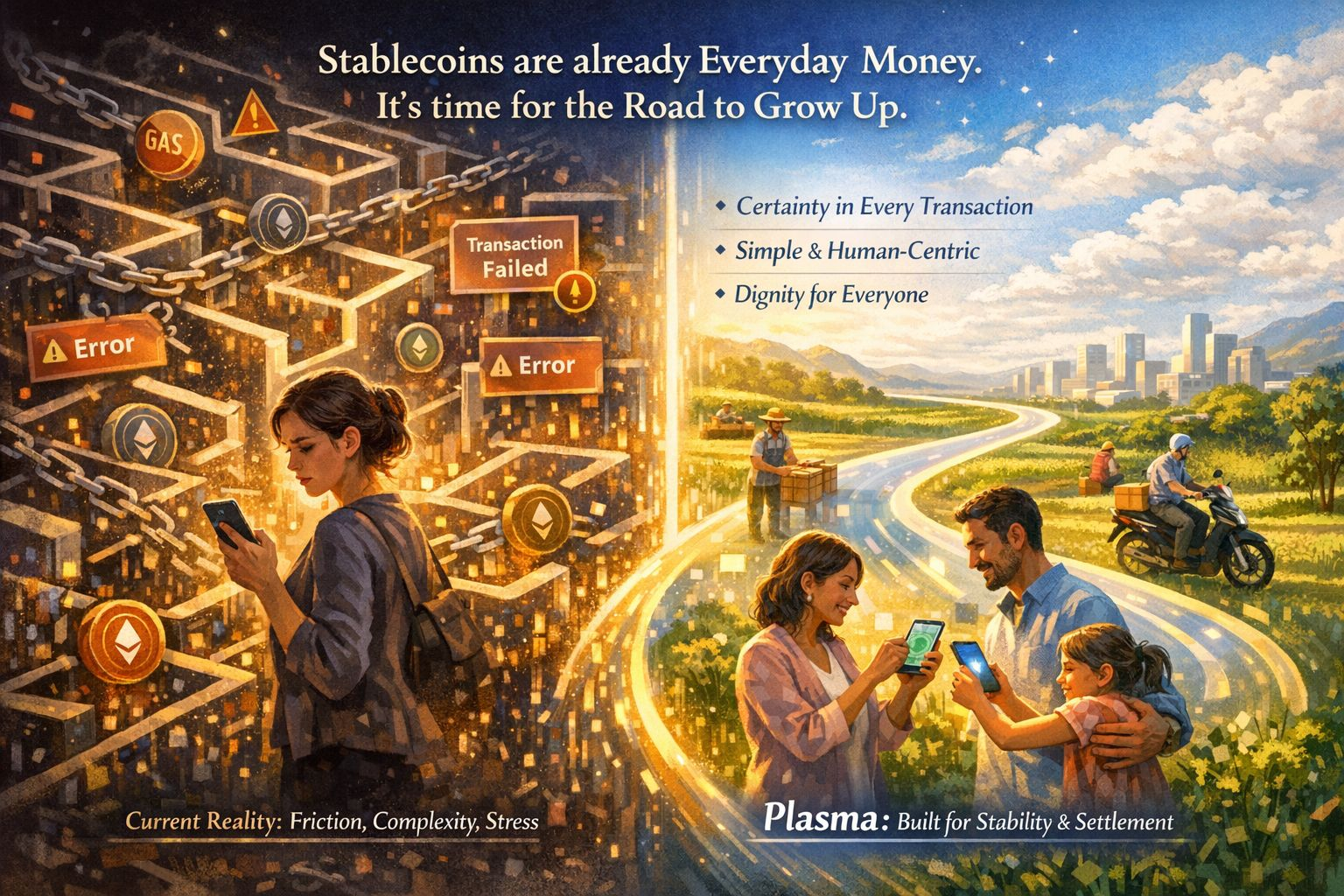

I’m thinking about how strange it is that stablecoins already behave like real money for millions of people, yet the experience around them still feels fragile, complicated, and emotionally tiring, like we built a digital dollar but forgot to design the road it travels on. A person can hold value that is more stable than their local currency, trust it more than certain banks, and still the simple act of sending it forces them into a maze of gas tokens, confirmations, and invisible rules that punish mistakes. They’re trying to do something human and basic, which is move money, support family, pay for work, protect savings, and the system answers with friction. Plasma begins from that quiet frustration that people rarely say out loud but feel every time a transaction fails or stalls. It is not chasing spectacle first. It is reacting to a reality where stablecoins already function as everyday money in many parts of the world, and when money becomes real in practice, the infrastructure around it has to grow up emotionally as well as technically. We’re seeing adoption driven by necessity, not by slogans, and Plasma is essentially saying that necessity deserves a chain designed around settlement, certainty, and dignity instead of treating payments like a side feature.

They’re not trying to position Plasma as a playground chain or a temporary hype cycle. They’re aiming at something quieter and more serious, a settlement layer that treats stablecoins as the center of gravity rather than an afterthought. The philosophy is simple but heavy: if stablecoins are already acting like digital cash, then the base network should be built around their movement in the same way roads are built around traffic, not around theoretical possibilities. Plasma keeps deep compatibility with the Ethereum world so builders are not asked to abandon years of habits, tools, and security assumptions, and that choice carries emotional weight because developers already live with enough uncertainty. By preserving a familiar execution environment, the chain reduces fear and hesitation. At the same time, the consensus layer is designed for fast deterministic finality, and that word deterministic is not marketing decoration, it is psychological reassurance. When someone sends money, they are not benchmarking performance charts, they are asking a silent question about safety and finality. Plasma’s design tries to answer that question with a bounded window where confirmation becomes emotionally reliable, not just technically impressive. If It becomes normal for salaries, remittances, and business payments to move through stablecoins, Plasma wants to feel less like an experiment and more like invisible infrastructure that simply works.

The famous idea of gasless stablecoin transfers is less about clever engineering and more about respect for the user’s mental load. Forcing a person to acquire a volatile asset just to move a stable one is a design decision that quietly punishes newcomers and excludes people who do not want to speculate. Plasma is absorbing that pain into the protocol through sponsored transaction mechanisms so the most common action, sending stablecoins, feels natural instead of ritualistic. Resources are not magically free, and the system still has to defend itself against abuse, but the important shift is philosophical. We’re seeing infrastructure take responsibility for complexity instead of pushing it onto the user. Every removed step restores confidence. Every restored confidence increases the chance that someone will use the system again without fear. Stablecoin-first gas pushes this idea even further by aligning the unit people hold with the unit they spend for fees, which quietly reshapes the mental model of the network. When the currency of interaction matches the currency of value, the system stops feeling foreign and starts feeling like an extension of a wallet rather than a machine you must negotiate with.

The decision to connect long-term security assumptions to Bitcoin introduces another emotional layer, because payments infrastructure eventually becomes political and historical, not just technical. Bitcoin carries a reputation for resilience and neutrality earned over years of stress. By anchoring to that gravity, Plasma is trying to inherit a form of long memory, a resistance to casual rewriting of history. Fast local finality answers the question of immediate trust, while anchoring answers the question of enduring trust. They’re acknowledging that a payments chain cannot survive on speed alone. It must survive scrutiny, pressure, and time. This is not about spectacle. It is about designing a system that expects to be judged over decades, not over market cycles. The architecture is essentially an attempt to balance familiarity, performance, and long-term defensibility so that the chain can carry real economic weight without collapsing under its own ambition.

When I think about Plasma’s health as infrastructure, the loud metrics suddenly feel less important than the quiet ones. The real signal is consistency. Finality must remain predictable even during congestion. Sponsored transfers must succeed without opening the door to uncontrollable spam. Validators must stay diverse and operational because a settlement layer cannot afford theatrical outages. Liquidity depth in stablecoins becomes existential, since the usefulness of a payments chain is tied directly to the value flowing through it. We’re seeing a transition where success is measured less by peak throughput and more by operational discipline. A true settlement network is judged by how calmly it behaves during chaos. Plasma is positioning itself inside that discipline-first mindset, where reliability becomes the primary product.

The problems Plasma is trying to solve are not flashy, but they are deeply human. Complexity taxes attention. Uncertainty taxes trust. Fragmented tooling taxes adoption. Gasless transfers reduce the fear of making the first move. Deterministic finality reduces counterparty anxiety. Compatibility reduces developer hesitation. Anchoring strengthens the narrative of long-term safety. Each improvement removes a small invisible barrier that has historically slowed real-world usage. Stablecoins already power remittances, cross-border trade, and informal economies that depend on speed and certainty. Plasma is not inventing that behavior. It is attempting to build rails worthy of behavior that already exists.

At the same time, the design carries risks that cannot be ignored if the project wants to mature. Subsidized user flows introduce governance surfaces that must be handled transparently or they risk becoming points of control. Dependence on major stablecoins ties the chain to issuer policy and regulatory climates that may shift suddenly. Validator coordination remains a delicate balance in any Byzantine fault tolerant system. Anchoring adds strength but demands honest verification and data availability. There is also a strategic tension between specialization and expansion, because focusing too narrowly could limit ecosystem creativity, while expanding too broadly could dilute the payments-first identity that gives Plasma meaning. These are not flaws unique to Plasma. They are the real tradeoffs of building infrastructure that intends to carry serious value.

In the practical world, access and liquidity bridges like Binance matter because infrastructure without gateways remains theoretical. People need simple paths in and out. But Plasma’s long-term identity cannot be trading volume. Its identity must be quiet settlement, the background layer where value clears reliably. Exchanges are entry points. Settlement layers are foundations. Confusing the two would shrink the ambition of the project.

I’m imagining a future where stablecoins stop being described as crypto assets and start being understood as a basic layer of digital cash. In that future, the chains underneath fade into invisibility. Users care about experience, not architecture diagrams. They care that money moves quickly, fees make sense, and history cannot be casually rewritten. Plasma is pointing toward that invisible future by designing for psychological safety as much as technical performance. If they succeed, the victory will look boring from the outside, and boring is exactly what financial infrastructure is supposed to be.

At the center of all this technology are people trying to protect value, send help to family, run small businesses, and survive inside systems that often feel indifferent to their needs. Stablecoins grew because they answered a real human demand for reliable digital money. Plasma is an attempt to build rails that respect that demand instead of exploiting it. I’m hopeful not because any single chain is destined to dominate, but because design choices reveal priorities. When a network chooses simplicity, predictability, and user dignity as guiding principles, it pushes the entire ecosystem toward maturity. If Plasma continues walking that path with patience and discipline, it can help shape a world where digital payments feel less like a gamble and more like a quiet promise that value can travel safely wherever people need it to go.

At the center of all this technology are people trying to protect value, send help to family, run small businesses, and survive inside systems that often feel indifferent to their needs. Stablecoins grew because they answered a real human demand for reliable digital money. Plasma is an attempt to build rails that respect that demand instead of exploiting it. I’m hopeful not because any single chain is destined to dominate, but because design choices reveal priorities. When a network chooses simplicity, predictability, and user dignity as guiding principles, it pushes the entire ecosystem toward maturity. If Plasma continues walking that path with patience and discipline, it can help shape a world where digital payments feel less like a gamble and more like a quiet promise that value can travel safely wherever people need it to go.