Bitcoin recent pullback is being seen less as a chart failure and more as a liquidity issue. Ki Young Ju points out that the rally was driven by steady new capital, and that flow has now slowed. In this context, he says a deep full-cycle crash like a 70 percent drawdown would likely depend on one thing only whether Strategy shifts from being a major buyer to becoming a serious seller.

Will Bitcoin Experience Another -70% Bear Market?

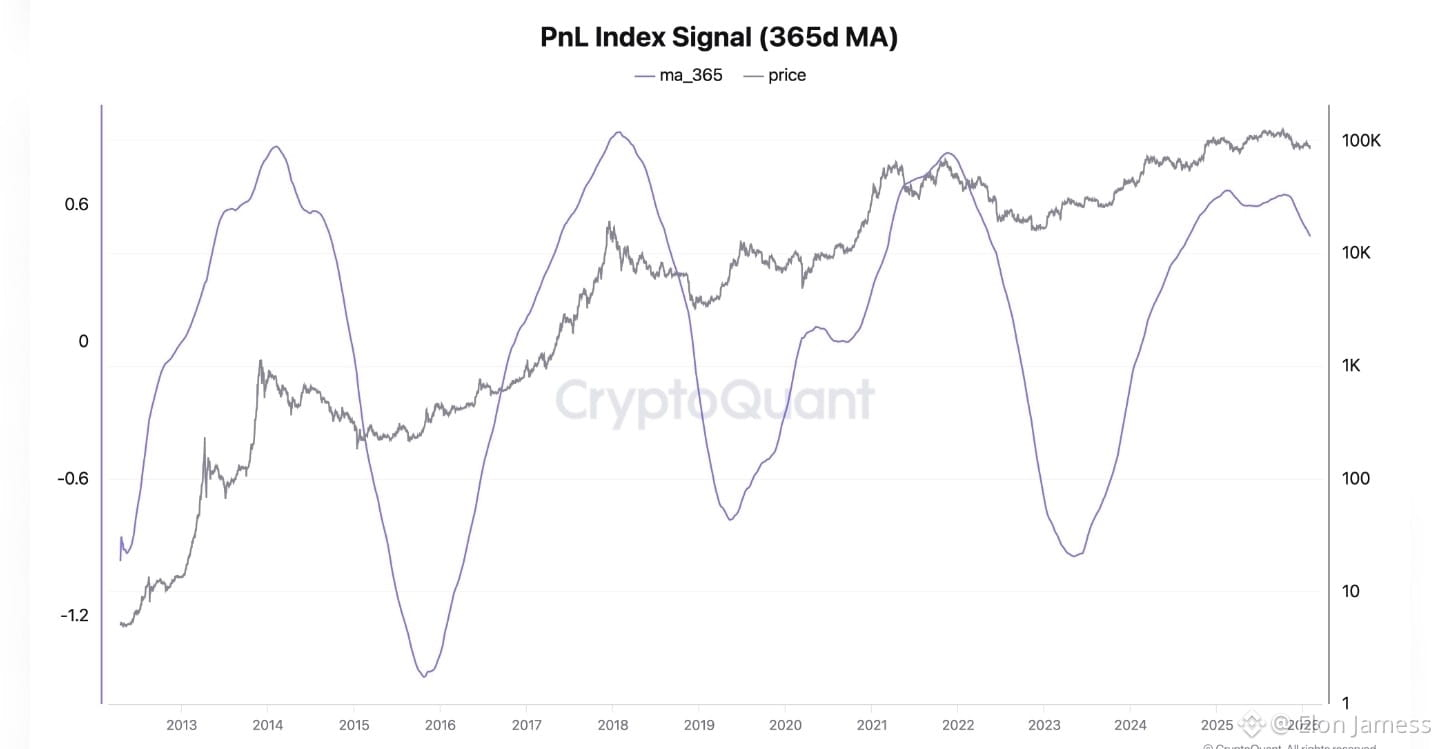

In a post on Feb 1 Ki said Bitcoin is falling because sellers are still active while new money has stopped flowing in He highlighted that the Realized Cap has gone flat which shows that no additional capital is entering the market and linked this to the overall structure He explained that when realized cap is flat and market cap drops that is not a bull market.

His read is that the profit-taking has been there for a while, it was simply absorbed. Early holders, he wrote, were “sitting on big unrealized gains thanks to ETFs and MSTR buying,” and “have been taking profits since early last year, but strong inflows kept Bitcoin near 100K.” The change now, in his telling, is that the bid that mattered most has faded: “Now those inflows have dried up.”

That is where the downside math shifts Ki said Strategy MSTR has been one of the main forces behind this rally but believes the kind of self reinforcing crash seen in past cycles is unlikely unless the company flips its balance sheet approach He said a deep seventy percent style collapse would only happen if Saylor aggressively sells his holdings framing it as a clear condition not an unavoidable outcome.

Still he did not say the market has already bottomed Ki said selling pressure remains and the low is not confirmed yet He added that the more likely outcome is time passing rather than a sharp flush His main view is a broad sideways phase where price can stay volatile but struggle to trend without fresh buyers stepping in.

Stablecoin Liquidity Dries Up

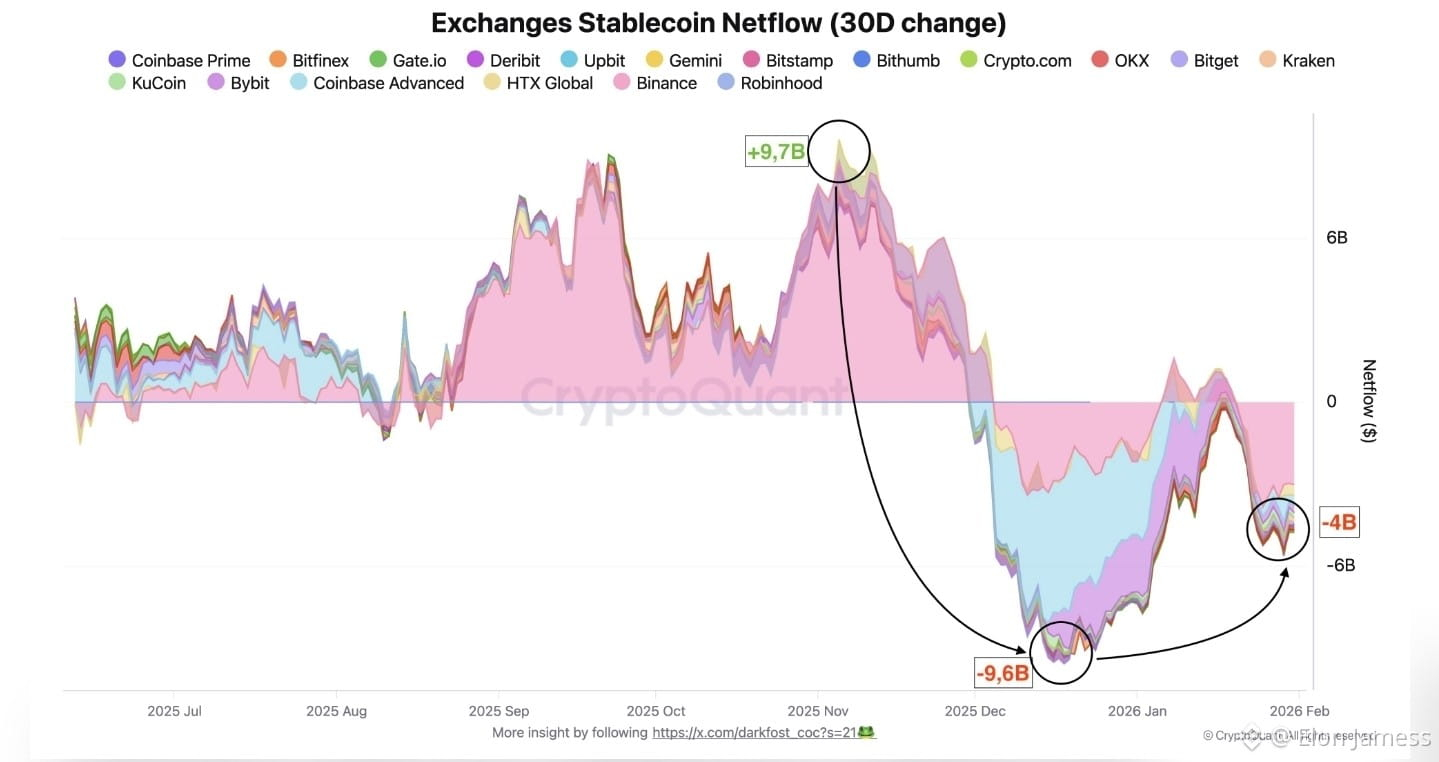

CryptoQuant analyst Darkfost expanded on what no fresh capital really means under the hood He said stablecoin activity which is often used as a short term gauge for ready crypto liquidity has dropped hard as uncertainty remains high

The crypto market is currently going through a delicate phase marked by a structural lack of liquidity in a context of persistently high uncertainty he wrote calling it an environment not conducive to risk taking especially relative to assets like precious metals and equities that are still drawing flows.

Darkfost said the stablecoin market grew by over 140 billion dollars since 2023 but noted that total stablecoin supply started to fall in December ending that long growth phase He said the clearer signal comes from exchange flows strong inflows usually show investors want exposure while outflows point to capital protection and lower risk taking.

He highlighted October as the last clear liquidity-heavy month when average monthly stablecoin netflows exceeded $9.7B with nearly $8.8B concentrated on Binance alone conditions that supported Bitcoin’s rally toward a new all time high. Since November he said those inflows have been largely wiped out with an initial $9.6 billion drop then a brief stabilization followed by renewed net outflows of more than $4 billion including $3.1 billion from Binance.