@Walrus 🦭/acc When people hear “prediction market,” they often imagine a clean contest between two outcomes, a tidy probability curve, and a final answer that snaps into place. Living inside Myriad feels different. The real work is not the trading interface. The real work is the messy middle: the screenshots, the clips, the posts that get deleted, the article that gets quietly edited after the fact, the “official source” that contradicts another official source by a single sentence. In a market that asks humans to put money behind a belief, the first thing that breaks under stress is not price discovery—it’s shared reality. That is why the Myriad partnership with Walrus matters, and why it shows up as infrastructure rather than a marketing event.

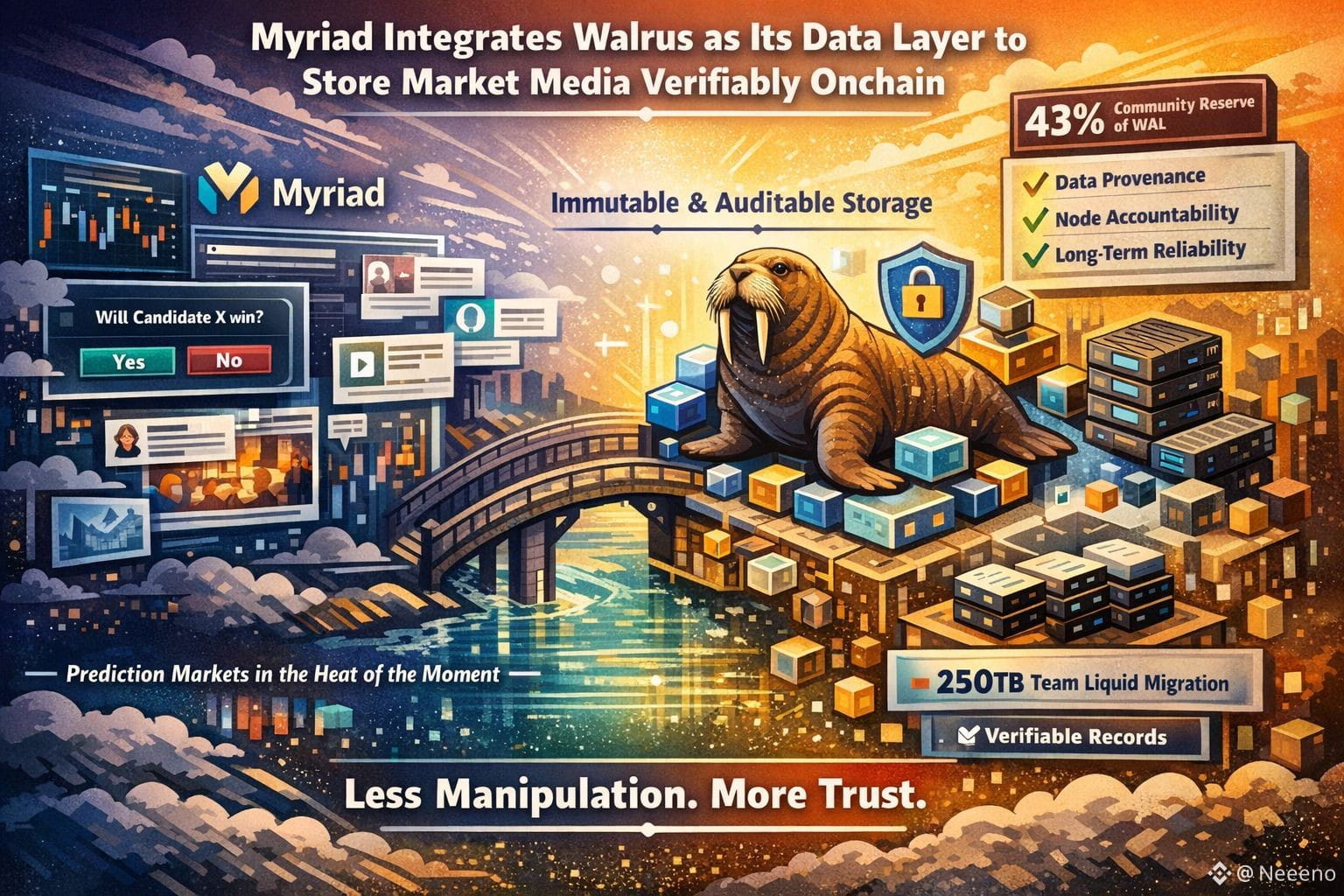

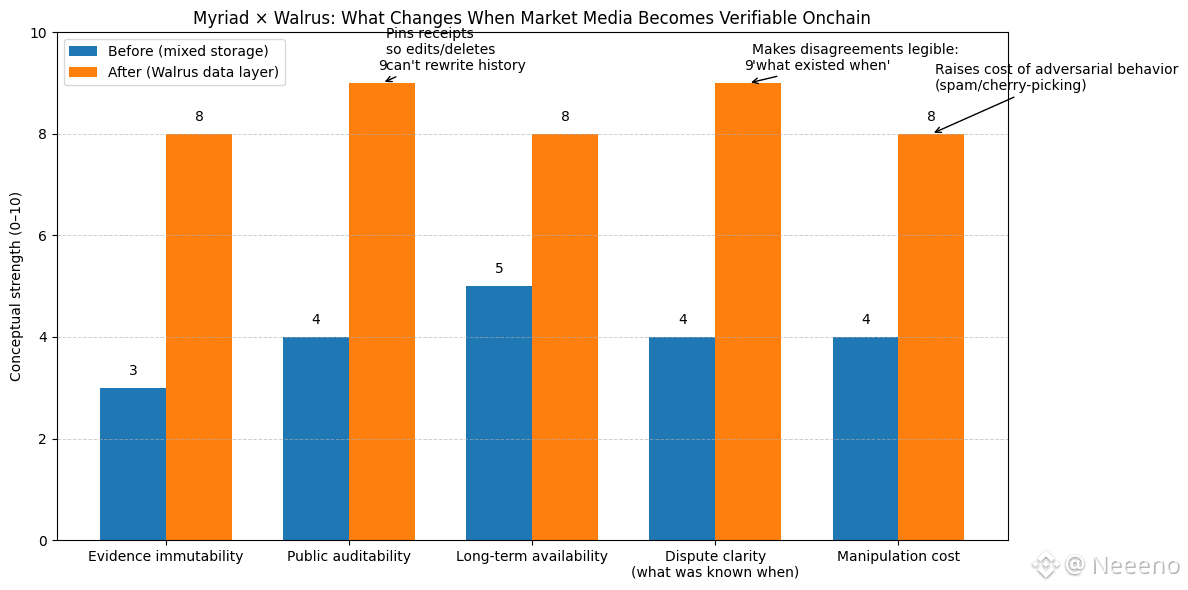

Myriad has always carried an unusual burden because it is wired directly into live media. It is not asking users to leave their context, calm down, and make a rational forecast in isolation. It asks them to act while the story is unfolding, while the timeline is arguing, while the latest update is still hot enough to burn your fingers. Walrus framed the integration as replacing a prior mix of centralized and IPFS-style storage with something verifiable and publicly auditable, tuned for provenance rather than convenience. That shift is not aesthetic. It changes what it feels like to participate when you are uncertain, because your fear is often not “am I wrong,” but “will the record move under me.”

The subtle promise in this partnership is not that outcomes become more correct. It’s that disagreements become more legible. Myriad’s own language around the integration points at bringing a market’s surrounding media and the final outcome “onchain” in a way that can be checked later, rather than trusted in the moment. When you have been in these markets long enough, you start to notice how often people are not fighting about the answer—they are fighting about what was known when the answer was tradable. Walrus is basically saying: pin the evidence trail so the argument can’t be quietly re-written after the crowd has already paid.

This is where storage stops being “just storage.” Images and media aren’t decoration in a prediction market. They are often the primary evidence people use to justify a trade, especially when they don’t trust each other’s summaries. If that evidence is off-chain, mutable, or hosted in a place that can disappear, the market inherits a background anxiety: you can be right and still feel cheated. By moving the media layer into a system designed around verifiable availability, Myriad is choosing a kind of emotional safety. Not the soft kind that tells users everything will be fine, but the hard kind that leaves a trace when something goes wrong.

It also changes incentives in a quiet way. In calm markets, people tolerate a lot of ambiguity because nothing feels urgent. Under pressure—breaking news, fast reversals, controversial outcomes—bad incentives show up immediately. People spam low-quality “proof.” They cherry-pick. They link to sources that will be edited later. A durable, checkable media record doesn’t make manipulation impossible, but it makes manipulation more expensive, because you can’t rely on later deletion to erase the footprint. Walrus’ own framing leans into that idea: competitive behavior is shaped not only by rules, but by the cost of adversarial behavior, and the system is designed to minimize it.

The economics matter here because Walrus is not pretending that good behavior happens out of kindness. WAL is explicitly positioned as the payment and security backbone for storage, with mechanisms meant to stabilize costs in fiat terms and distribute payments over time to the parties keeping data available. There’s an honesty in that design: data persistence is not a vibe, it’s an ongoing service that has to be paid for long after the original hype cycle ends. When Myriad anchors its evidence trail to Walrus, it is choosing to pay for memory in a way that doesn’t depend on any one company continuing to care.

WAL’s own distribution story reinforces why this isn’t a cosmetic integration. Walrus states a 5,000,000,000 max supply, with an initial circulating supply of 1,250,000,000, and a distribution where 43% is set aside as a community reserve, alongside specific allocations for a user drop and subsidies. It also describes deflationary pressure via burning mechanisms tied to network behavior and, longer term, penalties for poor performance. If you live in these systems, you recognize what that’s trying to do: make long-term reliability financially rational, and make short-term, destabilizing behavior costly enough that it stops being a default strategy.

Myriad, for its part, is also trying to normalize prediction markets as something you can do without turning your day into a trading desk. Decrypt’s own “getting started” guide describes Myriad as blending prediction markets into written and video content, including Decrypt and Rug Radio, and emphasizes stablecoin-based participation. Trust Wallet’s guide goes further and portrays Myriad as an in-wallet experience, describing stablecoin trading and high user activity metrics, including a March 2025 launch date and cumulative usage numbers as of its publication. Even if you treat any single metric with caution, the direction is clear: Myriad is pushing markets closer to where attention already lives, which makes the integrity of the underlying record more important, not less.

This is also why Walrus’ recent updates feel relevant to Myriad’s choice.

Walrus isn’t aiming to be a small, niche tool. It keeps saying it’s built to handle big scale and stay dependable. In January 2026, it published a post about how growth can quietly concentrate power, and why staying decentralized takes deliberate design—using checkable performance and consequences for nodes that don’t do the job.

Around the same time, Walrus highlighted a 250TB migration by Team Liquid as a milestone dataset entrusted to the network. Those are not prediction-market stories, but they matter for prediction markets, because a market is only as trustworthy as its ability to keep its receipts when the stakes are high and the audience is hostile.

The most interesting line in Walrus’ own reflection on 2025 is that it places Myriad inside a broader pattern: a world where weekly prediction volume can be enormous, and where Myriad had already processed millions in transactions “since launch,” with the data stored verifiably on Walrus. Whether you focus on that figure or the larger numbers cited elsewhere later, the partnership’s intent stays the same: make the market’s memory durable enough that users can argue honestly about what happened without also having to argue about what existed. That is the difference between a market that feels like a game and a market that feels like a civic tool.

In the end, this Myriad–Walrus partnership is not really about making prediction markets louder. It’s about making them harder to gaslight. When you anchor the media trail and outcome context to a data layer that is designed to be verifiable, you are accepting a kind of quiet responsibility: the responsibility to preserve the uncomfortable evidence, not just the convenient narrative. The best infrastructure rarely gets applause because, when it works, nothing dramatic happens. People simply feel less fear when they place a trade, less suspicion when a market resolves, and less exhaustion when a dispute erupts—because the system can point to what it saw, when it saw it, and who was paid to keep that record intact. That is invisible work. In the long run, being dependable matters more than getting noticed. Attention comes and goes, but reliability stays.