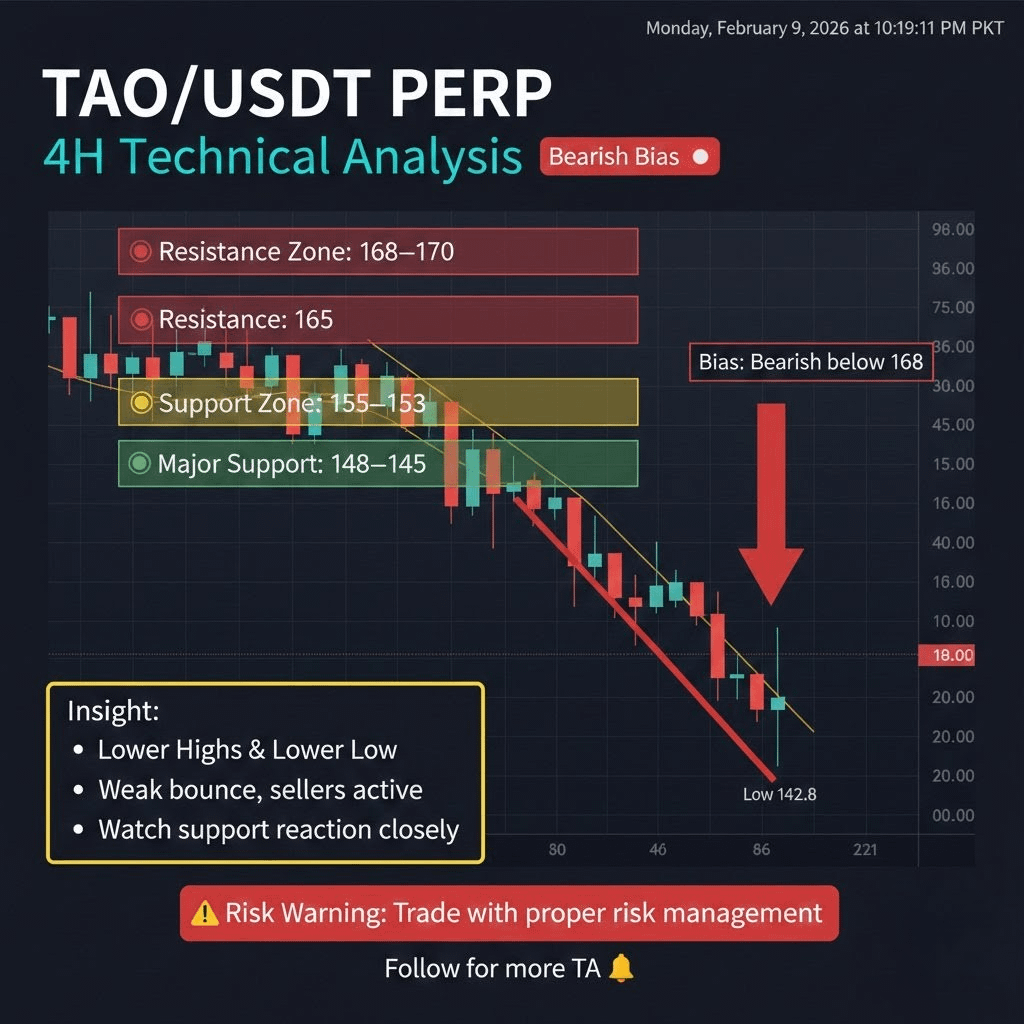

$TAO remains under strong bearish pressure on the 4H timeframe, trading around 158 after a sharp rejection from the 167–170 supply zone. Price structure continues to print lower highs and lower lows, confirming trend weakness. The recent bounce from 142.8 was corrective, not impulsive — indicating sellers are still dominant.

Key Support: $TAO

• 155–153 (short-term demand)

• 148–145 (major support & breakdown zone)

A clean breakdown below 153 could accelerate selling toward 148–145, where buyers may attempt another defense.

Key Resistance:

• 165–168 (strong supply & trend resistance)

• 175+ (trend reversal only above this)

Momentum indicators favor bears, and volume remains weak on green candles — a classic sign of distribution.

📌 Trade Insight:

Bias stays bearish below 168. Aggressive traders may look for short setups on pullbacks, while conservative traders should wait for confirmation near major support.

⚠️ Volatility expected — manage risk accordingly.

📌 Not financial advice. Trade with proper risk management.

Disclaimer: I am not your financial advisor.

#BinanceSquare #TechnicalAnalysis #altcoins