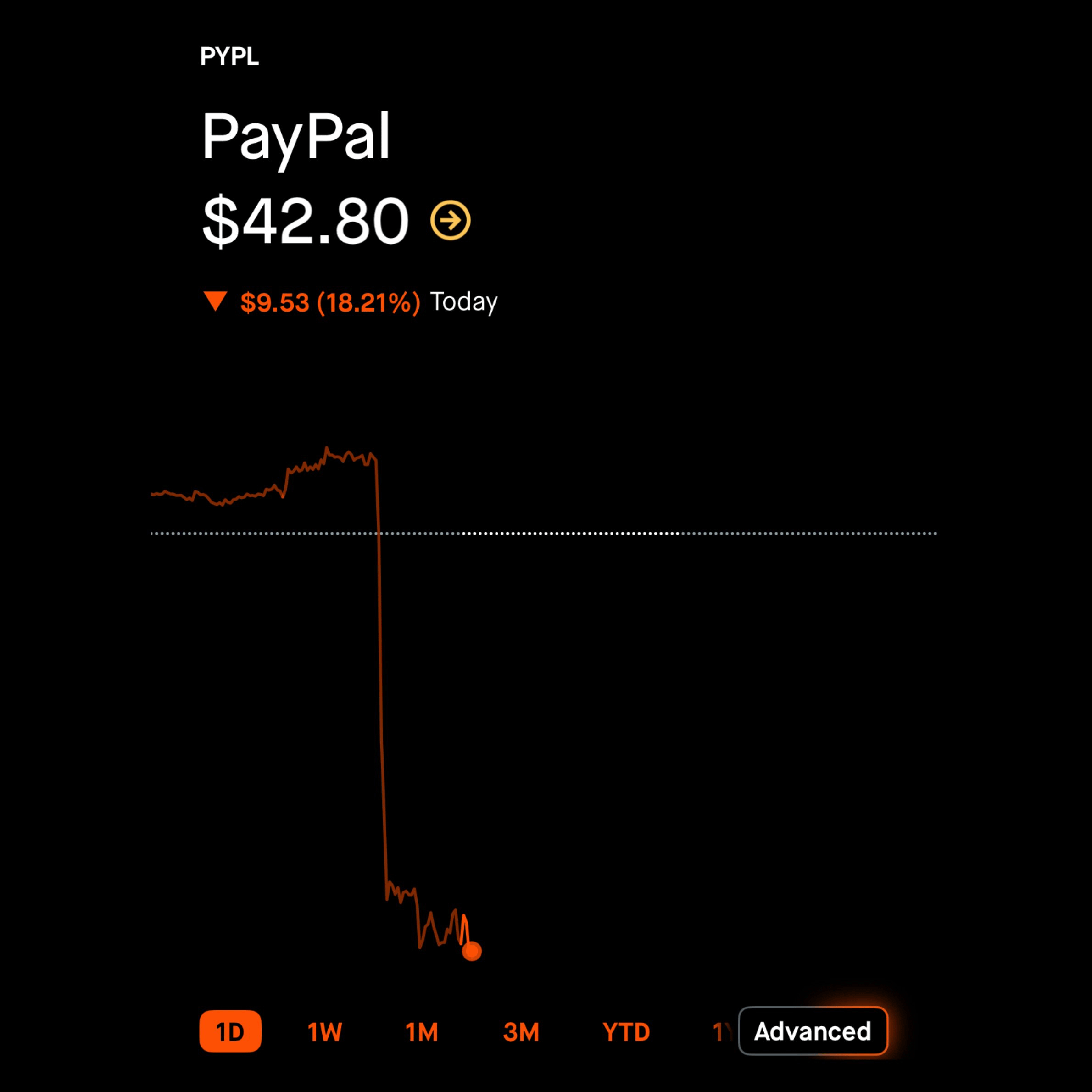

PayPal (PYPL) stock fell sharply by nearly 20% after the Q4 report, not necessarily due to poor figures but because of a rather bleak outlook ahead. Revenue and profit are still increasing, but the company openly admits that growth will slow down in the near future.

Revenue: $8.7 billion (+4%)

Operating profit: $1.5 billion (+5%)

Forecast: Full-year EPS slightly down (mid-single digit)

Meanwhile, PayPal is changing leadership and facing increasing pressure from BNPL, Big Tech, and even stablecoins. Although PYUSD has exceeded $3.6 billion in supply, legal barriers make the growth story not really clear.

On the chart, PYPL is still in a downtrend, with no reliable reversal signal yet