GoldSilverRebound wasn’t just a bounce on the chart, it was a message from the market. A reminder that even the oldest “safe havens” can turn ruthless when positioning gets heavy and confidence turns one-sided. What played out across gold and silver was not a simple dip and recovery, but a full cycle of euphoria, liquidation, and recalibration compressed into days.

The Setup: A Trade Everyone Agreed On

Going into late January, gold and silver had become consensus trades. The narrative felt bulletproof. Inflation risks lingered, global uncertainty stayed elevated, and trust in long-term monetary discipline remained shaky. Every pullback was treated as an opportunity. That kind of environment invites leverage, because the downside feels theoretical while the upside feels inevitable.

Silver took the lead, and that mattered. When silver starts outperforming gold aggressively, it often signals speculation accelerating faster than fundamentals. Price action became steeper, corrections became shallow, and the market stopped asking “what if” questions. That was the warning sign.

The Break: Confidence Unwinds Before Price Does

The sell-off wasn’t sparked by one catastrophic event. It was sparked by a shift in expectations. A policy headline, a firmer dollar, and suddenly the market was forced to reconsider assumptions that had gone unchallenged for weeks. Gold and silver don’t offer yield, so when rate expectations reprice, those trades get vulnerable fast

Once price started slipping, stops began to trigger. Liquidity thinned. What followed wasn’t panic selling by long-term holders, but forced liquidation by leveraged participants. Gold dropped in sharp segments. Silver unraveled violently. This was mechanical, not emotional. Margin calls don’t care about narratives.

Why Silver Broke Harder

Silver always exaggerates the truth of the market. It lives between two worlds — monetary hedge and industrial asset — and attracts speculative capital when momentum builds. That combination makes it explosive on the way up and unforgiving on the way down. When leverage unwinds, silver becomes the release valve, and that’s exactly what happened.

The speed of the decline wasn’t a sign that silver “failed.” It was a sign that too many people were leaning the same way at the same time.

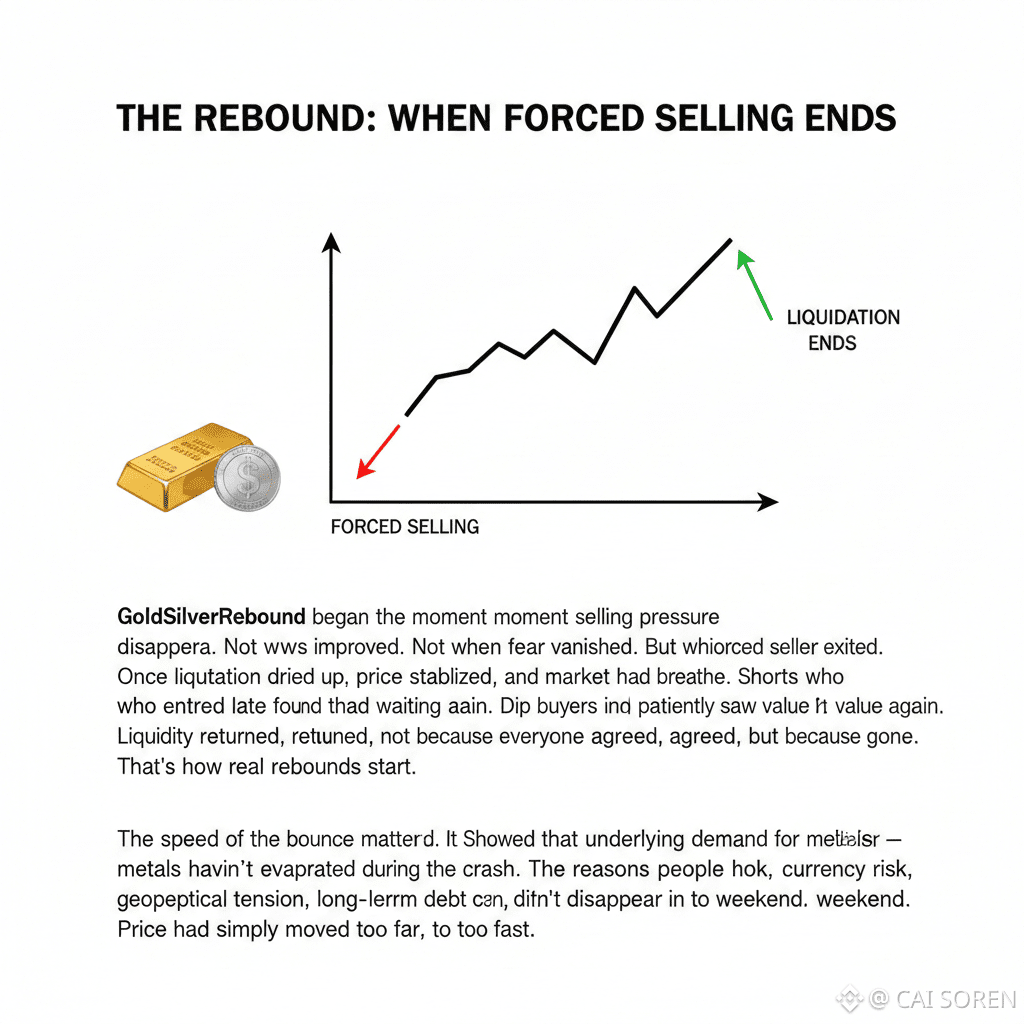

The Rebound: When Forced Selling Ends

GoldSilverRebound began the moment selling pressure disappeared. Not when news improved. Not when fear vanished. But when the last forced seller exited. Once liquidation dried up, price stabilized, and the market finally had room to breathe.

Shorts who entered late found no continuation. Dip buyers who had been waiting patiently saw value again. Liquidity returned, not because everyone agreed, but because imbalance was gone. That’s how real rebounds start.

The speed of the bounce mattered. It showed that underlying demand for metals hadn’t evaporated during the crash. The reasons people hold gold and silver — currency risk, geopolitical tension, long-term debt concerns — didn’t disappear in a weekend. Price had simply moved too far, too fast.

What This Rebound Is — and What It Isn’t

This wasn’t a clean bullish victory. It was a reset.

GoldSilverRebound doesn’t guarantee a straight path higher. It signals a shift from an easy, one-directional trade into a volatile, two-sided market. Rallies now need acceptance. Pullbacks will be deeper. Leverage will be punished faster.Silver, specially, is unlikely to calm down immediately. High-volatility assets don’t settle quietly after liquidation events. They test both patience and conviction.

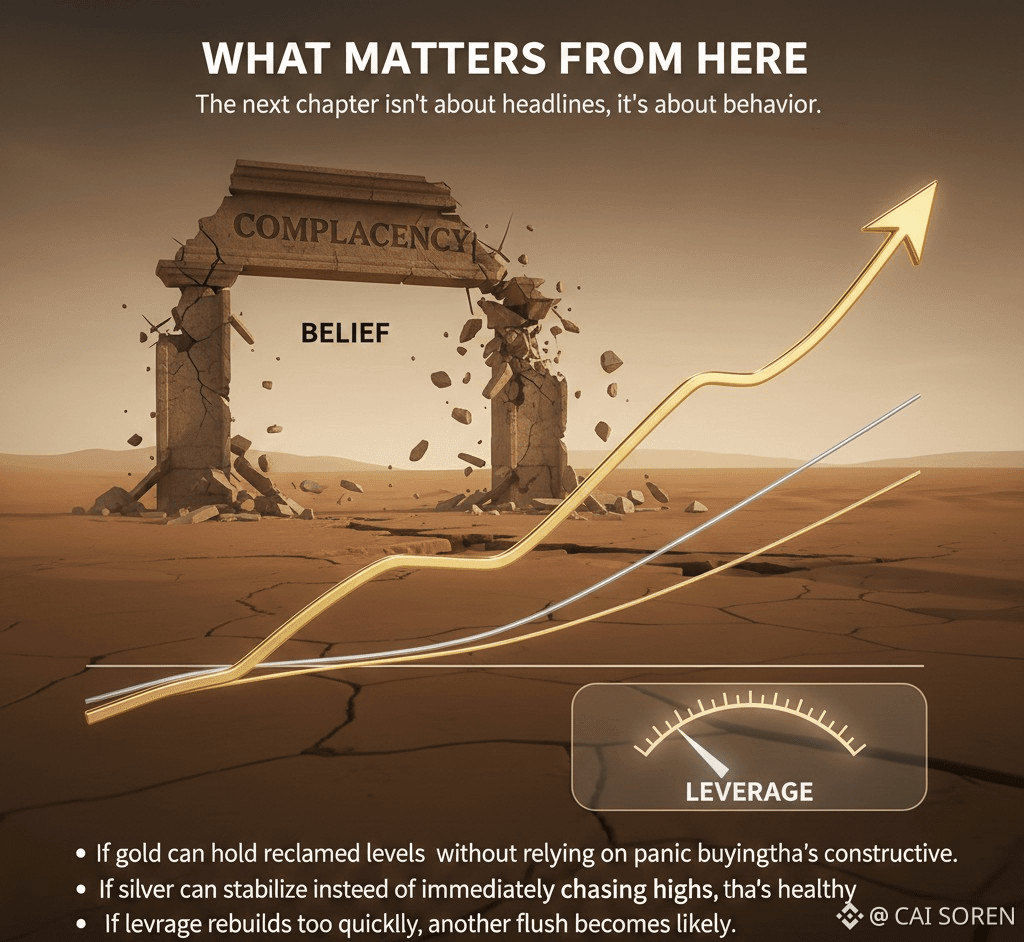

What Matters From Here

The next chapter isn’t about headlines, it’s about behavior.

If gold can hold reclaimed levels without relying on panic buying, that’s constructive.

If silver can stabilize instead of immediately chasing highs, that’s healthy.

If leverage rebuilds too quickly, another flush becomes likely.

Markets don’t end trends by collapsing belief. They end them by breaking complacency

The Bigger Meaning of GoldSilverRebound

This episode will be remembered not because gold fell or silver rebounded, but because it reminded everyone of a simple truth: safe havens are still markets. They still hunt imbalance. They still punish crowding. They still demand respect.

GoldSilverRebound wasn’t the end of the metals story.

#GoldSilverRebound