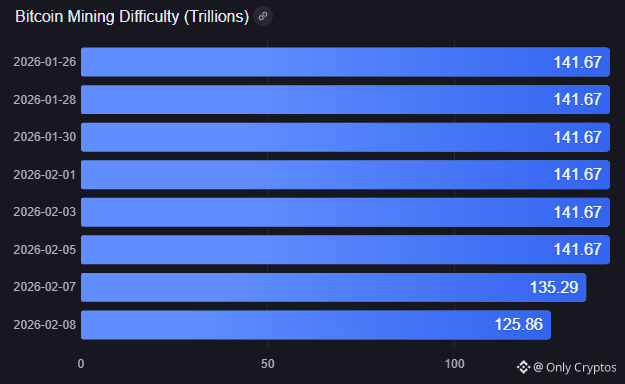

difficulty dropped sharply by 11.16%, falling to 125.86 trillion. This marks the largest negative adjustment since the 2021 China mining ban.

Here’s why this happened:

🌨 Severe Winter Storms

Winter Storm Fern in the U.S. forced major mining operations in Texas and other regions to cut power, leading to a significant drop in network hashrate.

📉 Bitcoin Price Pressure

BTC fell from $126,000 in October to around $69,500, squeezing miner margins and causing many less-efficient miners to exit the market.

💰 Mining Profitability Hits Record Lows

The “hashprice” — a measure of daily mining revenue — dropped to $33–$35 per PH/s, below the $40 breakeven point for many miners.

🤖 Operational Shifts

Some major mining firms, like Bitfarms, are now repurposing hardware for AI workloads to maintain steady revenue streams.

⚖ Self-Correcting Market

While the drop reflects stress in the market, it reduces competition for remaining miners and may improve their profitability, signaling a potential local market bottom.

📅 Next Difficulty Adjustment

The network is expected to increase difficulty by 12–15% around February 20, 2026 as block times begin to speed up again.

💡 Takeaway

Stay informed, trade smartly, and support the crypto community by sharing and engaging with educational content like this.

BTC Price Update:

BTC: $67,630.33 (-3.15%)

BTCUSDT Perp: $67,601.5 (-3.08%)$BTC

#BTCMiningDifficultyRecord #bitcoin #BTC☀ #CryptoNewss s #MiningUpdates