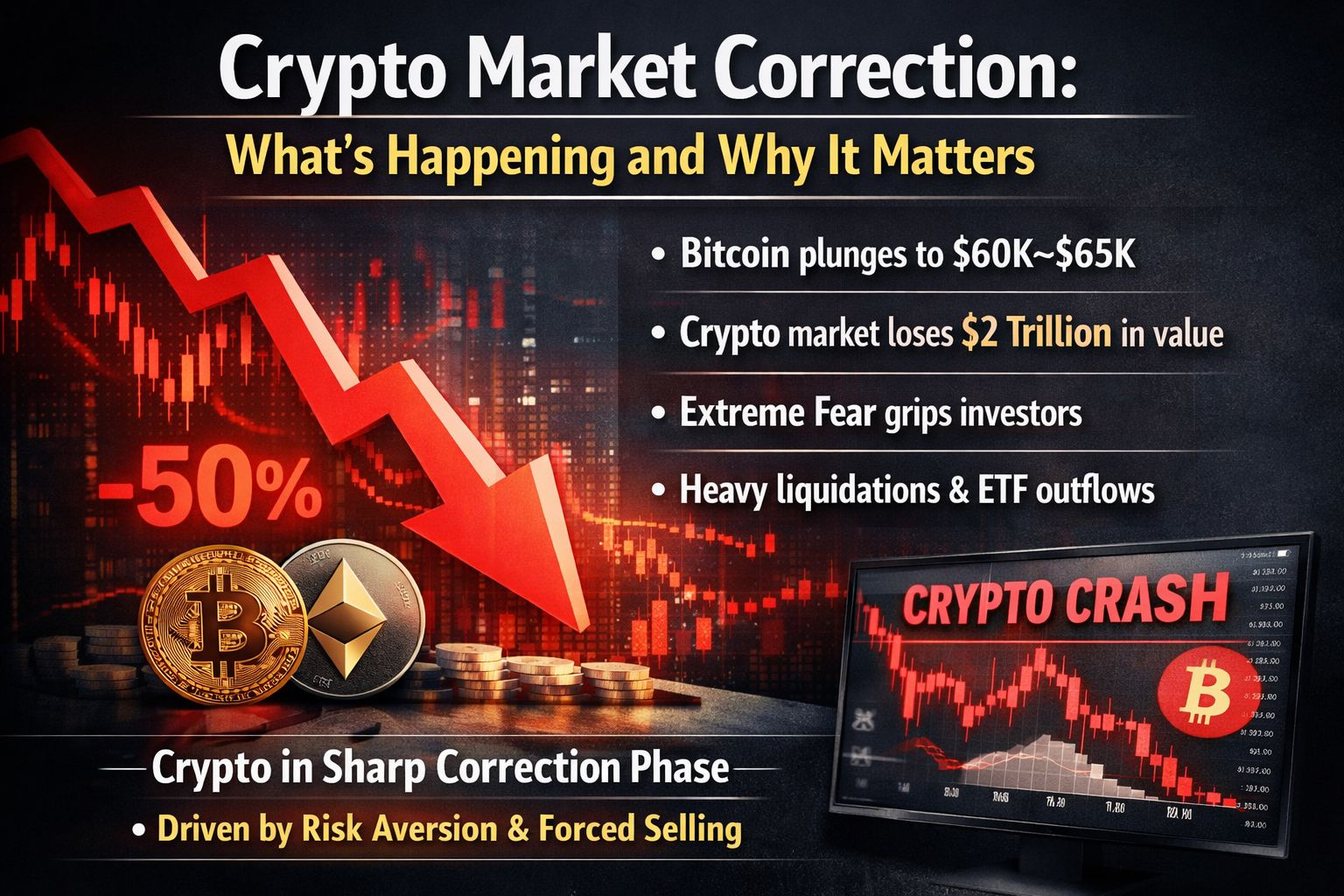

The cryptocurrency market is currentl#MarketCorrection sharp correction, with Bitcoin, Ethereum, and most altcoins facing heavy selling pressure. Over the past few weeks, the total crypto market has lost nearly $2 trillion in value, signaling one of the deepest pullbacks since 2024 .

Bitcoin has dropped from its late-2025 peak near $126,000 to the $60,000–65,000 range, marking its biggest decline in over a year. Ethereum and major altcoins have also fallen by double-digit percentages, reflecting broad risk-off sentiment across markets .

This correction is being driven by several factors:

Global risk aversion, as investors move away from high-risk assets

Heavy liquidations in leveraged crypto positions

Institutional and ETF outflows, adding extra selling pressure

Spillover from weak stock and tech markets

Market sentiment has entered “extreme fear,” which often appears during late stages of corrections. While analysts see potential short-term bounces, volatility remains high and a full recovery may take time .

In summary, the crypto market is in a strong correction phase, driven by macro uncertainty and forced selling. Investors are now watching for stabilization before any sustained recovery begins.$BTC

#RiskAssetsMarketShock #MarketCorrection #WhenWillBTCRebound #WarshFedPolicyOutlook #Binance