As we move deeper into 2026, I’m seeing a clear shift in the market—from pure hype to real utility. From what I’ve observed, most Layer 1s still struggle with fragmented data and slow AI inference. @vanar, though, is taking a very different path by tackling these problems head-on.

What really draws me in is Vanar’s AI-native architecture. With tools like Kayon for on-chain reasoning and Neutron as a semantic memory layer, this isn’t just about executing smart contracts—it’s about building a chain that can reason. That’s essential for a future where autonomous agents manage assets, optimize strategies, and execute trades with minimal human friction.

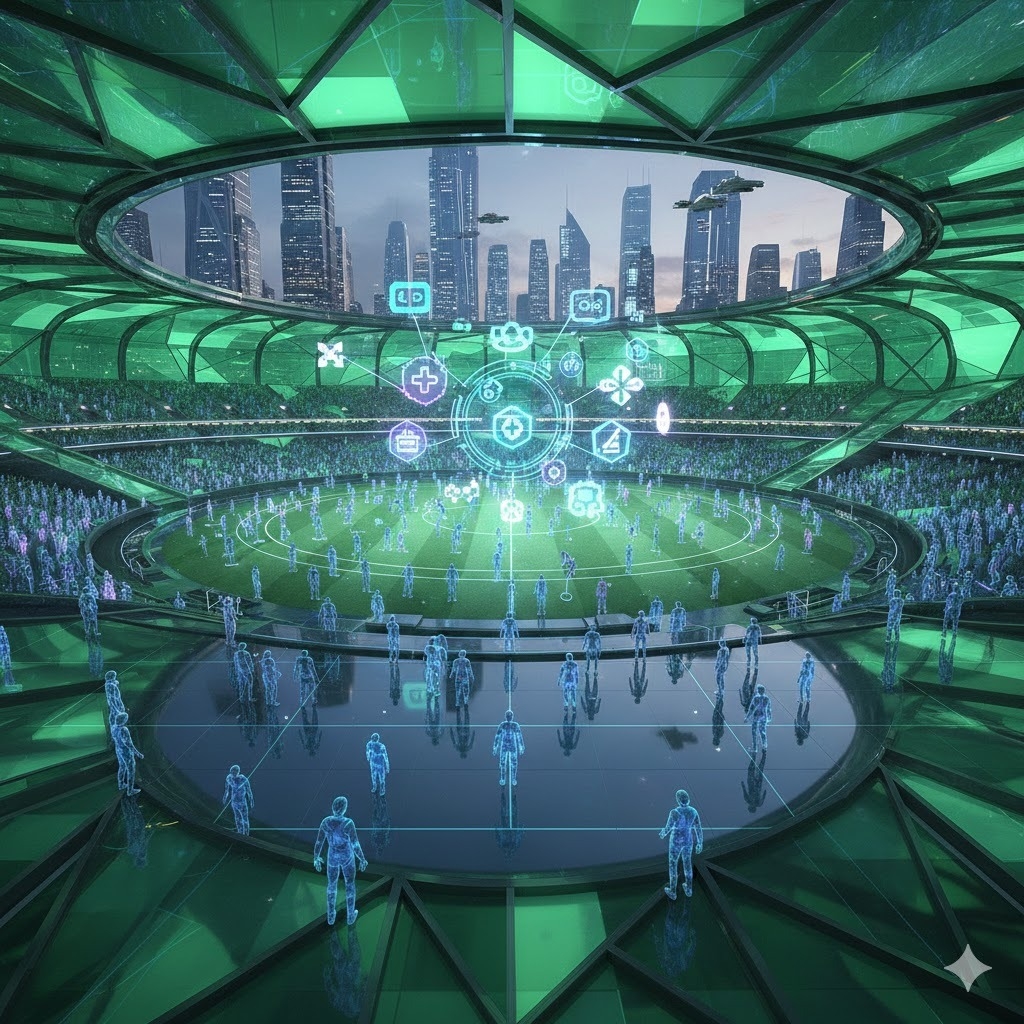

I also appreciate their strong real-world focus. Between gaming collaborations with NVIDIA and metaverse experiences with brands like Shelby American, #VANAR is clearly designed to handle mainstream-scale traffic. The fact that the network runs on green power via Google Cloud is a big plus for me—it’s sustainability done right.

On a personal note, I’m especially excited about seeing AI-driven NPCs and adaptive worlds evolve on Vanar’s gaming stack. The idea that in-game characters can learn, remember, and respond dynamically over time is exactly the kind of crossover between AI and gaming I’ve been waiting for.

With major events like AIBC Eurasia and Consensus Hong Kong just around the corner, I’m keeping a close eye on the $VANRY ecosystem. The upcoming Governance 2.0 proposal—giving holders influence over AI model parameters—feels like a genuine step toward meaningful decentralization.

The bottom line:

We’re watching the emergence of a true Intelligence Layer. I’m holding $VANRY for the long term as these AI-native features move from roadmap to reality.