Vanar Chain is steadily positioning itself as a blockchain built with enterprises in mind, where VANRY acts as the operational fuel behind secure, intelligent systems that businesses can actually rely on. Instead of chasing short term excitement, the network focuses on real problems companies face every day like compliance overhead, fragmented data, and inefficient payment flows. What stands out to me is how naturally Vanar connects advanced AI tooling with familiar enterprise processes, making Web3 feel less experimental and more like a practical upgrade to existing infrastructure.

Building for Real Adoption Instead of Empty Buzz

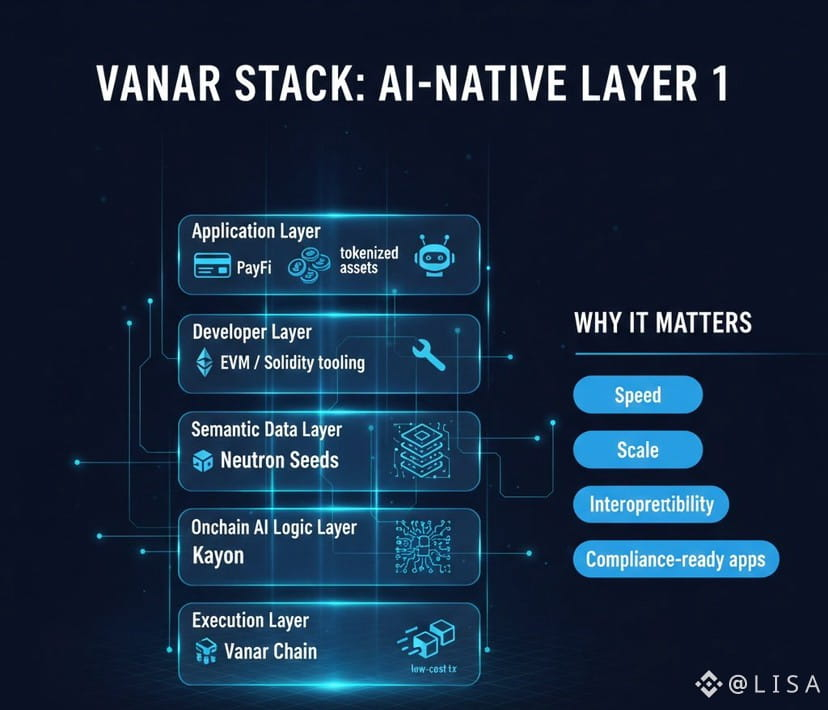

Vanar takes a deliberate approach to enterprise adoption by working with industries already looking for better digital solutions rather than forcing blockchain into places it does not belong. Media companies use the chain to protect intellectual property, embedding licensing details as Neutron Seeds that permanently prove ownership and usage rights. Entertainment firms automate royalty tracking, where Kayon evaluates usage data and resolves disputes before they even surface.

Instead of encouraging hundreds of shallow integrations, Vanar focuses on partnerships that generate meaningful activity. Payment providers like Worldpay reference immutable Seeds to resolve transaction issues faster and with less fraud. From what I can see, this slower and more selective onboarding results in smoother launches and better long term retention. Development timelines adapt to real usage data rather than speculative roadmaps, which makes the ecosystem feel grounded.

Regulatory awareness plays a major role here. Kayon continuously evaluates rules across many jurisdictions and produces audit ready outputs directly on chain. Financial teams use this for treasury visibility, combining internal ERP records with blockchain history for clearer risk assessments. Public institutions experiment with transparent reporting tools where data access is tightly controlled by the original owner, not exposed by default.

PayFi as a Smarter Way to Run Global Payments

PayFi is where Vanar truly shows its enterprise strength. Payments are no longer just transfers from one wallet to another but structured processes that understand context. Companies upload invoices as compressed Seeds and Kayon validates them against contracts, compliance rules, and market data before releasing funds automatically. A logistics firm can approve a large shipment payment in seconds once conditions are verified, all for a predictable low fee.

This reduces costs dramatically. Traditional disputes that consume a large share of transaction value simply disappear when the source of truth is verifiable on chain. Large gateways integrate PayFi to process volume while retaining full audit trails that regulators can inspect at any time. Small and medium businesses benefit too, as tokenized invoices can be used as collateral to unlock liquidity.

VANRY sits at the center of this flow. It covers computation, governs upgrades, and is burned during complex reasoning tasks. APIs allow companies to connect existing systems with minimal changes, while validators ensure outputs cannot be tampered with. I have seen early pilots where supply chains track goods from origin to final payment, each step confirmed and stored permanently.

Turning Assets and Infrastructure Into Programmable Systems

Asset tokenization is another area where Vanar feels especially suited for institutional use. Media rights, property, and commodities can be digitized with rules baked directly into logic. A studio can tokenize film rights, with Neutron compressing contracts and Kayon distributing royalties automatically when revenue events occur. Payments flow in VANRY and ownership history remains provable forever.

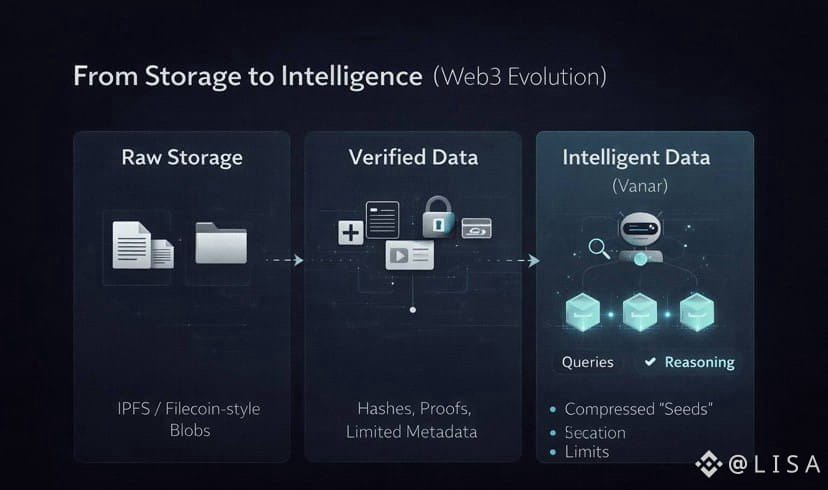

Physical assets benefit just as much. Renewable energy projects tokenize ownership while linking real time production data to returns. Compliance checks happen automatically during transfers. What I find compelling is how companies can extract value from their data without exposing the raw information. Seeds allow selective insight sharing that can be revoked or limited at any time, opening the door to data driven marketplaces.

Enterprise and entertainment overlap here as well. Brands host virtual events with tokenized tickets and on chain attendance proofs that feed loyalty programs. VANRY becomes the settlement layer across all of it, while staking rewards encourage long term participation.

Making Enterprise Data Easier to Govern and Audit

Vanar excels at handling enterprise data where traditional systems struggle. CRM and ERP records are transformed into programmable Seeds that can be queried using natural language prompts. Kayon combines this information with blockchain history to produce summaries or structured outputs that auditors can trust.

Financial institutions use this to enforce compliance rules during transactions rather than after the fact. Public sector teams experiment with transparent grant tracking. Even gaming companies use these tools to balance economies by analyzing player behavior data stored as Seeds.

Security remains a priority. Data stays encrypted by default and access rights are granular and reversible. Computation is distributed across validators so no single party controls outcomes. Advanced usage requires VANRY subscriptions, creating recurring demand as enterprise adoption scales.

Tools That Feel Familiar to Corporate Developers

Vanar lowers friction for enterprise developers by supporting familiar environments. Solidity contracts run without modification, while WASM enables high performance workloads. SDKs make it easy to integrate Kayon reasoning, and third party tooling abstracts complexity for fast prototyping.

Non technical teams are not left out. No code tokenization tools allow businesses to launch asset projects without deep blockchain expertise. Community funded hackathons encourage experimentation, while responsive support helps teams launch without surprises. From my perspective, this curated growth model avoids fragmentation and keeps the ecosystem cohesive.

Fiat on ramps simplify treasury operations and social wallets remove the need for managing keys, making dashboards accessible through standard logins.

Partnerships That Translate Into Real Usage

Vanar enterprise growth is driven by targeted partnerships. Payment providers bring transaction volume, tokenization platforms unlock liquidity, brands contribute users, and infrastructure partners ensure sustainability. Each integration adds real demand rather than empty metrics.

Governance plays a role too. Stakers vote on where treasury resources are deployed, prioritizing pilots with strong potential. This bottom up decision making helps the ecosystem adapt naturally as conditions change.

Scaling With Patience and a Long View

Vanar expands with intention, balancing throughput, finality, and cost efficiency. Proof of Reputation keeps validators reliable, reducing operational risk during high demand. The roadmap includes deeper enterprise connectors and intelligent agent coordination across regions.

There are challenges, especially around integration complexity, but the focus on usability reduces friction. Early 2026 metrics show steady growth from enterprise pilots even when broader market sentiment remains neutral.

Vanar Chain and VANRY represent a maturing vision of enterprise Web3, where trust is automated quietly and infrastructure works in the background. As companies tokenize operations and intelligence moves on chain, it raises an interesting thought for me. When every enterprise record can reason and act on its own, how much inefficiency quietly disappears from global commerce over time?