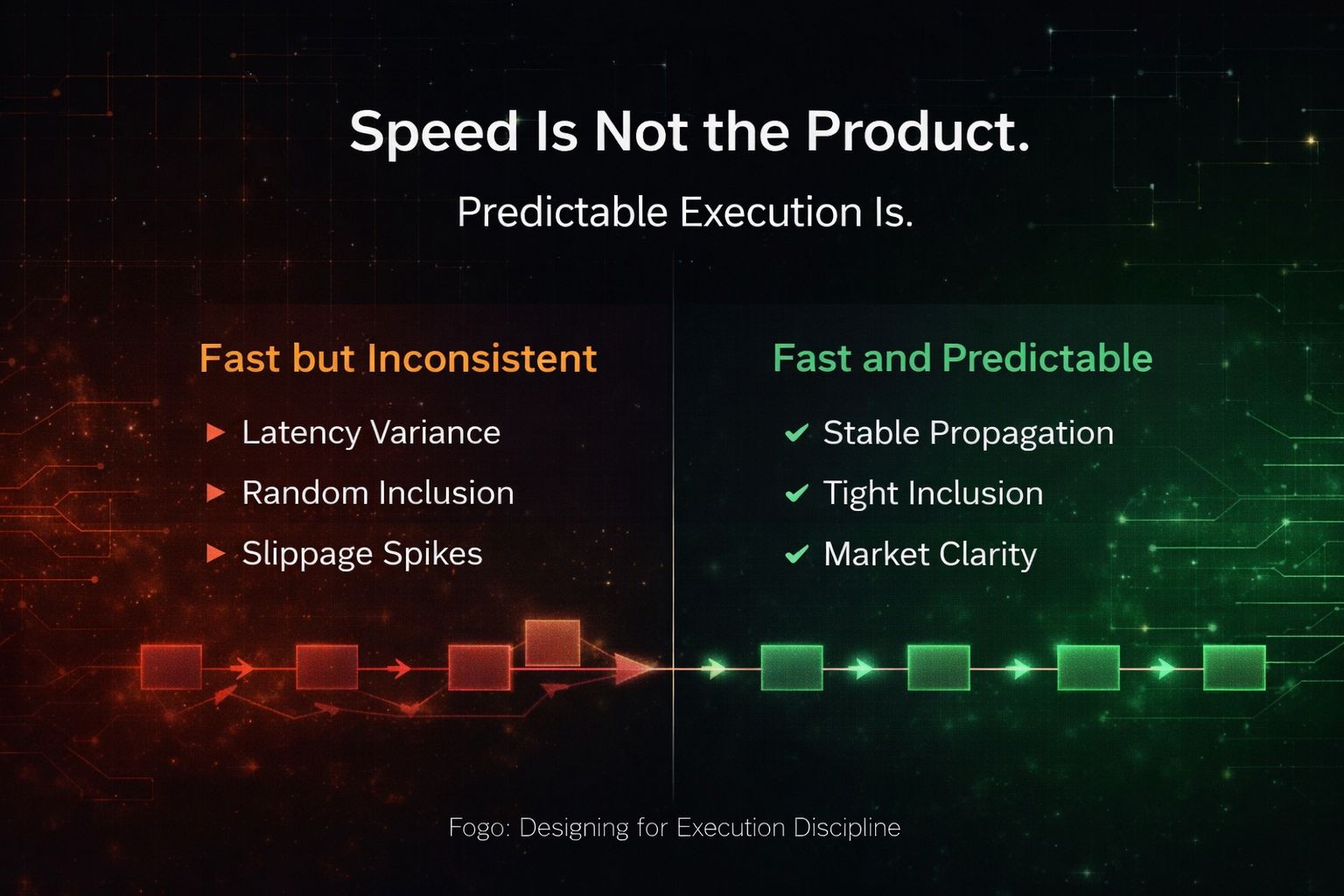

Most people still hear “high-performance SVM chain” and mentally file it under the same category as every other throughput pitch. Faster blocks. Higher TPS. Lower fees. The surface narrative is simple: speed is good, more speed is better.

That framing misses the point.

Latency is not just a performance metric. In financial systems, latency is market structure. And market structure determines who consistently wins.

Fogo’s design choices only make sense when viewed through that lens.

If you reduce block times and tighten propagation, you are not just making transactions feel faster. You are compressing the window in which randomness and timing asymmetry operate. On slower or more volatile networks, small differences in propagation and inclusion can create invisible edges. When execution timing becomes inconsistent, market outcomes start to depend less on strategy and more on luck or infrastructure advantages.

Reducing latency variance changes that equation.

When block production is predictable and execution cycles are tight, randomness shrinks. Markets become more legible. Slippage becomes less chaotic. Liquidation cascades become less disorderly. That is not cosmetic improvement. That is structural refinement.

This is where Fogo’s SVM foundation matters.

Parallel execution is not simply about processing more transactions at once. It is about isolating independent state transitions so they do not interfere with each other. When independent actions can proceed without artificial serialization, the network behaves less like a congested highway and more like a system built for concurrent flow.

But there is a second layer that matters more.

Low latency without predictable consensus behavior is noise. Performance that collapses under stress is marketing. The real test of a performance-focused L1 is not how it behaves during calm weeks, but how it behaves during volatility spikes, liquidation waves, or synchronized user surges.

Fogo’s bet appears to be that crypto’s next competitive battlefield is not general-purpose programmability. It is execution quality under stress.

That is a very specific bet.

Trading-heavy environments amplify small inefficiencies. When thousands of users interact with the same markets in short time windows, state contention increases, propagation delays widen, and fee spikes distort participation. On many networks, this is where the illusion of performance breaks down.

If Fogo can maintain consistent block timing and predictable inclusion during those moments, the chain does not just feel faster. It becomes structurally more usable for latency-sensitive applications.

And that has consequences.

When execution becomes tighter and more predictable, the beneficiaries shift. Casual participants who rely on randomness and wide spreads lose invisible advantages. Professional actors operating with strategy rather than timing games gain clarity. Markets become less chaotic and more competitive on design rather than luck.

Some will frame this as centralization versus decentralization. That framing is too simplistic.

Every infrastructure system operates on tradeoffs. Geographic dispersion increases resilience but introduces propagation variance. Curated or optimized validator sets reduce variance but alter decentralization dynamics. The question is not whether tradeoffs exist. The question is whether the chosen tradeoffs align with the intended workload.

If the workload is real-time financial activity, then latency predictability becomes a first-order concern.

That also explains the focus on execution ergonomics. Gas abstraction and session-style interactions are not cosmetic features. In trading contexts, repetitive signing and transaction friction compound into missed opportunities. If user flow becomes smoother without sacrificing self-custody, participation increases. Participation increases liquidity. Liquidity stabilizes markets. Stability attracts more serious actors.

These feedback loops matter more than raw TPS claims.

The harder part is sustainability.

Low latency can attract early attention. It cannot manufacture durable order flow. Markets consolidate where reliability is proven repeatedly under pressure. That proof is earned during failure scenarios, not benchmark demos. If performance remains stable during stress events, confidence compounds. If it degrades, trust erodes quickly.

This is why the most useful way to view Fogo is not as “another SVM chain,” but as a thesis about where crypto competition is moving.

The early era was about programmability. The middle era was about scaling. The next era may be about execution discipline.

If on-chain markets are going to compete seriously with centralized venues, then latency, inclusion predictability, and concurrency isolation are not luxuries. They are prerequisites.

Fogo is optimizing around that premise.

Whether it succeeds will not be determined by headline metrics. It will be determined by how the system behaves when real capital stresses it.

Because in the end, speed is not the product.

Predictable execution is.