The first time I tried to imagine building a regulated DeFi application on an EVM chain, I felt a familiar unease. Solidity is straightforward, but once real-world financial data enters the mix, stakes rise instantly. One misstep, one exposed transaction, and trust can vanish. How do you preserve privacy while proving to auditors that everything is legitimate?

That question lingered over my late-night coding sessions.

Then I discovered Hedger on Dusk.

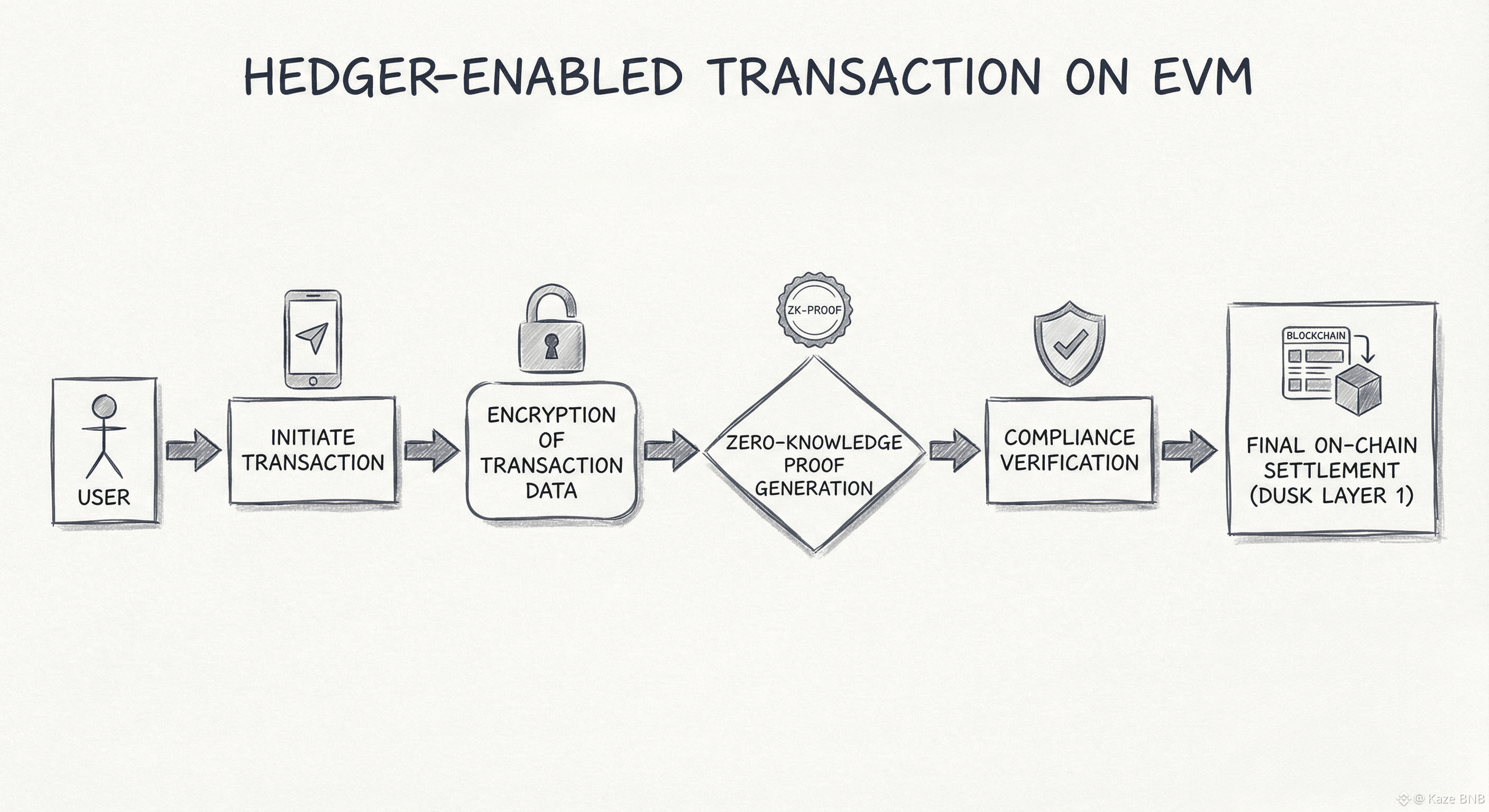

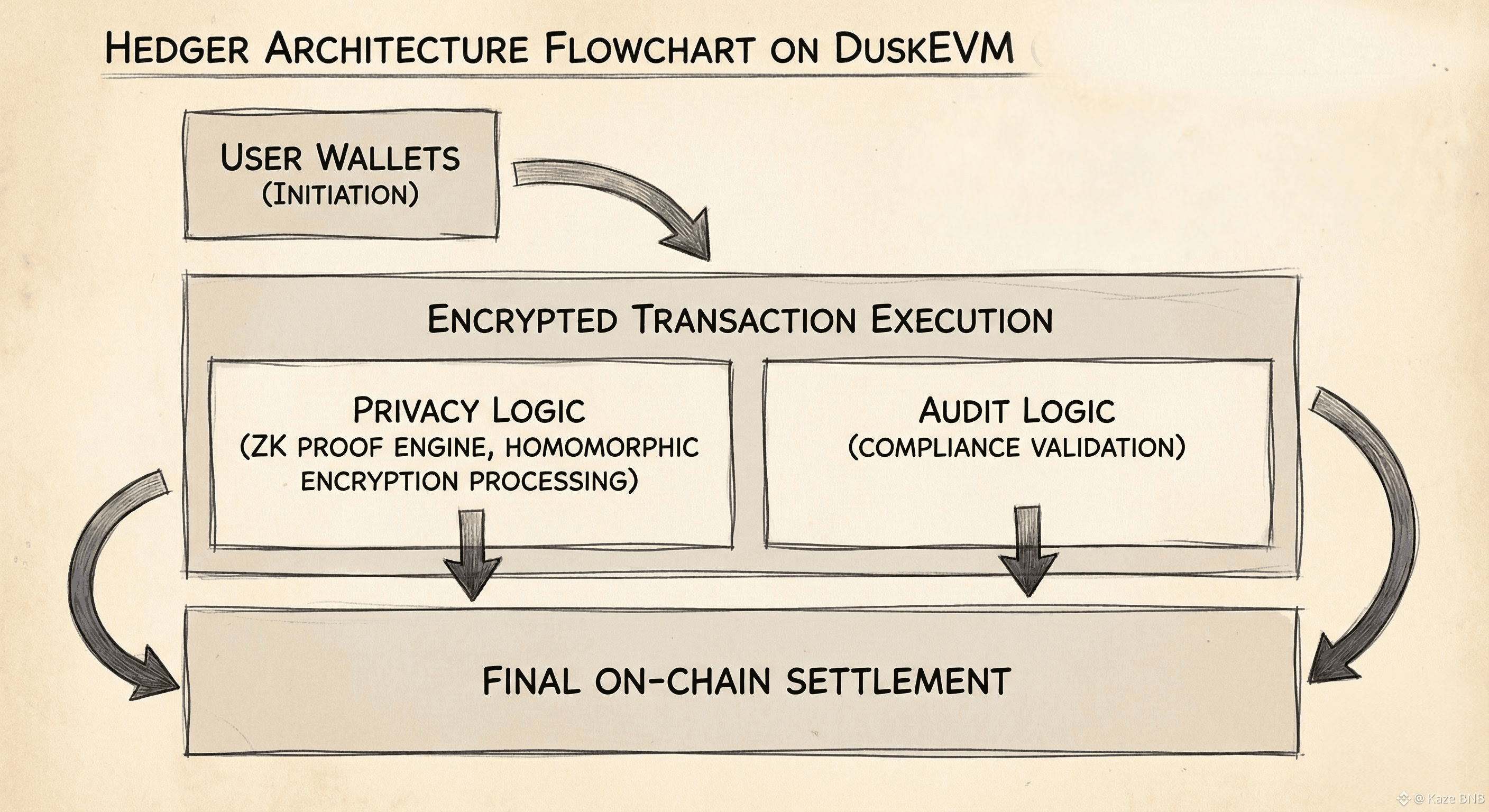

Hedger is Dusk Foundation’s solution for privacy-preserving yet auditable transactions on EVM. It leverages zero-knowledge proofs and homomorphic encryption so every transaction is verifiable without revealing sensitive details. Suddenly, regulated DeFi felt less like walking a tightrope and more like driving on a secure highway, with invisible guardrails quietly ensuring compliance.

I remember my first test deployment vividly. I wrote a Solidity smart contract for a simple lending protocol. Previously, masking balances, hiding identities, and satisfying auditors meant off-chain solutions and complicated workflows. With Hedger, privacy and auditability were baked in. I deployed, watched transactions propagate, and saw cryptographic proofs automatically generated and validated. It felt like magic but grounded in math.

What struck me most was how modular Dusk is. Hedger doesn’t impose a rigid structure. Developers define who sees what, when, and how. Transactions stay private, yet verifiable proofs appear automatically for auditors. It felt like sitting in a room with tinted windows: outsiders could confirm a meeting occurred, but the details remained shielded. I watched the system handle sensitive data silently, and yet I felt the stakes in every transaction.

I tested a small RWA transfer between two institutional wallets. Hedger ensured encryption end-to-end. Zero-knowledge proofs validated correctness. Compliance checks passed invisibly. Nobody outside the authorized participants could see amounts or addresses, but anyone who needed certainty had it. Every micro-step mattered. I could sense the invisible coordination happening behind the scenes, like a conductor leading a symphony I couldn’t see.

The implications for institutional finance are enormous. Banks, asset managers, and regulators can finally interact with DeFi applications with confidence. Developers no longer have to compromise privacy for compliance. Hedger combines both, making the system predictable, auditable, and trustworthy.

I experimented further with a tokenized bond example. Each transfer executed privately. Proofs of compliance were generated automatically. Auditors confirmed legitimacy without seeing sensitive data. It was like observing an orchestra: every note encrypted, yet perfectly synchronized. The tension was subtle, almost imperceptible but present in every micro-event.

Dusk Foundation isn’t building technology alone; it’s creating an environment. Hedger proves that privacy and auditability aren’t opposing forces, they’re complementary. Validators act because of DUSK, not rules imposed externally. Every proof, every coordination, every verification occurs quietly, yet it shapes the network’s behavior in real time.

For me, as a developer, this changes everything. I can build compliant DeFi protocols, tokenized asset marketplaces, or financial products institutions trust, all on familiar EVM. Hedger preserves privacy, guarantees auditability, and allows me to focus on functionality, not firefighting compliance issues.

Sometimes progress isn’t about headlines or hype. It’s about quiet precision, trust, and accountability. With Hedger on DuskEVM, regulated DeFi finally feels real resilient, intelligent, and adaptive. Each transaction, proof, and micro-event pulses through the network, invisible yet tangible, reminding me that privacy and compliance can coexist beautifully.