In the world of trading and the stock market, understanding chart patterns is a vital skill that every trader should possess. Chart patterns are formations or patterns created by the price movements in the market that can help traders decide when to buy or sell. These patterns are typically used in technical analysis to predict future price movement directions.

In this article, we will take a detailed look at what graphic patterns are, their types, and how to use them to improve your trading strategies.

What is a graphic pattern?

A graphic pattern is a formation or structure that arises from the price movements of assets such as currencies, stocks, or commodities, which are displayed on a price chart. This pattern reflects market behavior and is often used by traders to forecast potential future price directions. Graphic patterns arise from the interaction of buying and selling forces in the market, providing clues as to whether the price will rise, fall, or move sideways.

Graphic patterns are divided into two main categories:

Reversal patterns - indicate a possible change in trend.

Continuation patterns - indicate the likelihood of this trend continuing.

Home / Tutorial / What is a graphic pattern - a guide for beginner traders?

What is a graphic pattern - a guide for beginner traders?

SocialVPS - In the trading world, especially in Forex and the stock market, understanding graphic models is a vital skill that every trader must possess. Graphic models are formations or patterns created by price movements in the market that can help traders decide when to buy or sell. These models are typically used in technical analysis to predict future price movement directions.

In this article, we will take a detailed look at what graphic patterns are, their types, and how to use them to improve your trading strategies.

What is a graphic pattern?

A graphic pattern is a formation or structure that arises from the price movements of assets such as currencies, stocks, or commodities, which are displayed on a price chart. This pattern reflects market behavior and is often used by traders to forecast potential future price directions. Graphic patterns arise from the interaction of buying and selling forces in the market, providing clues as to whether the price will rise, fall, or move sideways.

Graphic patterns are divided into two main categories:

Reversal patterns - indicate a possible change in trend.

Continuation patterns - indicate the likelihood of this trend continuing.

Also read What is MT5 (MetaTrader 5) and how to use it?

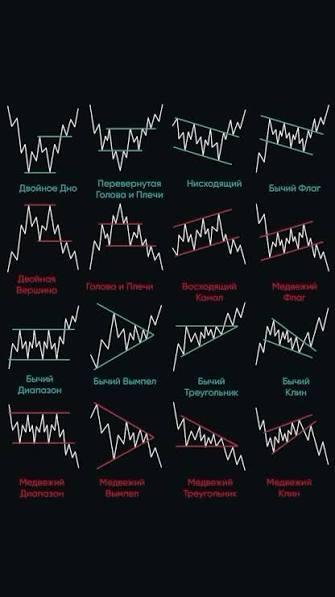

Types of graphic patterns

Below are some common graphic patterns used by traders for market analysis:

Reversal patterns

Reversal models signal that the current trend is likely to change to the opposite direction. Examples of reversal models include:

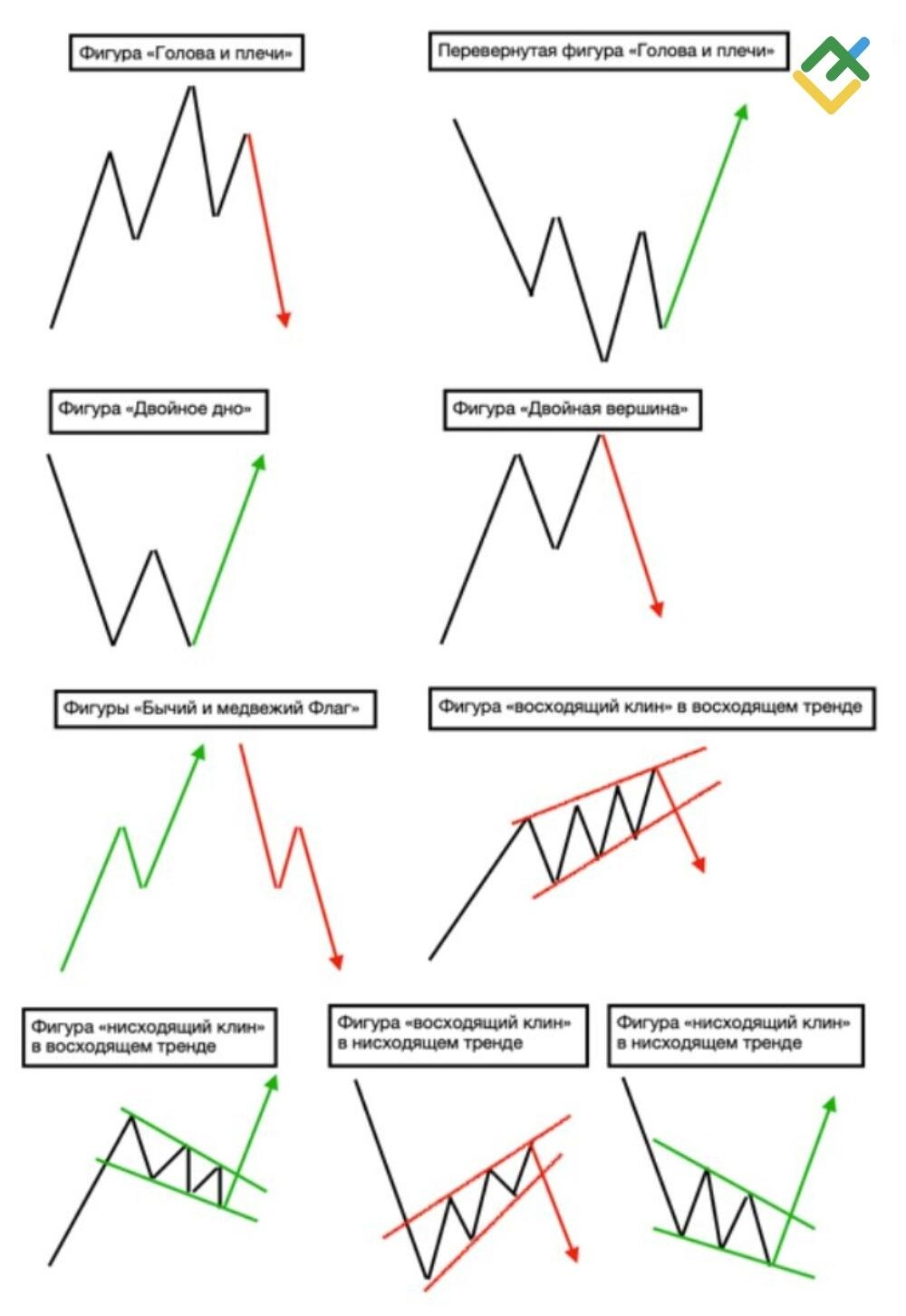

Head and shoulders

Head and shoulders - one of the most popular reversal patterns. It consists of three peaks, with the middle peak (head) higher than the two side peaks (shoulders). This pattern indicates that the bullish trend will shift to bearish.

Head and shoulders (normal): Indicates a reversal from an upward trend to a downward one.

Inverse head and shoulders: Indicates a reversal from a downward trend to an upward one.

Double top and double bottom

Double top and double bottom - other recognizable reversal patterns.

Double top: Formed when the price reaches two identical peaks but cannot break above, indicating that the upward trend will shift to a downward trend.

Double bottom: Conversely, formed when the price reaches two identical lows, signaling a reversal of the downward trend to an upward trend.

Triple top and triple bottom

Similar to the 'Double top' and 'Double bottom', but with three peaks or troughs. This pattern also indicates a trend reversal.

Continuation patterns

Continuation patterns signal that the current trend will continue after a brief pause. Some popular continuation patterns include:

Flag and pennant

Flag: This pattern resembles a flag, formed during a sharp price movement in the trend, followed by a brief consolidation period resembling an inclined channel. After consolidation, the price usually continues its original trend.

Pennant: Similar to a flag, but the consolidation phase forms a small triangle, indicating a brief pause before the trend resumes.

Symmetrical triangle

A symmetrical triangle is a continuation figure where the price moves within a narrowing range. Both buyers and sellers lose dominance, but eventually, the price breaks out of this pattern, usually in the direction of the previous trend.

Ascending and descending triangle

Ascending triangle: This pattern is formed when the price moves between a horizontal resistance level and an upward trend line, often indicating a breakout upward.

Descending triangle: Opposite to the ascending triangle, this pattern suggests a breakout downward.

How to use graphic patterns in trading

Once you understand the various types of graphic patterns, the next step is to apply them in your trading strategy. Here are some tips for effectively using graphic patterns:

Clearly define patterns

It is very important to clearly define patterns on the price chart. Use tools such as trend lines and support/resistance levels to help recognize forming patterns.

Confirmation with other indicators

Although graphic patterns are a powerful tool, always confirm signals with other technical indicators such as RSI, MACD, or moving averages. This ensures that the signals generated by the pattern are valid.

Use stop-loss

Like any other trading strategy, it carries risk. Therefore, always use a stop-loss to protect your capital if the price moves against your forecast.

Pay attention to volume

Trading volume is an important indicator that can confirm the pattern. For example, in a breakout pattern, high volume indicates the strength of the move.

Align with your trading timeframe

Adjust the use of graphic patterns according to your timeframe. A pattern visible on a daily timeframe may not be relevant on shorter timeframes, such as 15 minutes or 1 hour.

Conclusion

Graphic patterns are a valuable tool for technical analysis for traders in the Forex, stocks, and cryptocurrency markets. By understanding and using these patterns, traders can more easily predict price movements and make more accurate trading decisions. Whether you are a beginner or an experienced trader, mastering these patterns can give you a significant advantage in trading.

If you need a Forex VPS for uninterrupted operation of automated trading robots, consider using the service from SocialVPS. With a high-performance VPS, your trading will run more smoothly and efficiently.

If you enjoyed the content, click 'subscribe', 'like', 'comment', and 'share' with others. Thank you!❤️

#COSSocialFiRevolution #Write2Earn #writetoearn #Write2Earn! #USInflationAboveTarget