@Vanarchain is one of those projects that keeps popping up in sharp traders' radars lately - and for good reason.

Many still slap on the old "ex-gaming chain" label from its Terra Virtua days 🕹️. But zoom out, dig into the product stack, on-chain activity, and 2026 roadmap, and a clearer picture emerges:

Vanar is transforming into the AI-native infrastructure layer for Web3.

Not just another L1 chasing TPS numbers. This is a chain designed to make blockchain think, remember, and act intelligently.

This isn't vaporware hype. It's a rational look at why $VANRY is starting to draw real eyes in a sea of AI narratives.

Current Snapshot (as of Feb 2026)

• Price: ≈ $0.0063 💰

• 24h Volume: ≈ $1.8M 🔄

• Market Cap: ≈ $14M 🧮

• Holders: Growing steadily (post-rebrand momentum)

Low cap. High conviction tech. Classic setup for the next leg up.

Here are 10 reasons why Vanar is gaining traction — backed by product, not promises.

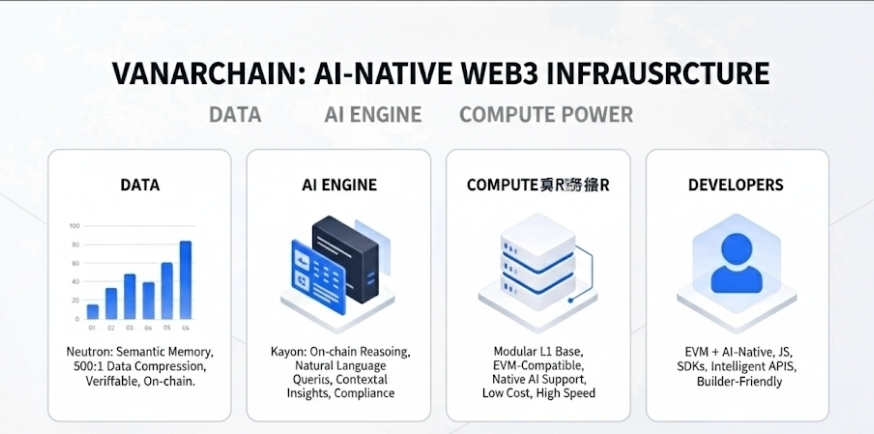

1. Built AI-Native from Day One 🏗️

Most chains retrofit AI like a bad plugin. Vanar was designed for it.

EVM-compatible L1 with native support for inference, training, and semantic ops. No oracles. No middleware. Everything on-chain.

This is the foundation for apps that actually learn and adapt - not just execute.

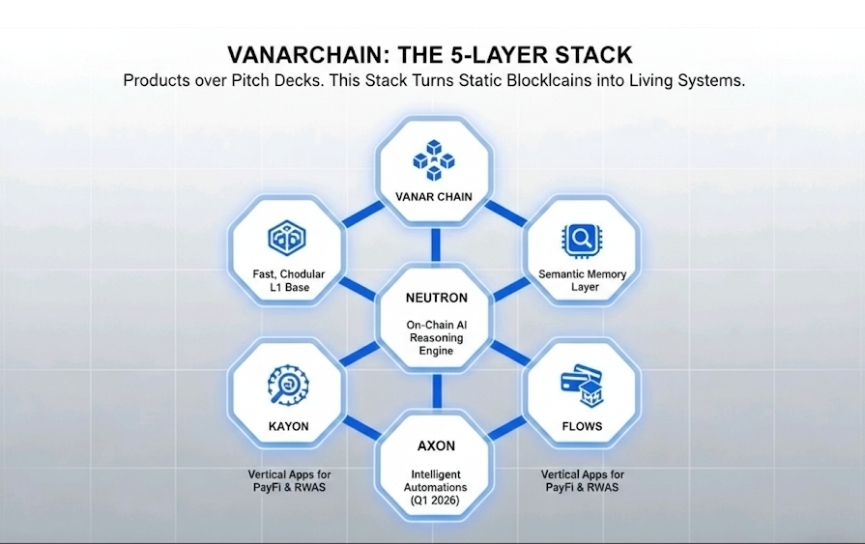

2. The 5-Layer Stack That Actually Delivers 🧩

Vanar isn't selling a whitepaper vision. It's shipping a full AI infrastructure:

• Vanar Chain: Fast, cheap, modular L1 base

• Neutron: Semantic memory layer (more on this)

• Kayon: On-chain AI reasoning engine

• Axon: Intelligent automations (Q1 2026)

• Flows: Vertical apps for PayFi & RWAs

Products over pitch decks. This stack turns static blockchains into living systems.

3. Neutron Solves the "Dumb Data" Problem 📚

Traditional chains store files like a dusty hard drive. Neutron compresses them into AI-readable "Seeds" — 500:1 ratios, fully verifiable, on-chain.

PDFs become queryable. Invoices trigger agents. Deeds become programmable logic.

No more broken IPFS links. Real semantic memory for agents and apps.

4. Kayon Brings Actual Reasoning to the Chain 🔍

Natural language queries on on-chain (or enterprise) data.

"Ask: Which wallets bridged over $1M last week?" → Auditable answer in seconds.

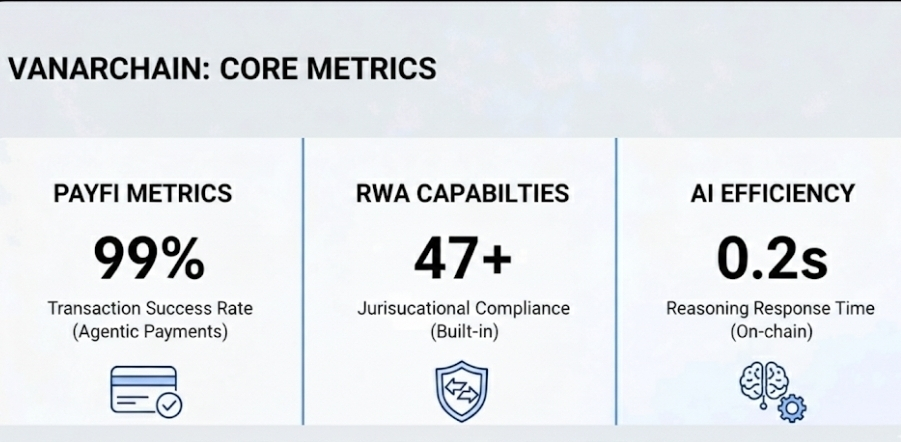

Contextual insights + compliance-by-design across 47+ jurisdictions.

This isn't "AI narrative." This is blockchain that understands what it's holding.

5. $VANRY Is Becoming a Real Usage Ticket 🎫

The token model is evolving — and it's ruthless in the best way.

2026 focus: AI tools (myNeutron, Kayon) moving to subscription fees settled exclusively in VANRY.

Gas is just the start. Real revenue from enterprise tools, agents, and PayFi flows.

Token = product demand. Not just speculation.

6. PayFi + RWA Narrative Alignment 🔥

The hottest 2026 meta: AI + payments + real assets.

Vanar is all-in:

• Agentic payments with Worldpay partnership (stage at Abu Dhabi Finance Week)

• Tokenized RWAs with built-in compliance and reasoning

• On-chain finance that thinks for itself

From retail pumps to institutional rails.

7. Undervalued AF in a Hot Narrative Market ⚖️

$14M market cap.

Compare to other AI plays (many 10-100x higher) with less real product.

High beta. Real tech. Perfect asymmetry.

8. Shipping Fast in 2026 📈

• myNeutron live and expanding (integrations: QuickBooks, CRM, Slack)

• Kayon mainnet progress

• Governance upgrades (Proposal 2.0)

• Multiple major events lined up (Consensus HK, TOKEN2049, etc.)

Execution > promises. The team is delivering.

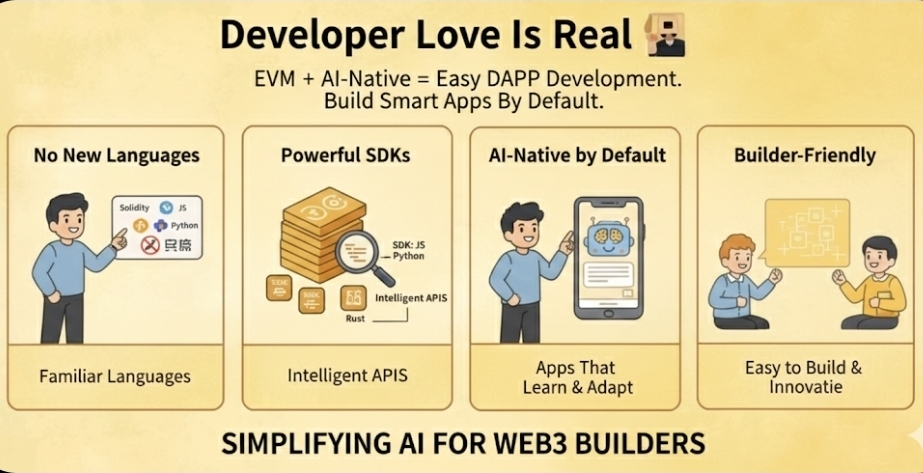

9. Developer Love Is Real 👨💻

EVM + AI-native = no new languages needed.

SDKs in JS, Python, Rust. Intelligent APIs with just a few lines of code.

Builders are noticing: easy to make apps that are smart by default.

10. The Perfect "Engine Swap" Story 🚀

Vanar isn't starting from zero - it's a rebrand with history, now pivoting to the future.

Old gaming roots → new AI infrastructure.

The market loves transformation plays when the tech checks out.

Bottom Line: Watch This One Closely

Vanar Chain isn't the loudest voice in the room. But it's building the infrastructure that the loud ones will eventually need.

Advantages:

• Clear, shipping product stack

• Token tied to real usage

• Perfect timing with AI + PayFi boom

Risks:

• Competitive L1 space

• Still early on paid adoption

• Macro can crush everything

This is a project in "engine replacement" mode. If the new one fires up, the upside is massive.

Stay rational. Track the metrics:

• Neutron/Kayon usage

• Subscription revenue

• Dev activity

• VANRY burn from fees

The smart money is already paying attention.