BTCUSD−4.82%

Bitcoin may continue its downward trend, as there are few catalysts capable of reversing the cryptocurrency's fortunes, according to Galaxy Digital's research lead, Alex Thorn.

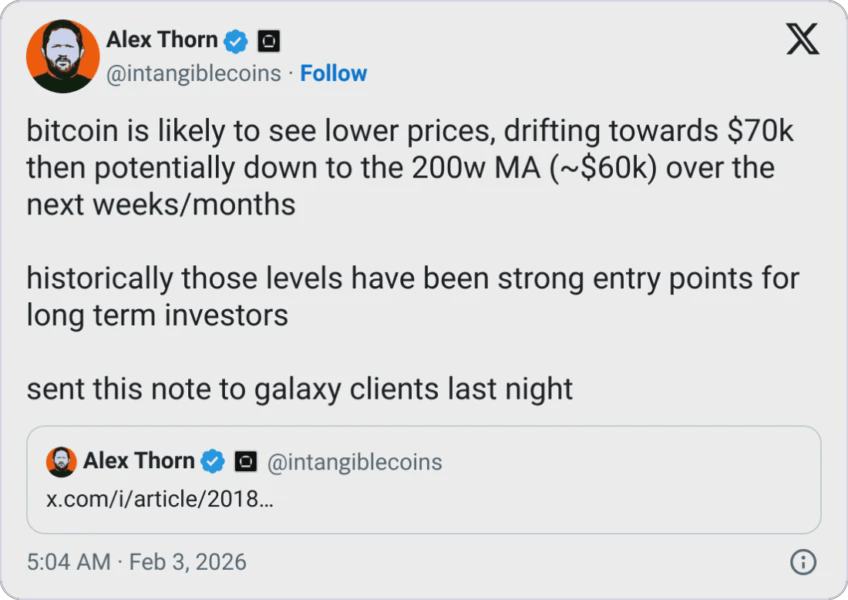

Thorn said in a note released on Monday that there is a 'significant chance' that, in the coming weeks, Bitcoin

BTCUSD

could drop to the bottom of a supply gap at $70,000 before testing its realized price of $56,000 — the average cost of all BTC in circulation.

'The catalysts remain difficult to find and the narratives also work against Bitcoin, as it fails to trade alongside gold and silver as part of a 'devaluation hedge' across the market,' he added.

Bitcoin rose 3% on Monday, trading just below $78,500, after bouncing from a 9-month low. Currently, the asset has accumulated a 39% decline from its all-time high of over $126,000 in early October, according to data from CoinGecko.

Bitcoin may find support at the realized price, marking a bottom

Thorn noted that Bitcoin has historically traded below its realized price at the bottom of previous bear markets and typically found support 'around or slightly below' the realized price before rising again.

He added that Bitcoin also found 'key support' at its 200-week moving average — the average price during that period — in each of the last three bull market cycles, when the asset fell below the 50-week moving average.

Second Thorn, Bitcoin lost support from the 50-week moving average in November, while the 200-week moving average is currently at $58,000.

'These levels have historically marked cycle bottoms and have proven to be strong entry points for long-term investors,' he added.

Slowing sales by long-term holders may signal that the bottom is near

Thorn said there is also 'little evidence of significant accumulation' by large buyers and long-term holders. This could weigh on Bitcoin's price, as it signals that buyers may be waiting for lower levels before entering.

However, Thorn stated that profit-taking by long-term holders — which could pressure prices — 'has started to notably decrease,' but added that 'it is possible that there are still long-term holders waiting for higher prices to sell,' which could create resistance to upward movements.

The average purchase price of Bitcoin ETFs is at a loss as investors withdraw $2.8 billion in 2 weeks

'Still, the recent decline in profit-taking by long-term holders is significant and should signal that we are approaching a bottom,' he added.

The crypto market structure bill is unlikely to be a major catalyst

The crypto industry is closely monitoring the U.S. Senate, as lawmakers seek to pass a crypto market structure bill that aims to define how the sector will be regulated.

However, Thorn said that while the approval of legislation 'could act as a short-term exogenous catalyst, the chances of approval have decreased in recent weeks.'

Lawmakers are struggling to gain bipartisan support for the bill, and the momentum to pass it has weakened, as the Senate Banking Committee — a key player in the process — has yet to reschedule a meeting to move forward with the proposal.

Still, Thorn stated that 'any positive momentum generated by the approval is more likely to benefit altcoins than BTC.'