There is a quiet mistake the crypto industry keeps repeating.

We keep measuring success by how many users show up.But financial systems are not built by visitors.They are built by flows that never stop moving.

That is where Plasma stands apart.

While most chains compete for attention, Plasma focuses on something far harder to win — stablecoin flow.

And that choice says a lot about where it believes the next phase of crypto is heading.

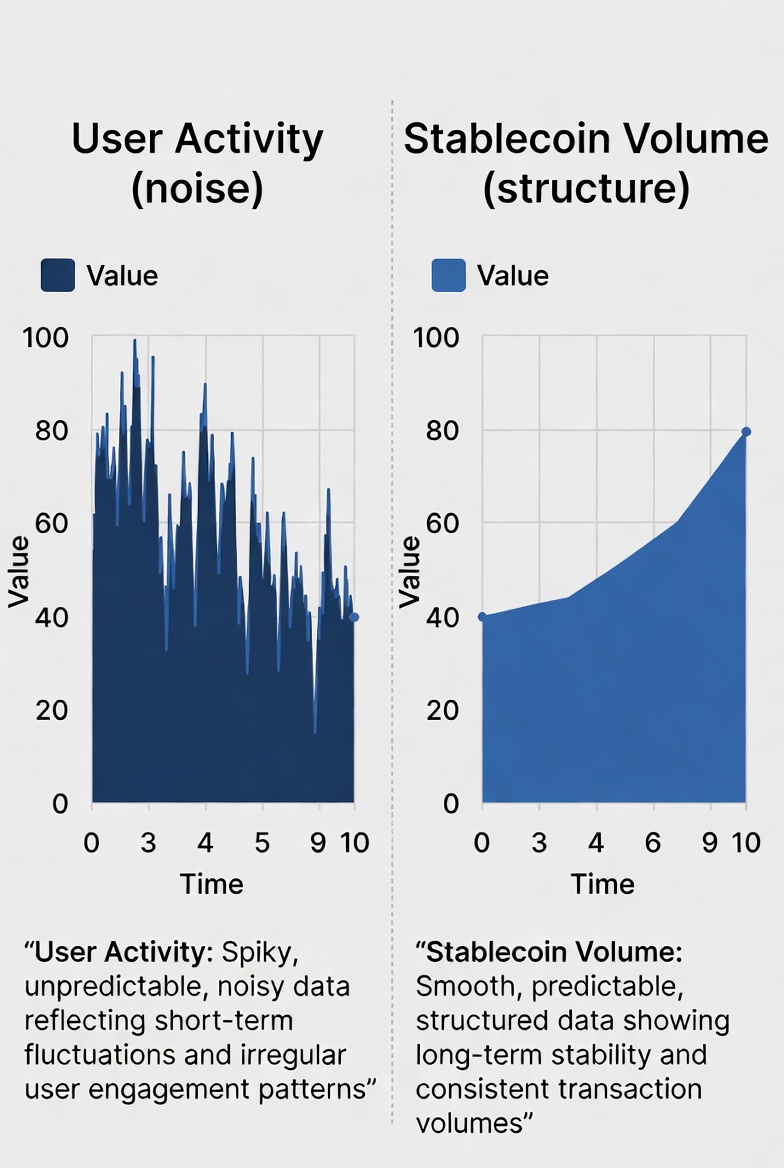

Users Create Noise. Stablecoin Flow Creates Structure.

A wallet can be created in seconds.Activity can be inflated with incentives.Campaigns can manufacture engagement.

But stablecoins behave differently.

When stablecoins move consistently on a network, it usually means:

• Payments are settling

• Treasury operations are running

• Protocols trust execution rules

• Capital is not afraid of staying

This kind of activity does not come from hype.

It comes from reliability.

Plasma is designed around that reality.

Why Plasma Doesn’t Compete on User Acquisition

Most networks grow by asking:

“How do we bring more people in?”

Plasma asks a different question:

“How do we keep value moving safely once it arrives?”

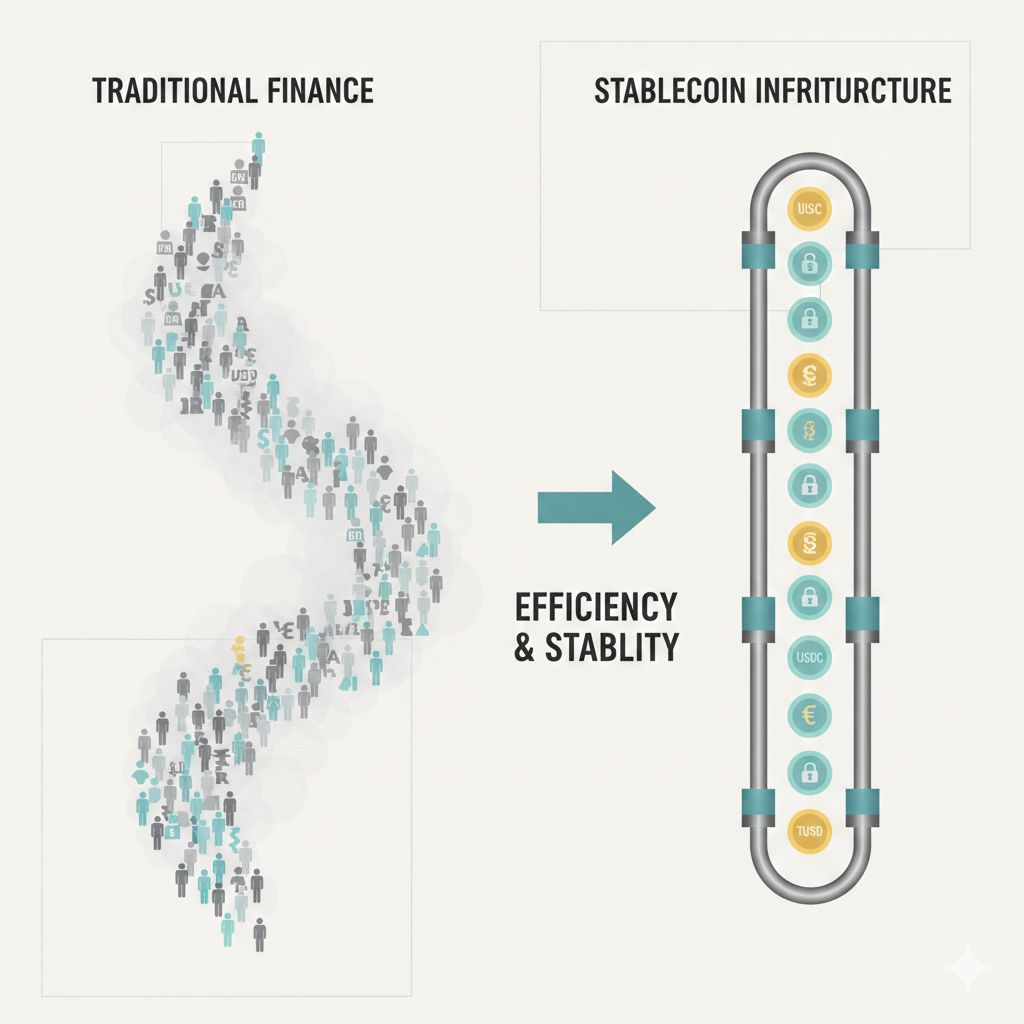

That difference shows up at the infrastructure level.

Plasma prioritizes:

• Predictable transaction behavior

• Stable execution paths for large volumes

• Governance-controlled upgrades

• Minimal disruption to ongoing flows

This makes Plasma less exciting on social media — and far more attractive for systems that move money every day.

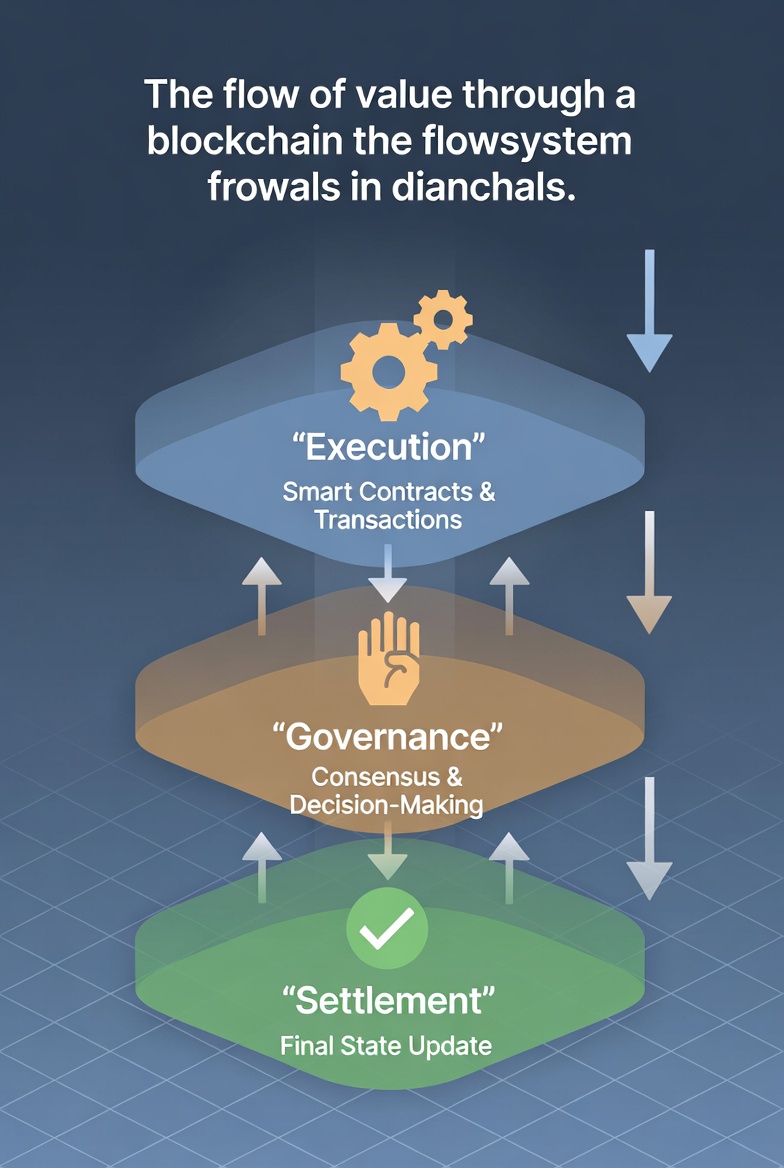

Stablecoin Flow Is Not a Metric. It’s a Commitment.

Stablecoin flow is not accidental.

Once a payment system, protocol, or treasury integrates a chain, switching becomes costly. Rules matter. Downtime matters. Governance discipline matters.

This is why stablecoin flow tends to compound, not fluctuate.

Even without publishing flashy numbers, Plasma signals alignment with this reality by how it designs:

• Settlement logic

• Fee behavior

• Upgrade pacing

• Risk containment

This is infrastructure thinking, not growth hacking.

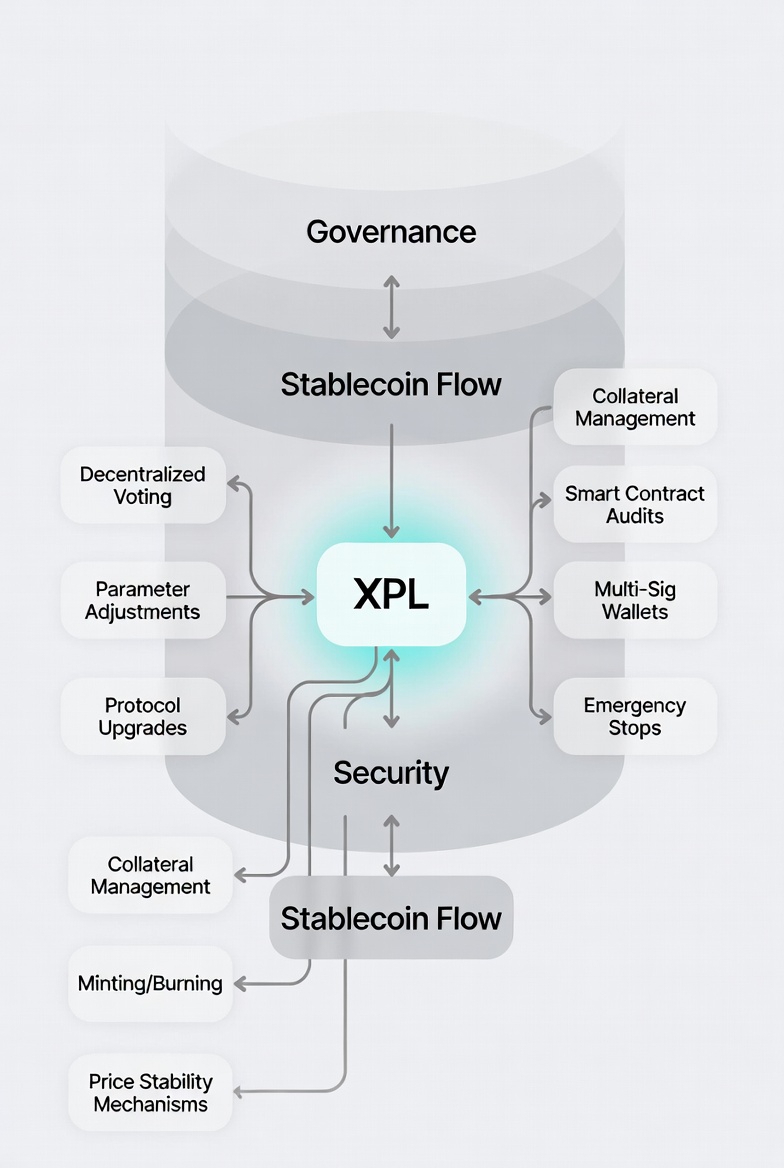

Where XPL Fits Into the Picture

XPL is not positioned as a speculative centerpiece.It functions as an alignment layer.

Its role connects:

• Governance decisions

• Network sustainability

• Incentive balance

• Long-term stability

Instead of extracting short-term value, XPL supports continuity — the exact quality stablecoin issuers and serious builders care about.

That is a subtle design choice, but a powerful one.

Flow-Based Growth Is Harder — and Stronger

Chasing users is easy.Capturing flow is difficult.

Flow-based growth requires:

• Trust before attention

• Discipline before scale

• Governance before marketing

But once flow is established, it rarely leaves without reason.

This is why traditional finance systems obsess over rails, not users.Plasma is borrowing that lesson early.

A Network Designed for the Quiet Majority

Most value in crypto does not come from traders.It comes from systems running quietly in the background.

Stablecoins moving.

Payments settling.

Balances reconciling.

Rules holding.

Plasma is building for that quiet majority.

It may never trend the loudest.But networks that last rarely do.

Key Perspective

Users create spikes.Flows create foundations.Foundations decide which networks survive.

Crypto is slowly growing out of its attention phase.

The next winners will not be the chains with the loudest communities, but the ones trusted to move value when nobody is watching.

Plasma understands this shift.

It isn’t chasing users.

It’s capturing stablecoin flow.

Do you think the next generation of blockchains will be built for visibility — or for settlement?