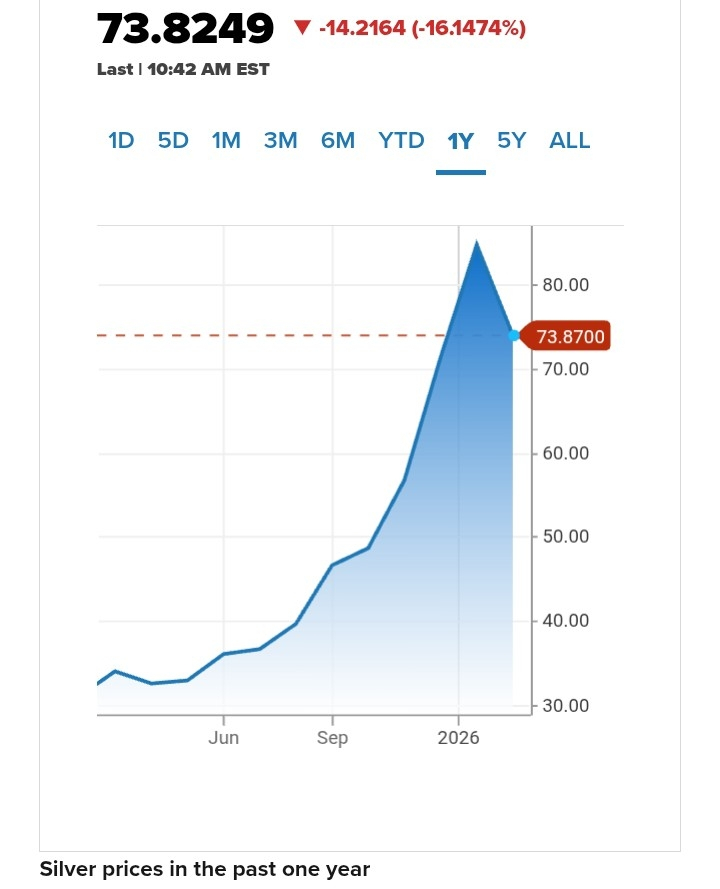

Silver just delivered one of its wildest moves in decades — and traders are still reeling 😵💫📊.

🔻 Silver prices plunged as much as 16%, wiping out a brief two-day rebound and extending a brutal sell-off.

At the lows:

• 🥈 Spot silver fell near $77/oz

• 📉 Futures slid toward $76/oz

• 🟡 Gold wasn’t spared either, down around 2%

🚀 From Boom to Bust — Fast

Before this crash, silver was on a record-breaking run 📈🔥:

• Up nearly 146% in 2025

• Then — 💣 collapsed almost 30% in a matter of days

This kind of volatility is rare… and dangerous ⚠️.

🧠 What’s Really Driving the Chaos?

Analysts point fingers not at physical demand ❌🏭, but at:

• 🧾 Heavy speculative flows

• ⚡ Leveraged positioning

• 🎯 Options-driven trading

💬 Market experts say speculative positions haven’t been fully flushed out yet, meaning more turbulence could be ahead 🌪️.

🧯 Margin Hikes Added Fuel to the Fire

🏦 Major exchanges, including CME, raised margin requirements after last week’s collapse.

That move:

• Forced liquidations 🔥

• Triggered stop-losses 🧨

• Turned dealer hedging from buying strength ➡️ selling weakness

📉 Losses cascaded quickly through the system.

🧩 Why Silver Fell Harder Than Gold

Goldman Sachs notes:

• 📉 Tighter liquidity in London magnified silver’s swings

• 🌍 Most violent moves happened while China markets were closed

• 👉 Suggesting Western speculative flows drove the boom and bust

🧠 “Is Silver the New Meme Trade?”

The comparison is getting louder 🔊:

🥈 Silver is now being likened to GameStop-style meme trades 📱🚀

Momentum and hype pushed prices far beyond sustainable levels, before reality snapped back hard 🪓📉.

⏳ What Happens Next?

While silver still has strong industrial uses (solar ☀️, electronics 🔌, catalysts 🧪), experts warn:

⚠️ The market may need more speculative leverage to be wiped out before stability returns.

📌 Until then, expect extreme volatility, sharp swings, and nervous positioning.

👀 Silver is no longer just a metal — it’s a battlefield. Trade carefully.

#Silver #SilverDip #WarshFedPolicyOutlook #WhenWillBTCRebound