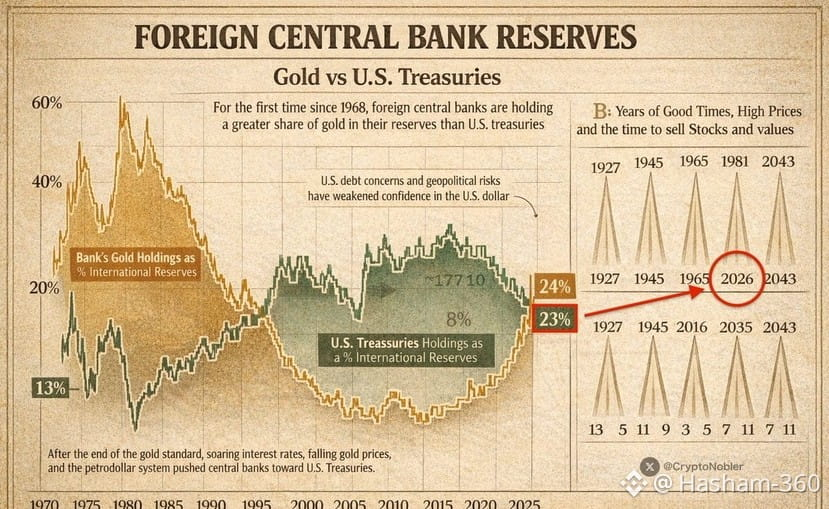

This hasn’t happened since 1968.

For the first time in more than 60 years, central banks now hold more gold than U.S. Treasuries.

Let that sink in.

They didn’t do this by accident.

They bought the dip — and they did it with purpose.

If you hold any assets right now, you need to pay attention.

This isn’t about politics.

This isn’t about diversification.

Central banks are quietly doing the opposite of what the public is encouraged to do:

• Reducing exposure to U.S. debt

• Accumulating physical gold

• Preparing for stress, not growth

U.S. Treasuries are the backbone of the global financial system.

They’re used as collateral.

They anchor liquidity.

They support leverage across banks, funds, and governments.

When confidence in Treasuries weakens, everything built on top of them becomes fragile.

That’s how real market collapses begin.

Not with panic.

Not with headlines.

But with silent shifts inside balance sheets.

History makes this clear:

1971–1974

→ Gold standard breaks

→ Inflation explodes

→ Stocks go nowhere for years

2008–2009

→ Credit markets freeze

→ Forced liquidations cascade

→ Gold preserves purchasing power

2020

→ Liquidity disappears overnight

→ Trillions are printed

→ Asset bubbles inflate everywhere

Now we’re entering the next phase.

The difference this time?

Central banks are moving first.

What we’re seeing now are early stress signals:

→ Rising debt concerns

→ Geopolitical tension

→ Tightening liquidity

→ Growing reliance on hard assets

When bonds finally crack, the pattern is always the same:

→ Credit tightens

→ Margin calls spread

→ Funds sell what they can, not what they want

→ Stocks and real estate follow lower

The Federal Reserve has no painless option:

Option 1 — Cut rates & print

→ Dollar weakens

→ Gold reprices higher

→ Confidence erodes

Option 2 — Stay tight

→ Dollar defended

→ Credit breaks

→ Markets reprice violently

Either path leads to damage.

There is no clean escape.

Central banks aren’t speculating.

They’re protecting themselves from systemic risk.

By the time the public realizes what’s happening, positioning will already be done.

Most will react.

A few will be prepared.

The shift has already begun.

Ignore it if you want.

Just don’t say you weren’t warned.

I’ve been calling major market tops and bottoms for over a decade — and I’ll do it again in 2026.

Follow and turn on notifications before it’s too late.