When the Market Stops Moving, Emotions Start

Sideways markets are often more challenging than volatile ones. Price moves within a range, momentum fades, and clear direction disappears. For new traders, this environment can feel uncomfortable — not because it’s risky, but because it’s boring.

That discomfort often leads to the biggest mistake: forcing trades when the market offers none.

Activity Is Not the Same as Progress

Many new traders associate trading with constant action. When price stops trending, they interpret inactivity as falling behind. This mindset creates pressure to enter positions without a clear edge.

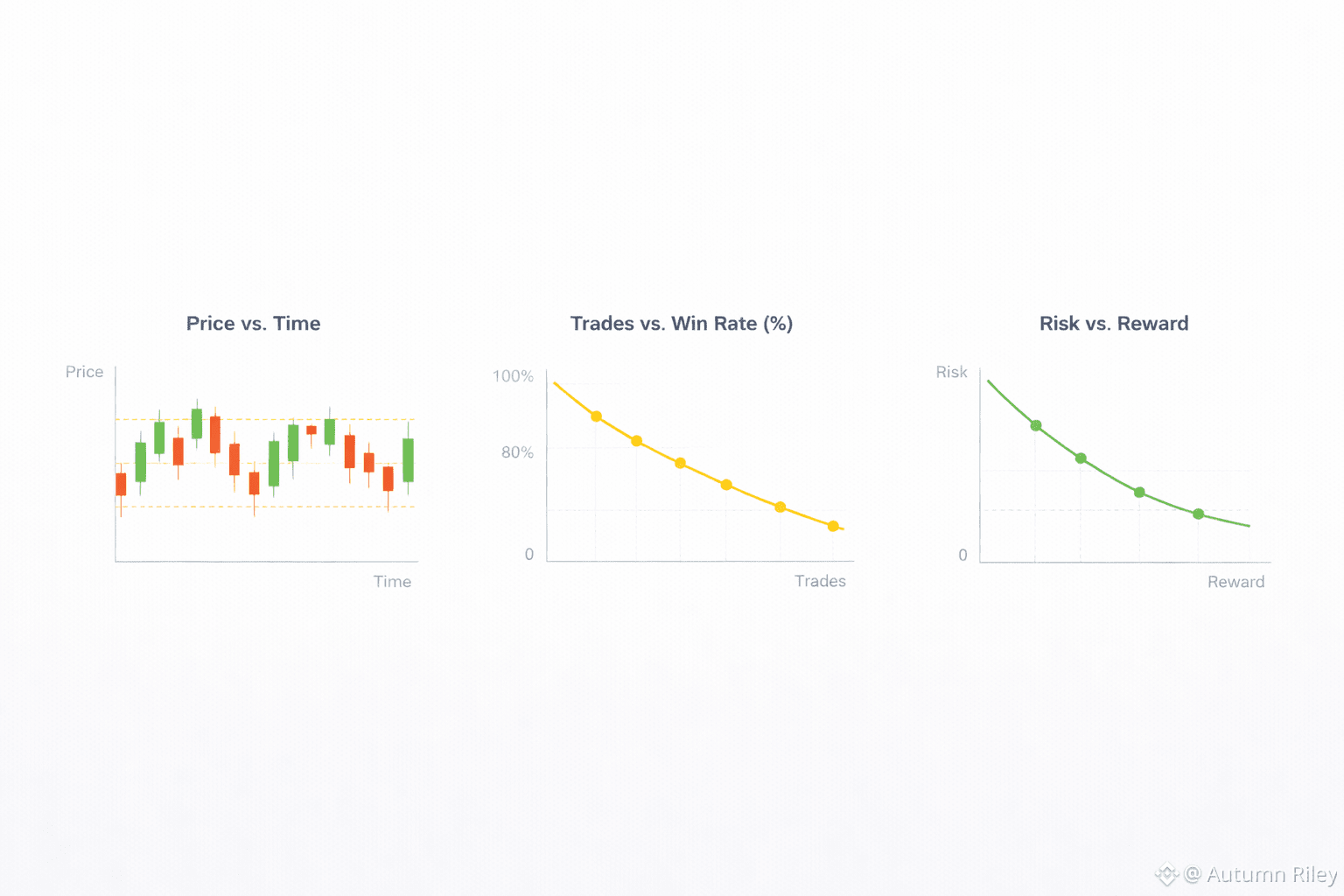

In sideways markets, most price movement is noise. Breakouts fail quickly, indicators conflict, and small gains are often erased by fees and impatience. Trading more in these conditions usually leads to less progress, not more.

Overtrading Becomes the Default Response

Without a strong trend, traders often lower their standards. Setups that would normally be ignored suddenly feel acceptable. Entries become reactive, exits become rushed, and discipline erodes quietly.

This isn’t a strategy problem — it’s a patience problem.

Sideways markets expose whether a trader can wait, not whether they can predict.

Why Sideways Markets Exist

Consolidation phases serve a purpose. They allow the market to absorb previous moves, redistribute liquidity, and reset sentiment. These periods are not gaps to be filled with trades, but transitions to be observed.

Experienced traders often reduce activity during ranges. They wait for clarity, structure, or confirmation. New traders do the opposite — they increase activity when clarity is lowest.

The Hidden Cost of “Almost Right”

In ranging conditions, being slightly wrong is expensive. Small stop losses trigger repeatedly. Entries feel correct, but follow-through never arrives. Over time, this creates frustration and self-doubt, even if the trader’s analysis isn’t fundamentally flawed.

The damage isn’t always financial. It’s psychological. Confidence erodes faster in sideways markets than in clear losses.

A Better Approach

Sideways markets reward restraint. Instead of searching for opportunity, they offer a chance to improve process.

This can mean:

Trading less, not more

Focusing on higher-timeframe structure

Waiting for range boundaries rather than mid-range entries

Preserving capital for when conditions improve

Sometimes the best trade is no trade.

What Sideways Markets Teach

These periods separate traders who need constant stimulation from those who can wait. Skill develops not only through execution, but through knowing when not to execute.

Sideways markets don’t punish impatience immediately. They drain it slowly.