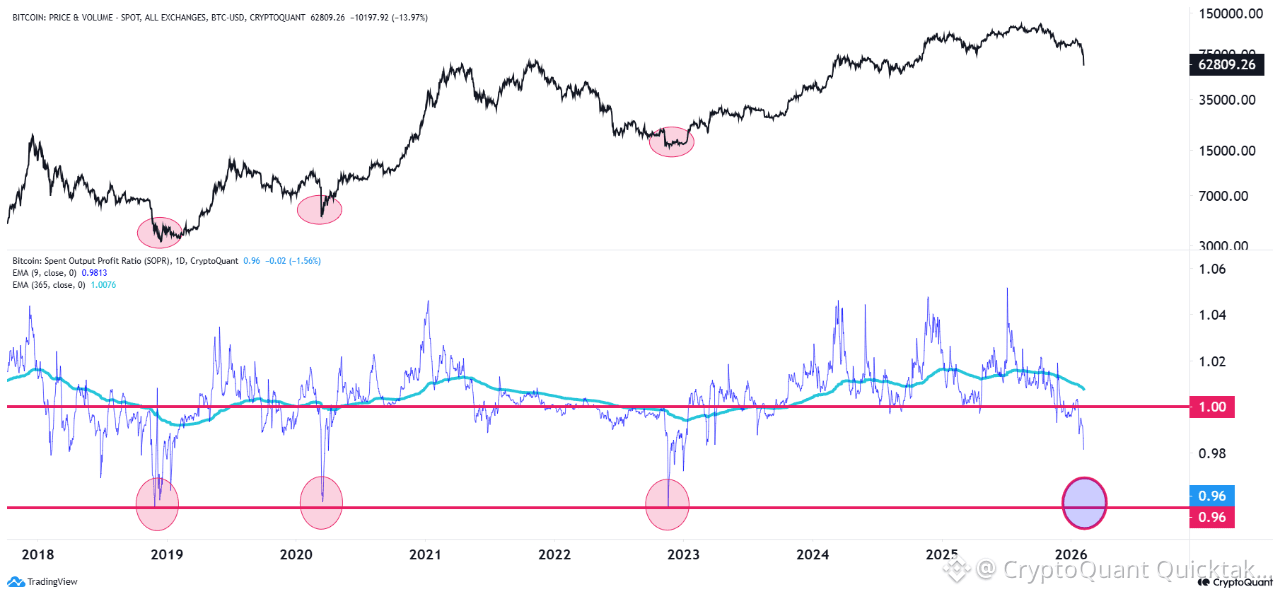

Bitcoin SOPR has once again broken below 1.0, signaling that coins are being spent at a loss.

Historically, this level has marked regime shifts, not short-term pullbacks.

What stands out is the context.

In previous cycles (2018, 2020, 2022), sustained SOPR weakness below 1 did not mark the bottom.

Instead, it appeared early in the bear market, followed by extended periods of distribution, failed rebounds, and deeper capitulation phases.

At this stage:

SOPR is below 1, but has not reached extreme stress levels

Loss realization is rising, yet panic behavior remains limited

Price is weakening, but capitulation-like dynamics are still absent

This suggests the market is transitioning into a bear phase, not completing it.

Historically, true bottoms formed only after:

Prolonged SOPR suppression

Multiple failed recoveries above 1

Broad and persistent loss realization across holders

Bottom line:

SOPR confirms bear market entry, but the bottom is likely still some distance away.

This looks more like the beginning of a longer adjustment phase than a final flush.

Written by 우민규 Woominkyu