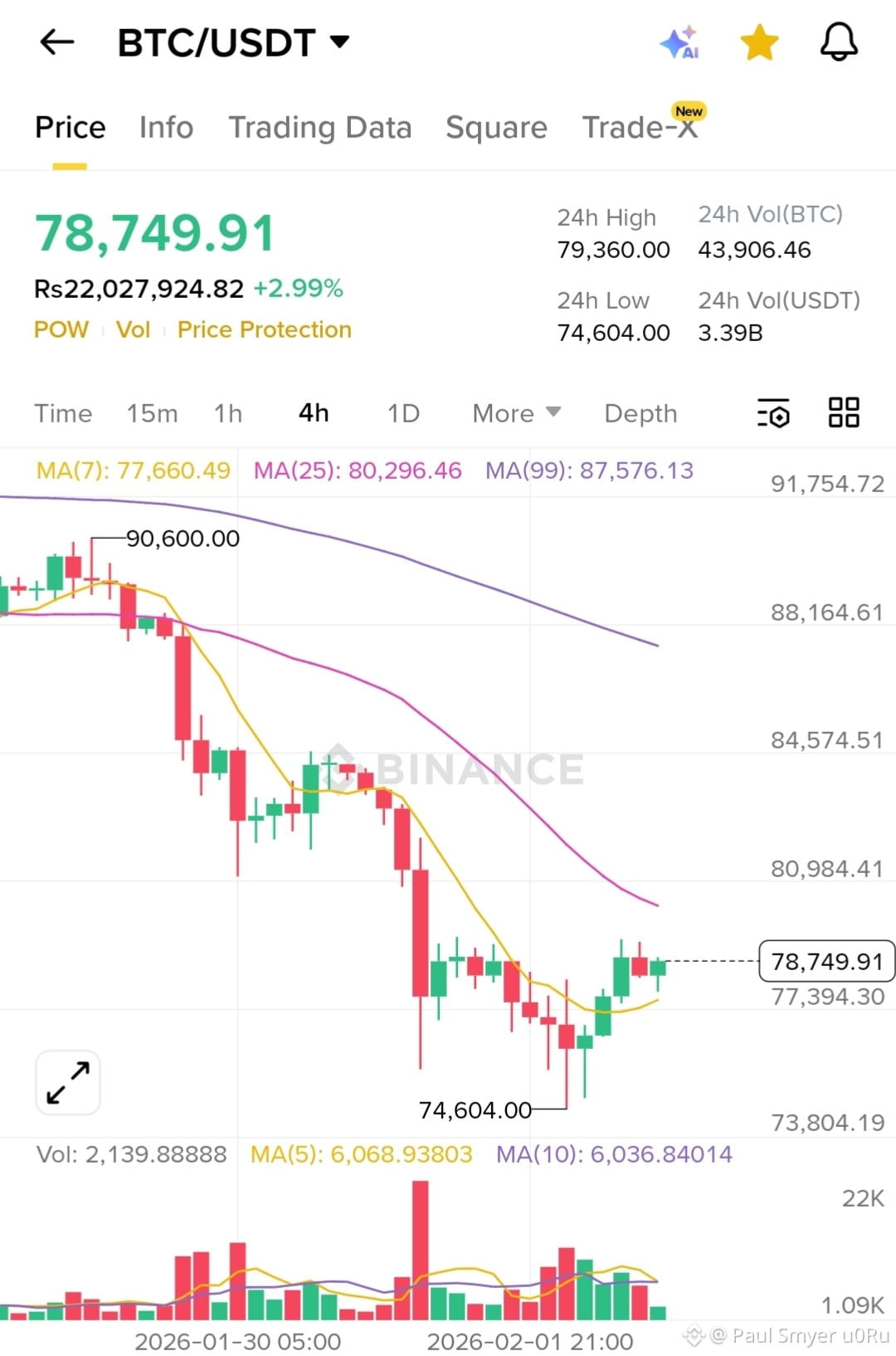

🚀Bitcoin ($BTC ) is showing upward momentum mainly due to a combination of technical recovery, market sentiment improvement, and macro-level demand. Recently, $BTC BTC bounced from the strong support zone near $74,600, which acted as a demand area where buyers entered aggressively. The 4H chart shows price moving above short-term moving averages like MA(7), suggesting early bullish strength after a corrective downtrend.

🚀Another major factor behind the price increase is market psychology. After a strong sell-off, traders often look for discounted entry points, creating buying pressure. Increased trading volume near the recent bottom also indicates accumulation by larger players or institutions, which usually supports price recovery.

From a technical perspective, BTC is currently attempting to stabilize below the MA(25) level, which is acting as short-term resistance. If BTC breaks and holds above this resistance zone near $80,000, it could trigger further bullish momentum and attract more buyers. However, the MA(99) still indicates a broader trend resistance, meaning the market is in a recovery phase rather than a confirmed long-term uptrend.

Fundamentally, Bitcoin demand continues to grow due to institutional interest, ETF inflows, and its status as a hedge asset during economic uncertainty. Reduced selling pressure from long-term holders also supports price stability and upward movement.

Traders should still watch key support around $77,000–$74,600 and resistance near $80,000–$84,000. A breakout or rejection from these zones will likely determine BTC’s next major direction.🚀

#StrategyBTCPurchase #AISocialNetworkMoltbook #USCryptoMarketStructureBill #MarketCorrection