Most blockchain discussions around privacy still miss the point. Privacy is often framed as an optional enhancement — something you add when users demand it or regulators complain. Dusk takes a very different position. In Dusk’s design, privacy is not a layer, not a toggle, and not a marketing hook. It is infrastructure.

That distinction matters, especially as blockchain moves closer to regulated financial activity.

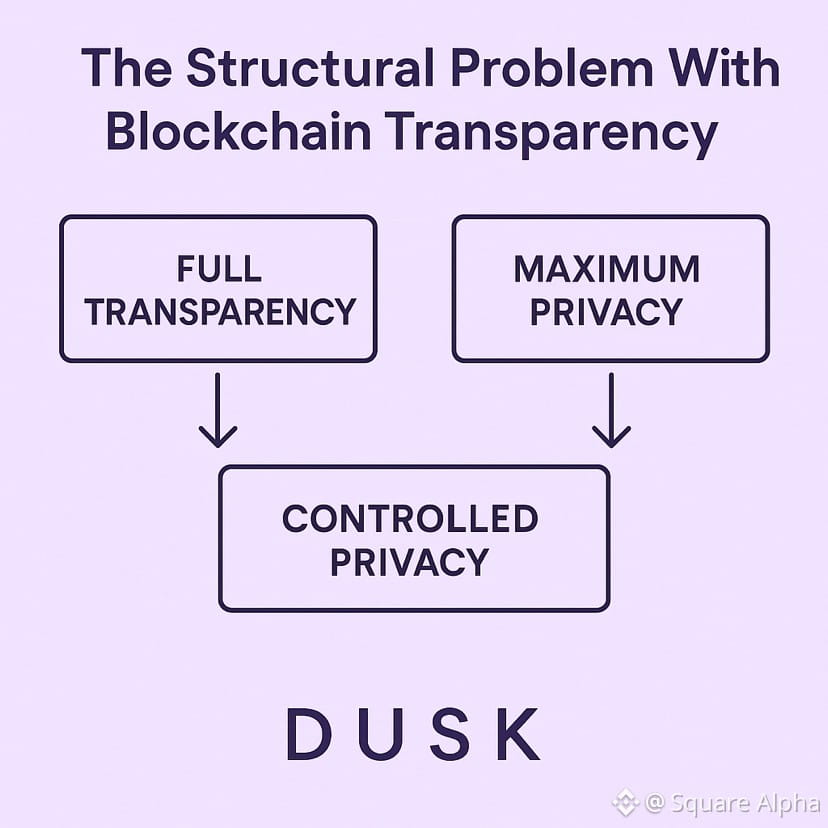

The Structural Problem With Blockchain Transparency

Public blockchains were never designed for capital markets. Full transparency works well for open experimentation, but it fails in environments where financial positions, settlement flows, and counterparties must remain confidential.

Institutions do not want “maximum privacy.” They want controlled privacy — the ability to restrict visibility without losing accountability. This is where most networks fail. They either expose everything or hide everything. Neither option works under regulation.

Dusk positions itself precisely in that gap.

Dusk’s Privacy Model Is Built for Verification, Not Obscurity

The core idea behind Dusk’s privacy architecture is simple but powerful: verification does not require disclosure.

Transactions on Dusk can be validated through cryptographic proofs without revealing sensitive data to the entire network. Validators confirm correctness, not content. This approach allows privacy to coexist with auditability, which is a non-negotiable requirement in regulated finance.

Instead of asking regulators to “trust the math” blindly, Dusk enables selective disclosure under defined conditions. That is a fundamentally different privacy philosophy from anonymity-driven chains.

Why This Matters for Real Financial Use Cases

The relevance of this design becomes clearer when considering real-world assets and regulated trading. Securities issuance, settlement, and secondary trading all require confidentiality — but also enforceability.

DuskTrade is a practical example of why privacy must be infrastructural. A regulated trading platform cannot function on a fully transparent ledger, nor can it rely on opaque systems that regulators cannot inspect. Dusk’s architecture supports private trading activity while maintaining legal verifiability.

This is not theoretical privacy. It is operational privacy.

Execution Familiarity Through DuskEVM

Privacy alone does not attract builders. Execution matters. This is where DuskEVM plays a strategic role.

By supporting Solidity-based smart contracts, Dusk lowers the cognitive and technical barrier for developers and institutions. Teams can deploy familiar contract logic while relying on Dusk’s Layer 1 for privacy-aware settlement.

This separation of execution and settlement is important. Developers build as usual. The network enforces privacy and compliance underneath. That reduces risk, shortens development cycles, and increases the likelihood of production deployment.

The Role of DUSK in a Privacy-Centric Network

In networks focused on speculation, tokens exist to attract attention. In Dusk, $DUSK exists to support activity.

$DUSK is used for transaction execution, staking, and securing the network that enforces privacy guarantees. As regulated applications grow, token demand is linked to actual usage — not narrative cycles.

This creates a slower feedback loop, but also a more durable one. Infrastructure tokens rarely move first. They move when systems begin operating at scale.

Why Dusk’s Approach Is Easy to Miss

Dusk does not optimize for visibility. It optimizes for correctness.

There are no flashy demos, no aggressive narratives, and no retail-first positioning. That makes Dusk easy to overlook in hype-driven markets. But infrastructure is rarely exciting at first glance. It becomes valuable when others fail to scale into regulated environments.

Privacy as infrastructure is boring — until it becomes essential.

Closing Thought

Dusk is not building a privacy chain for crypto users.

It is building a privacy system for financial markets.

By treating privacy as a protocol-level guarantee rather than a feature, Dusk aligns itself with how regulated finance actually operates. That choice narrows its audience today, but expands its relevance tomorrow.

In markets where regulation is unavoidable, privacy done correctly becomes an advantage — not a liability.