🌊 $ENSO Finance (ENSO) – Latest Market Analysis (Feb 2026)

$ENSO is gaining renewed attention in the DeFi sector as on-chain activity and protocol integrations continue to expand. The project focuses on simplifying DeFi interactions through automated strategy execution and smart contract-based portfolio management.

📊 Market Overview

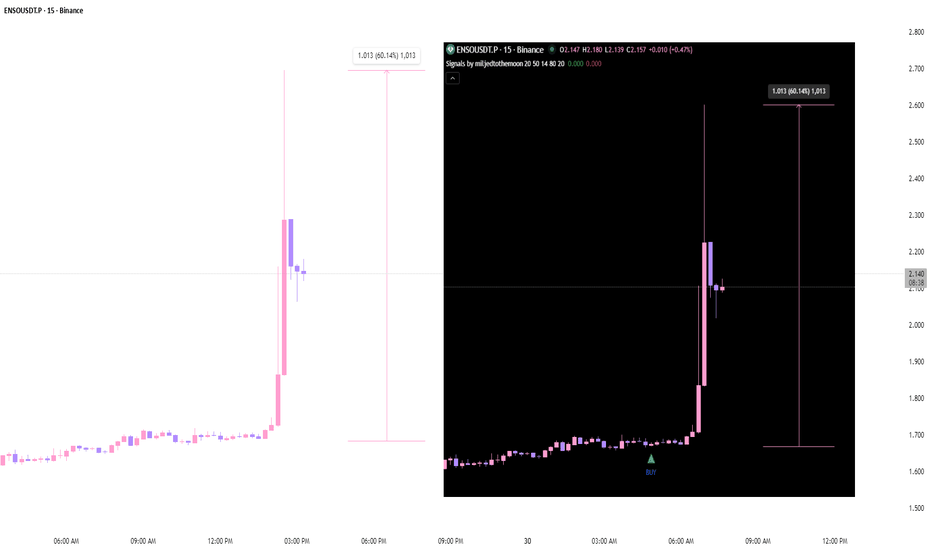

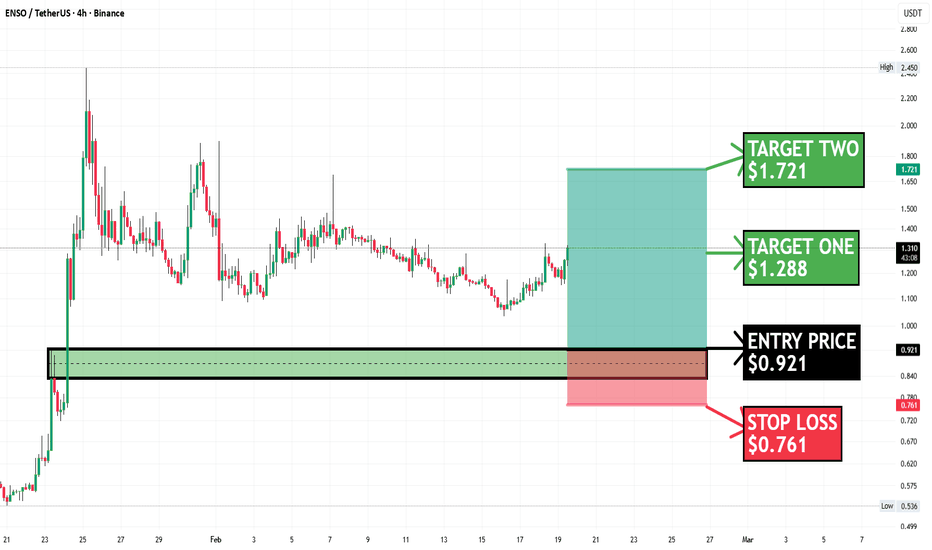

Recently, $ENSo has shown moderate bullish momentum, with higher lows forming on the daily timeframe. Volume has slightly increased, indicating growing trader interest. If buying pressure continues, $ENSO could attempt a breakout above its short-term resistance zone.

Trend: Short-term bullish bias

Support Zone: Near recent consolidation base

Resistance Zone: Previous local high

🔍 Technical Insight

Momentum indicators suggest improving strength, while price structure indicates accumulation rather than distribution. However, volatility remains high, which is common for mid-cap DeFi tokens.

🚀 Fundamental Outl$ENSO ’s long-term value depends on:

Expansion of DeFi integrations

Growth in total value locked (TVL)

Continued ecosystem partnerships

If the DeFi market sentiment remains positive in early 2026, ENSO could benefit from sector-wide capital inflows.