Private finance has always lived with a contradiction it never fully resolved.

Private finance has always lived with a contradiction it never fully resolved.

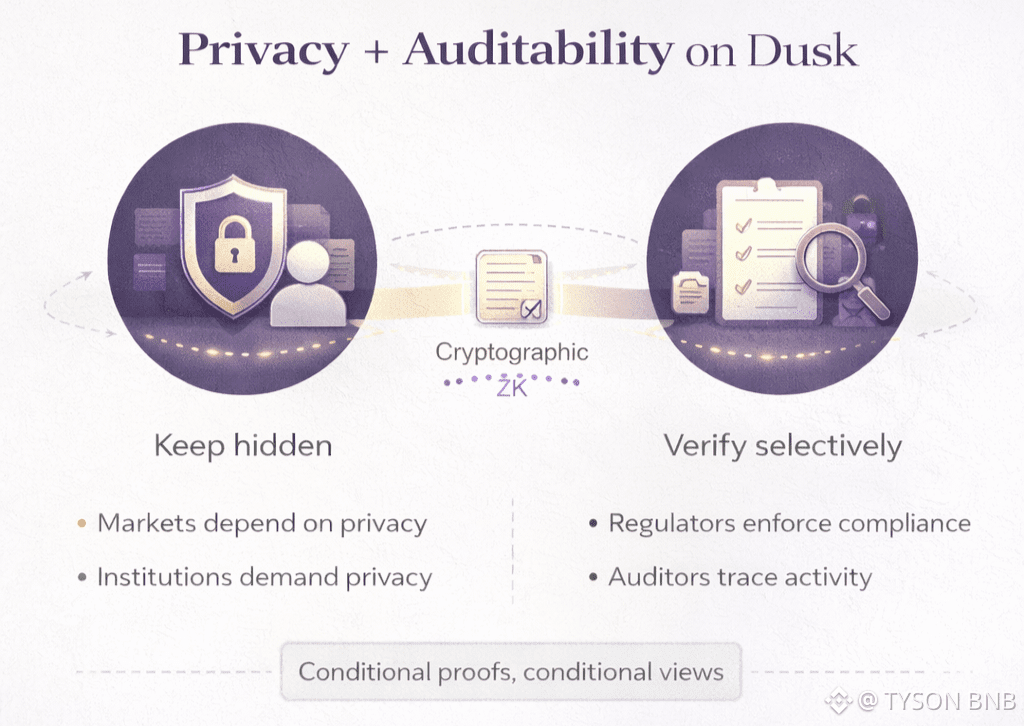

On one side, confidentiality is non-negotiable. Positions, counterparties, balances, and strategies must remain hidden. Markets depend on it. Institutions demand it. Without privacy, finance becomes performative instead of functional.

On the other side, auditability is mandatory. Regulators must verify compliance. Auditors must trace activity. Systems must prove that rules were followed, not just promise that they were.

Most infrastructure picks one side and apologizes for the other.

Traditional finance hides data and relies on trusted intermediaries to vouch for correctness. Public blockchains expose data and hope transparency substitutes for trust. Neither truly solves the paradox — they just choose which risk to live with.

The paradox isn’t theoretical. It shows up the moment real money is involved.

If everything is private, how do you prove compliance? If everything is public, how do you preserve market integrity?

Dusk starts by rejecting the idea that privacy and auditability are opposites.

They are different audiences asking different questions.

Privacy answers: Who should not see this?

Auditability answers: Who must be able to verify this?

Most systems collapse those questions into one crude answer either everyone sees everything, or no one sees anything. Dusk separates them at the protocol level.

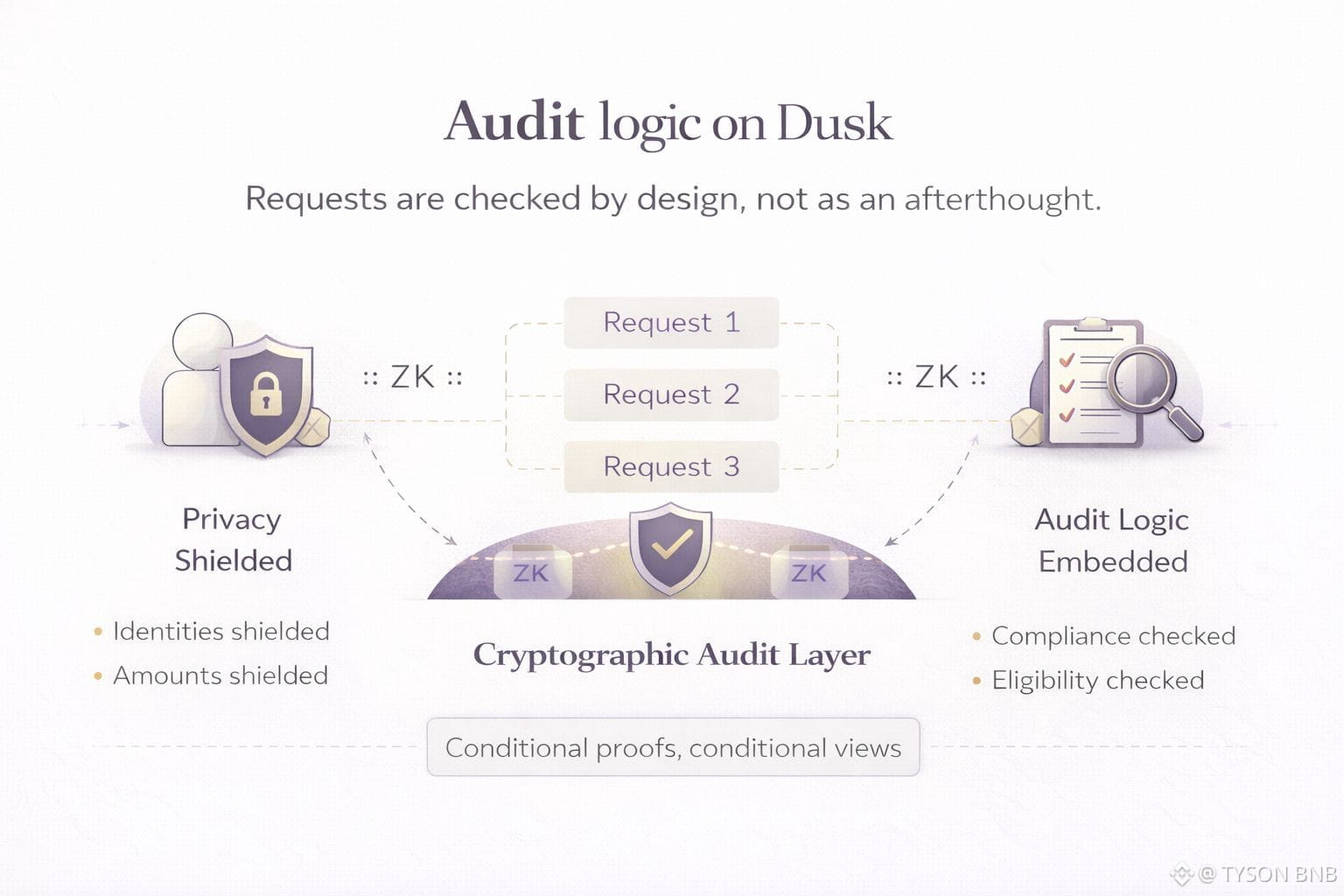

On Dusk, privacy is the default state, not a cover layer. Transactions, balances, and identities are shielded by design. But that shielding is not absolute. It is conditional, structured, and provable.

This is the key shift.

Auditability on Dusk does not mean exposure. It means compliance without disclosure.

Rather than disclose the details of a transaction, the system generates cryptographic proofs that the rules were obeyed. The transfers can be checked without disclosing the amounts. Eligibility can be enforced without disclosing identity. Ownership can be confirmed without publishing cap tables to the world.

Auditors don’t need to see everything. They need to see enough and know that what they see is correct.

Dusk treats audits as a permissioned act, not a public spectacle. Regulators and authorized parties can be granted selective visibility, while the rest of the network remains blind to sensitive details. The chain becomes a source of truth that adapts its transparency based on role, not ideology.

This matters because financial audits are not continuous public events.

They are contextual. They are time-bound. They are scoped.

Public blockchains force audits to be permanent and universal. Once data is exposed, it cannot be unseen. That might work for open markets, but it breaks down for private equity, debt instruments, security tokens, and regulated assets where disclosure itself creates risk.

Dusk avoids that trap.

By embedding audit logic into execution itself, it ensures that compliance is enforced as transactions happen, not reconstructed later from exposed data. There is no need to trust an off-chain report or a centralized intermediary. The proof exists at the moment of settlement.

The paradox dissolves because the system no longer asks privacy to carry the burden of trust.

Trust is shifted to cryptography.

This also changes institutional behavior.

On systems where auditability requires exposure, institutions hesitate. They limit activity. They keep value off-chain. On Dusk, participation doesn’t require surrendering confidentiality. Compliance becomes a property of the system, not a negotiation with it.

That’s the difference between experimental finance and deployable finance.

The uncomfortable truth is this:

Finance doesn’t want to be seen. It wants to be defensible.

Auditability isn’t about surveillance. It’s about assurance.

Dusk understands that private finance doesn’t need louder ledgers or brighter transparency. It needs infrastructure that can answer hard questions without betraying the people asking them.

Privacy without auditability breeds distrust. Auditability without privacy destroys markets.

Dusk doesn’t choose between them. It builds the narrow bridge where both can exist quietly, rigorously, and without compromise.

That’s not a philosophical stance.

It’s what financial infrastructure has been waiting for.