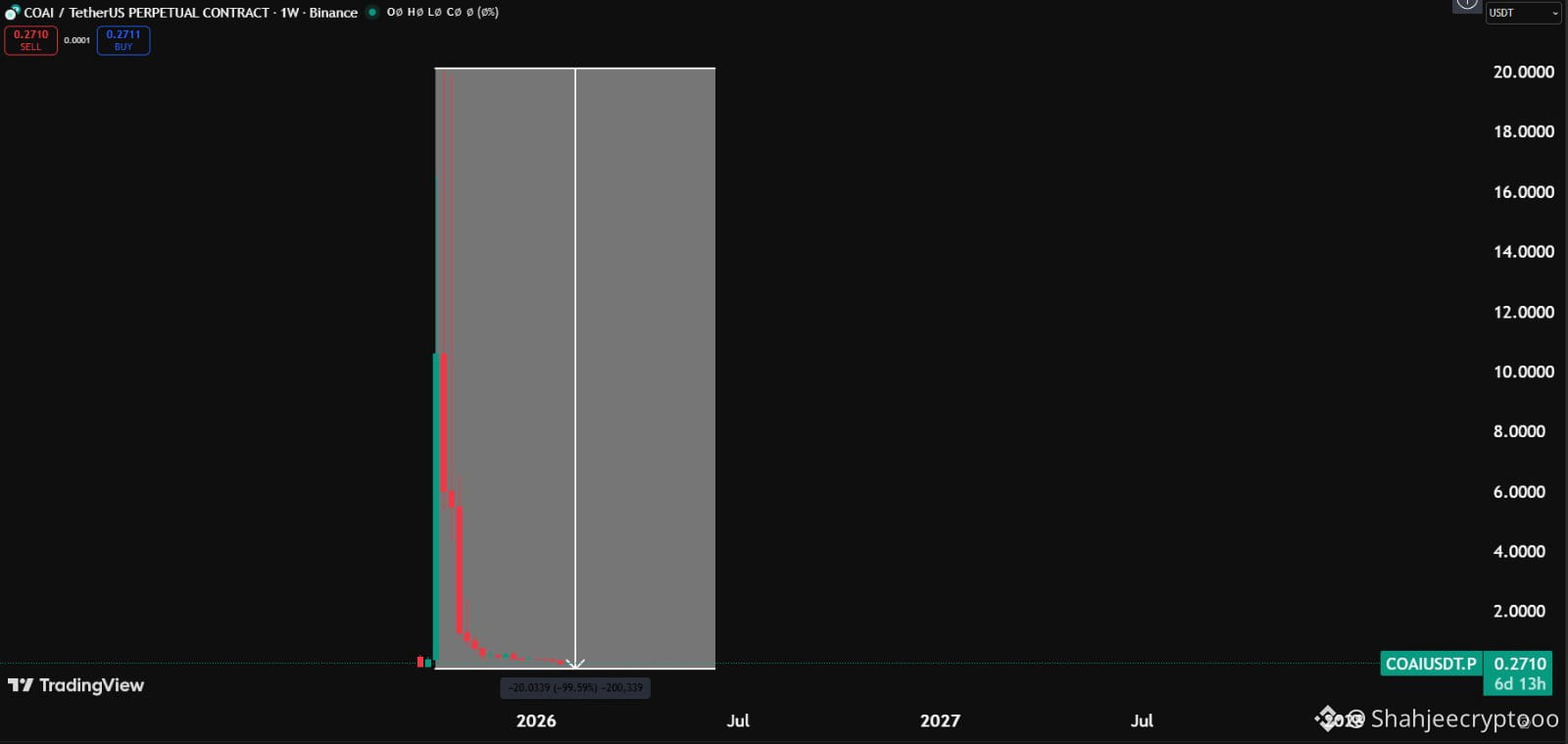

$COAI is where emotions trap people. From nearly 20 dollars to around 0.2 this coin is down close to 99 percent. A lot of investors are still stuck here waiting for a recovery for the last five months. The issue is not patience. The issue is structure. There are no higher lows no accumulation zones no real volume returning. Just sideways action at the bottom. Markets do not reward waiting without confirmation. Capital stays frozen while opportunity moves elsewhere.

What all these charts have in common is ignored structure and ignored liquidity. Strong coins bounce back when the market improves. Weak coins stay weak even during relief rallies. If a coin loses more than 90 percent and fails to reclaim key weekly levels for months the market is sending a clear message. Heavy influencer promotion combined with falling volume is another warning sign. Narrative does not protect price.

One of the hardest lessons traders learn late is simple. Price does not owe you a recovery. If liquidity leaves the trade is already over. Protecting capital matters more than being right. Exiting early and re entering strength is always safer than sitting in a broken chart hoping time will fix it.

Rug pulls are not always instant scams. Many fail slowly and look normal until it is too late. The real edge is avoiding these charts completely. You do not need every pump. You just need to survive long enough to catch the right ones.

#Rugpull #WhenWillBTCRebound #MarketCorrection #USGovShutdown #WhoIsNextFedChair