Vanar Chain’s Place in Web3 Payments

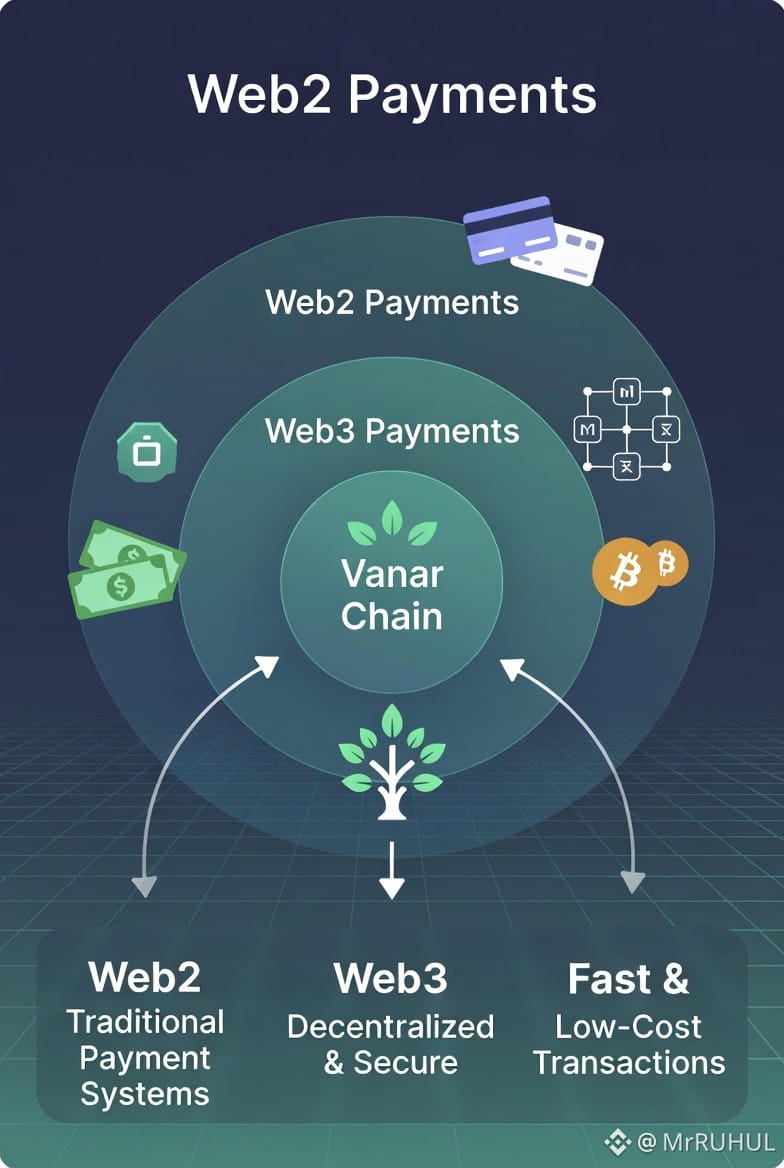

Web3 payments are shaking up digital finance, moving past old-school banks and card networks to build something way more open—decentralized, programmable payment systems anyone can tap into. At the heart of all this are blockchains built to move money in the real world: fast, cheap, transparent, and reachable from anywhere. Enter Vanar Chain. It’s a new Layer-1 blockchain that’s quietly building the tech and partnerships to become the backbone of Web3 payments.

So, what is Vanar Chain? It’s a Layer-1 blockchain, EVM-compatible, and wired for AI from the start. The team baked machine learning into its core, so the chain handles data smarter, automates compliance, and powers up financial logic using AI. It’s not just another chain for moving coins around. They’ve locked in ultra-low, fixed transaction fees—about $0.0005 each—and the network can handle a ton of transactions at once. That’s perfect for apps that need to move money fast and often. The Vanar ecosystem isn’t just about basic transfers, either. It’s ready for tokenized assets, AI-driven smart contracts, and dApps that crunch data and drive all sorts of finance use cases.

But here’s where things get really interesting: Vanar’s teamed up with Worldpay, which is a major player in global payment processing. We’re talking $2.3 trillion and tens of billions of transactions every year across 146 countries. By joining forces, Worldpay and Vanar want to blend blockchain tech into everyday payments, so you get Web3 products that actually work with the old financial world, not just against it.

Why does this matter? First, Vanar’s tech means payments settle almost instantly and cost next to nothing. That’s a big deal for things like micropayments or retail, where most blockchains just can’t keep up. Combine that with Worldpay’s reach, and you’ve suddenly got blockchain payments snapping right into existing fiat systems. No more big headaches for users and merchants who want to try DeFi but still need to deal with dollars, euros, or yen.

They’re also working on stablecoin settlement and hybrid payment tools. So, you can move money between cash and crypto, skipping the middlemen and the big cross-border fees. Plus, since everything runs on blockchain with Worldpay’s compliance smarts layered in, you get better transparency and a lot less fraud.

Put it all together, and Vanar’s not just another chain. It’s a bridge, connecting Web3 and traditional finance. Payments feel familiar, but they’re running on something way more powerful under the hood.

Now, Vanar’s not stopping at fast transactions. They’re actually putting intelligence on the blockchain itself. The core tech compresses and processes complex data right on-chain, so you don’t have to rely on outside servers. Compliance checks, risk scoring, and dynamic payment rules all run as part of every transaction—no waiting, no off-chain juggling. This makes it easier to spot fraud, follow regulations, and make smart calls in real time, which is exactly what global payment systems need.

Vanar’s also making life easier for developers and merchants. They’re building out an ecosystem where it’s actually doable to launch payment tools—thanks to things like smart wallets and account abstraction. For merchants, the selling points are obvious: super-low fees, quick settlements, worldwide reach. If you’re in gaming, entertainment, or any business with tons of small transactions, you finally get a payment solution that doesn’t eat your margins or drive your customers nuts.

All in all, Vanar’s push into Web3 payments is part of a much bigger shift—decentralized tech and traditional finance aren’t battling it out anymore. They’re merging, and Vanar Chain is right in the thick of it, building the rails for the next era of digital payments.@Vanarchain #Vanar $VANRY