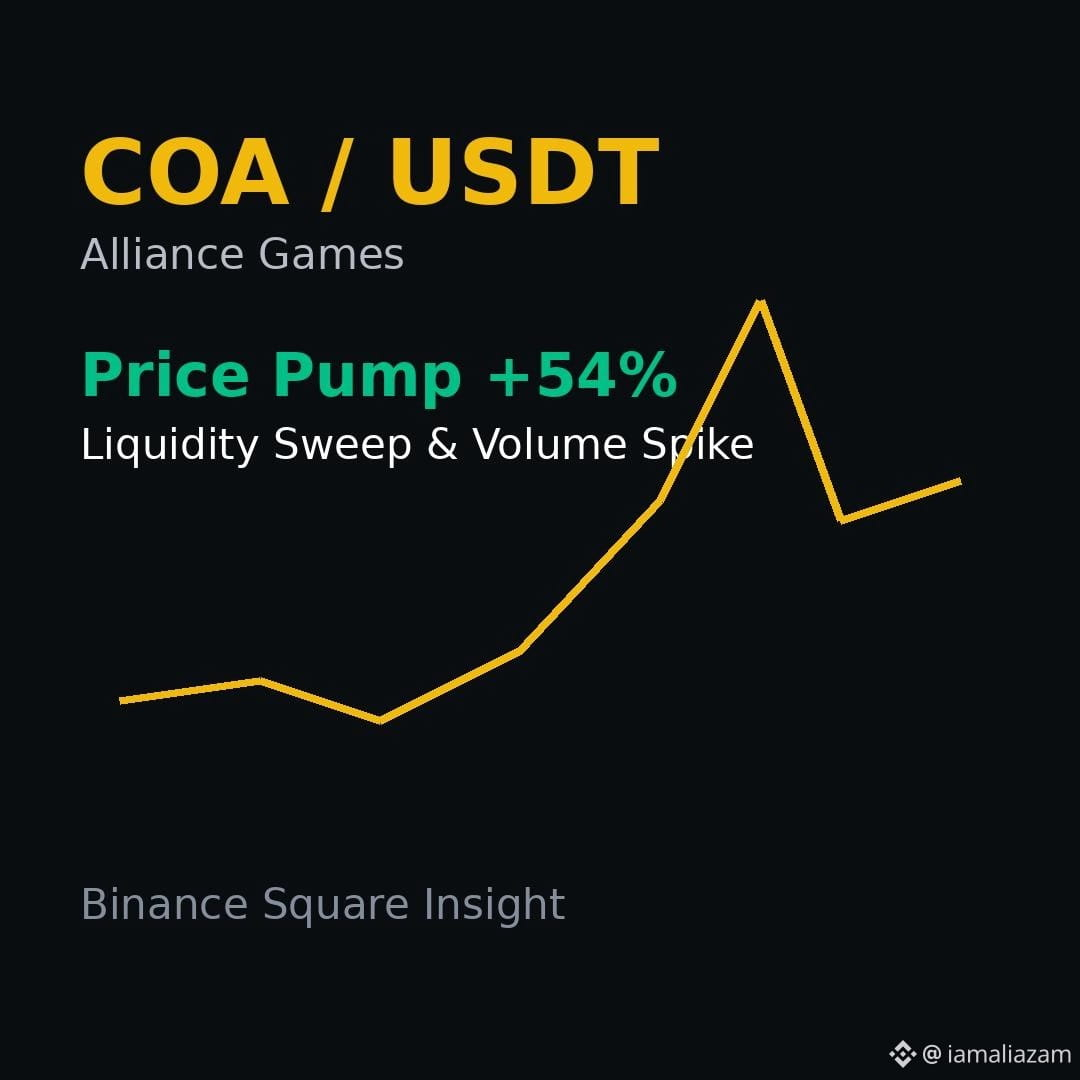

$COA (Alliance Games) has entered the spotlight after recording a sharp +54% price surge, drawing attention from traders across the on-chain and spot markets. This move was not random and can be explained through a combination of liquidity dynamics, low market capitalization behavior, and aggressive short-term participation.

🔍 Liquidity Grab Before the Pump

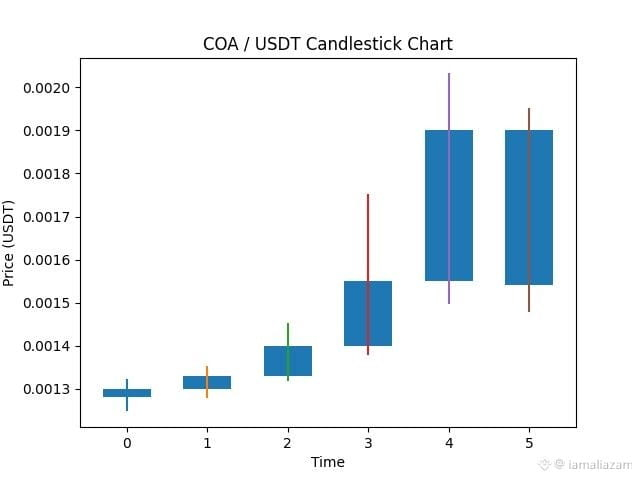

Prior to the breakout, COA was trading in a tight range below the MA60, creating a compression zone where both buyers and sellers were inactive. During this phase, sell-side liquidity gradually built up near the local lows. Once price dipped slightly, it triggered stop-losses and weak hands, allowing larger participants to absorb supply at discounted levels.

This liquidity sweep was immediately followed by a strong upside reaction, which is a classic sign of demand stepping in after sellers were exhausted.

📈 Low Market Cap Effect

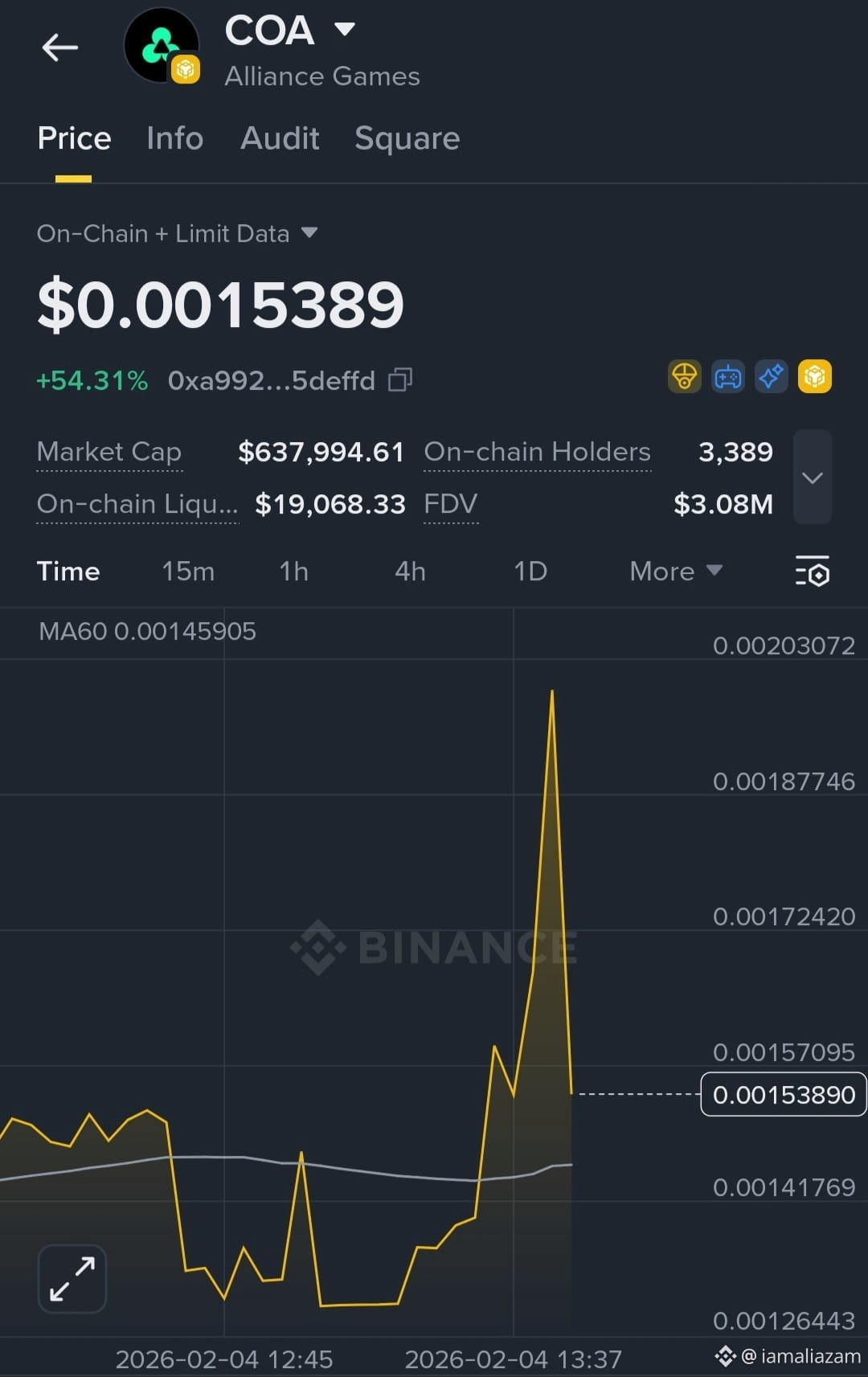

COA currently sits at a very low market cap (~$637K) with limited on-chain liquidity (~$19K). In such conditions, even moderate buy pressure can result in exaggerated price movements. Once momentum kicked in, price accelerated rapidly due to the lack of overhead supply.

This explains the near-vertical spike seen on the chart, where price moved aggressively with minimal resistance.

⚡ Momentum Ignition & FOMO Phase

After breaking above the MA60 (~0.00146), momentum traders entered aggressively. This breakout acted as a confirmation signal for short-term traders, triggering FOMO-driven entries. As price expanded upward, early sellers were forced to chase higher, further fueling the move.

The rapid spike toward the 0.00203 zone reflects this emotional phase of the market, where price often overshoots fair value in a short time.

📉 Healthy Pullback After Expansion

Following the spike, COA pulled back toward 0.00153, which is a normal and healthy reaction after a strong impulsive move. This pullback does not invalidate the pump; instead, it suggests profit-taking and market stabilization.

If price manages to hold above the 0.00145–0.00150 support zone, it increases the probability of consolidation and a possible continuation attempt.

🔑 Key Levels to Watch

Support Zones

0.00145 – MA60 & structural support

0.00126 – Breakdown level (loss of momentum)

Resistance Zones

0.00172 – First supply zone

0.00203 – Local top & rejection area

🧠 What This Move Indicates

COA’s pump is driven primarily by liquidity mechanics and momentum trading, not yet by long-term fundamentals. Such moves are common in low-cap assets and can offer opportunities, but they also carry elevated risk.

Sustained volume and consolidation above MA levels would be needed to confirm continuation. Without volume, price may range or retrace further.

📌 Final Thoughts

COA delivered a high-volatility move backed by liquidity sweep, breakout confirmation, and speculative momentum. Traders should remain cautious, manage risk properly, and avoid chasing extended candles.

This content is for educational purposes only.

#COA #BinanceSquare #CryptoAnalysis #binancearticle #Write2Earn

#COA #BinanceSquare #CryptoAnalysis #binancearticle #Write2Earn