There’s a level most traders aren’t watching — but historically, it’s the one that separates healthy corrections from real bear markets.

It doesn’t come from trendlines.

It doesn’t come from moving averages.

It comes from behavior.

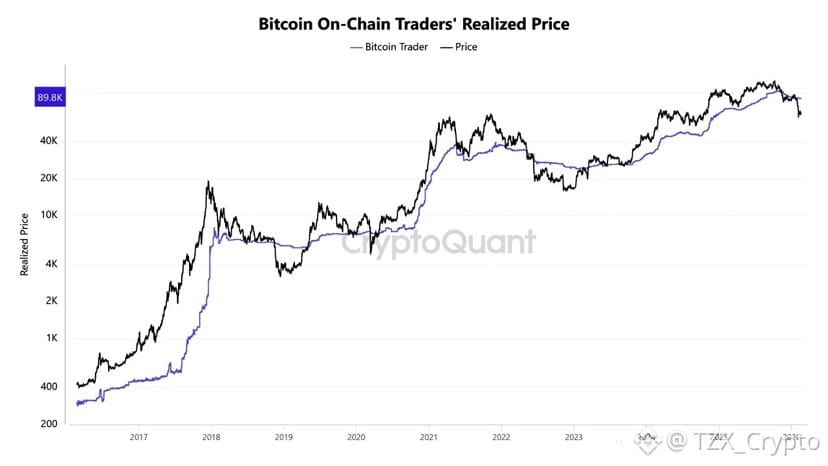

On-chain data shows that wallets holding between 10 and 10,000 $BTC — coins that moved within the last 1 to 3 months — have an average cost basis around $89,800. These aren’t tiny retail accounts. They aren’t ancient dormant whales either. This is active, meaningful capital. Big enough to move price. Active enough to reflect sentiment shifts in real time.

And right now, Bitcoin is trading far below what this group paid.

That matters.

Back in 2021, when $BTC hit its first major high near $67K, this same cohort had an average cost basis around $33K. During the mid-cycle pullback, price never truly violated their level. They stayed in profit. Confidence stayed intact. The structure remained constructive.

The bear market only became undeniable when price collapsed decisively beneath their cost basis in mid-2022. Once that floor broke, sentiment shifted from “pullback” to “prolonged pain.”

Fast forward to now.

This cohort’s realized price peaked near $94K late last year. Price slipped under it in December — and hasn’t recovered since. With $BTC hovering in the mid-$60Ks, these mid-weight active participants are sitting roughly 25–30% underwater.

That’s not just a chart detail.

That’s psychological pressure building day after day.

When active capital is trapped in loss, rallies tend to face supply. Every bounce becomes an opportunity for someone to reduce exposure. That dynamic doesn’t resolve quickly. It grinds.

Some are comparing this environment to mid-2021 — calling it just another cyclical shakeout.

But the structure is different.

In 2021, this group never went underwater.

Today, they are deeply underwater.

Until #BTC reclaims and sustains above the ~$89,800 region, the on-chain structure hasn’t truly repaired. Momentum can bounce. Volatility can expand. But structurally, the market remains below a key psychological cost basis.

This isn’t about fear.

It’s about positioning.

Cycles don’t flip because of headlines.

They flip when underwater capital breathes again.

And right now, that hasn’t happened yet.