The Core Thesis

This is not a chase trade.

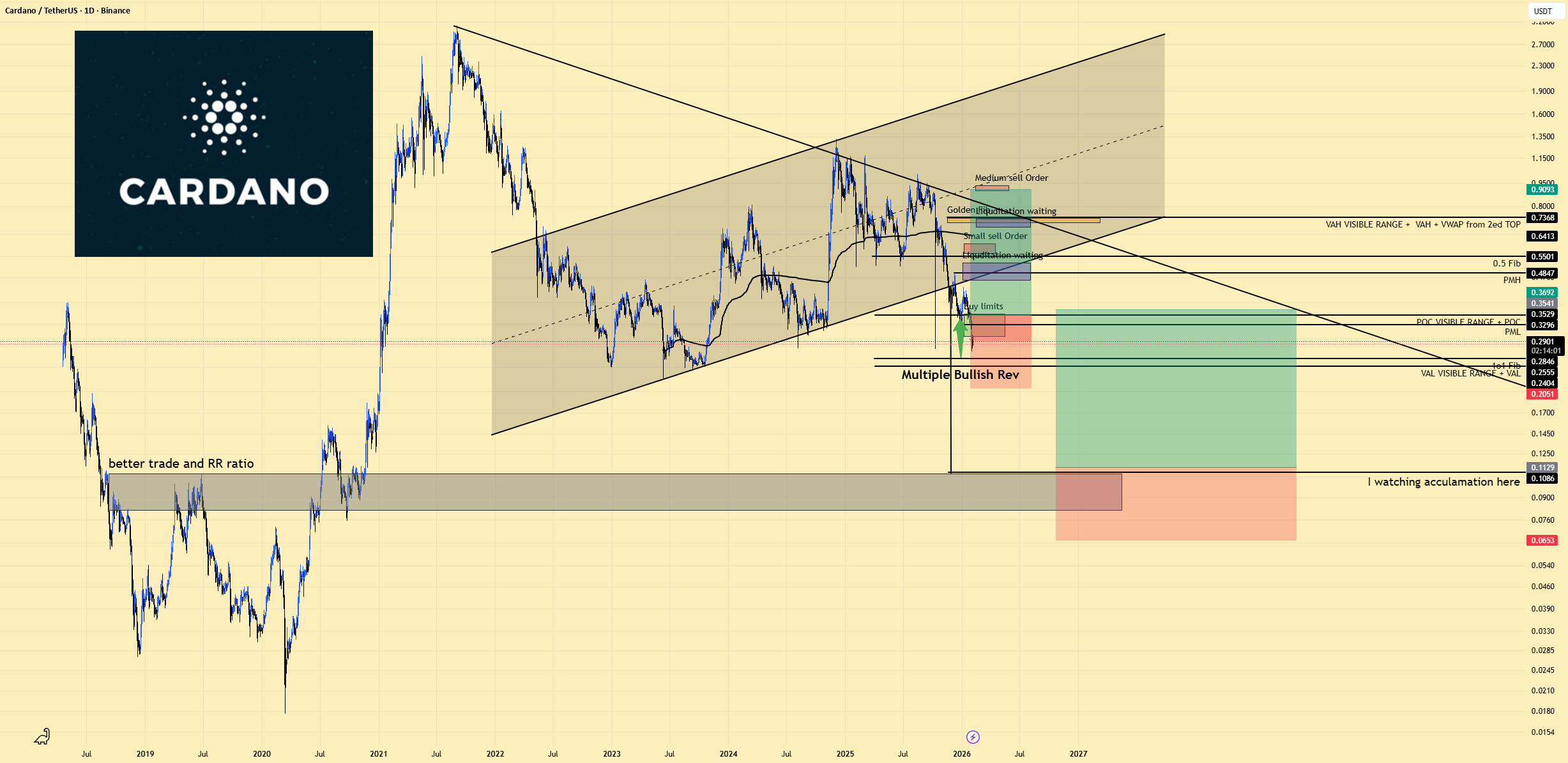

Cardano is sitting inside a larger rising channel, and price is currently compressing at a key decision point.

The market is showing multiple bullish reversal signals near demand.

If buyers defend this zone, ADA has room to rotate higher into overhead liquidity.

If not, the setup is invalidated quickly, and risk stays controlled.

That is the entire edge.

Entry Area, Buy Limits at Demand

My entry is focused around the buy limit zone marked on the chart.

This is where demand is showing up after the pullback.

Instead of buying strength, the idea is to participate where risk is defined and accumulation is taking place.

This is the level where buyers have the best positioning before any upside expansion.

Stop Loss, Clear Invalidation Below Structure

The stop is placed just below the reversal base and demand structure.

If price breaks down through this level, the bullish thesis no longer holds.

That is the purpose of the stop.

Not wide, not emotional, just clean invalidation.

Risk is always defined first.

Target, Rotation Into Sell-Side Liquidity Above

The upside target is mapped into the liquidity waiting overhead.

Above current price, we can see stacked small and medium sell orders, and the golden liquidation zone.

If demand holds, price naturally has room to rotate back into these sell-side pools.

Markets move from accumulation into liquidity, that is the path outlined here.

Bigger Picture, Accumulation at Key Support

On the macro level, ADA remains inside a long-term channel.

The lower support zone is still the major accumulation area.

This trade is simply a structured attempt to capture the next rotation higher, with clear risk and clear upside levels.

Disclaimer

This is not financial advice.

This is a technical trade idea shared for educational purposes only.

Always manage risk, use proper position sizing, and make your own decisions.